Update to Invoices for Freelancers and Clients

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Notify Moderator

After February 15th, freelancers will be able to view and download invoices that are sent to clients by going to their Reports.

Additionally, to conform to legal requirements for VAT compliance, both freelancer and client addresses will appear on invoices if the client is located in a VAT country. Displaying an address is optional for non-VAT clients by marking a checkbox on the company contact information page.

This is a retroactive change and once made, addresses will be visible on all current and past invoices from March 2015 onward. Please take a moment to verify or update the address you want displayed. Freelancers, you can find this under your contact information setting, and clients under company contact information.

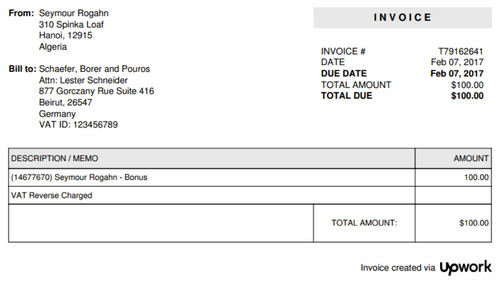

For reference, here’s how your address will appear on invoices:

Update 2/17/21

We want your invoices to always show your name, address, etc., as you had it listed at that time. Because of that if you update your information, your past invoices will not reflect the update. This is for accuracy and to ensure that your invoices reflect the same information as they did on the day they were created. Also, if you live in certain areas, we must collect taxes, such as sales or VAT. Having the proper address displayed at the time of invoicing is important to show what taxes were applicable and charged.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.