- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 30, 2015 04:53:53 AM by Quang N

Name on a received invoice?

I have a quick question on the invoices you receive from Upwork. As a client, when receiving an invoice from Upwork whose name and address is shown on that invoice? Is it Upwork itself or is it the name and address of the freelancer that was hired by you? So who are you paying according to the invoice, Upwork or the freelancer?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 30, 2015 11:31:12 PM by Alexey I

It can be big problem for companies. While oDesk for now works only as payment gateway and the value of oDesk is 2-3% (payment comission). This change also increase risk for companyes, while tax authority can tell that this payments is wage and companies should pay additional taxes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 1, 2015 02:17:26 AM by Florian K

The new invoice design (not containing any company information and just the name of the freelancer) is a big problem indeed. At least in the European Union. We just had a talk with our accountant who forwarded this to an Austrian tax inspector. The result: The new invoice cannot be used and is not legal in the EU!

An invioce always needs the address of the party selling the service. So either the address of upwork is needed or the full address of the freelancer.

If this does not get changed we are forced to leave odesk in the near future as we do not want to get into legal trouble.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 9, 2015 10:18:35 AM by Dave E

Did anyone at UW ever reply to this? The Elance invoices were great. I've contacted UW, made tickets, contact the CEO through Linkedin--I can only conclude UW is no longer for business!!

My invoice from UW shows I pay UW, so they are the contracting party. The company name of the provider never shows up.

Tickets fall on deaf ears and auto-responders, all I get is automated responses with no action behind it. I've had to taken to having the freelancer provide a separate, duplicate invoice that is tax-compliant in my area. This is intensely aggravating and may not hold-up if challenged since the money-flow is to UW.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 9, 2015 11:52:07 AM by Anonymous-User A

@Dave E wrote:Did anyone at UW ever reply to this? The Elance invoices were great. I've contacted UW, made tickets, contact the CEO through Linkedin--I can only conclude UW is no longer for business!!

My invoice from UW shows I pay UW, so they are the contracting party. The company name of the provider never shows up.

Tickets fall on deaf ears and auto-responders, all I get is automated responses with no action behind it. I've had to taken to having the freelancer provide a separate, duplicate invoice that is tax-compliant in my area. This is intensely aggravating and may not hold-up if challenged since the money-flow is to UW.

It seems that there is some hope for 2016. Please look at this thread

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 14, 2018 07:39:05 AM by Peter A

Is it enough to have only the Name and address? I thought also tax number (for example Russia) is a must or VAT in Europe. What do you think?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 14, 2018 10:42:02 AM by Joachim M

@Peter A wrote:Is it enough to have only the Name and address? I thought also tax number (for example Russia) is a must or VAT in Europe. What do you think?

Peter,

As your profile isn't public I don't know whether you are located in the EU or not.

If you are located within the EU and your freelancer is located outside of the EU, there is no specific format of invoice required. All requirements with regards to content and format are only for invoices within the EU. You only have to care about reporting the import of a service into your country and pay the importation VAT. That's it. You as importer are responsible for paying VAT for the import.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 15, 2018 12:42:48 AM by Peter A

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 15, 2018 01:08:23 AM by Joachim M

@Peter A wrote:But the issue is:I am in EU and in my country they require to have tax number on invoices even if the freelancer is in the EU or outside. Does any other country do that?

Peter,

Sounds like you are located in Romania. No, no country in the EU requires that. There do seem to exist countries without tax numbers - not in the EU though. The EU determines what is requested within the EU but not what happens beyond their borders.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 15, 2018 01:29:39 AM by Peter A

It is Hungary.

But you are saying that tax number is required to have on the invoices when you issue one in the EU. It is a must if you have one. Though in Austria (when I worked there as a client) did not give one till you reach a certain amount of money. So this means in some country it is not a requirement to have any tax number by default. Then why countries ask for that for the other party, right? Not fair.

So you mean EU does not require to request tax number on the other parties invoice? Which country? I will go there 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 15, 2018 02:45:32 AM by Joachim M

@Peter A wrote:It is Hungary.

But you are saying that tax number is required to have on the invoices when you issue one in the EU. It is a must if you have one. Though in Austria (when I worked there as a client) did not give one till you reach a certain amount of money. So this means in some country it is not a requirement to have any tax number by default. Then why countries ask for that for the other party, right? Not fair.

So you mean EU does not require to request tax number on the other parties invoice? Which country? I will go there 🙂

Peter,

You seem to be confusing VAT ID and tax number. As far as I know all EU countries issue tax numbers for any taxable person/company. This is not the case with the VAT ID, in most cases this is upon request only.

EU regulations call for either a VAT ID or a tax number to be on the invoice if raised in an EU member state. EU regulations say nothing at all about about invoices raised in non-member states e.g. Russia.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 15, 2018 04:56:06 AM by Peter A

Oh I see.

But which country are you in? In Hungary they request to have a number on the freelancer's invoice, which they usually don't have, since they might do freelancing as a freetime next to their regular jobs, so they declare the income as "other" income.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 15, 2018 05:38:46 AM by Joachim M

@Peter A wrote:Oh I see.

But which country are you in? In Hungary they request to have a number on the freelancer's invoice, which they usually don't have, since they might do freelancing as a freetime next to their regular jobs, so they declare the income as "other" income.

I'm located in Germany as you can see on my profile. Hungary is part of the EU and EU regulations apply - even if your Mr. Orban doesn't appreciate the idea.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 7, 2020 02:16:48 AM Edited Jul 7, 2020 02:18:06 AM by Ionut Cosmin M

Joachim, Romania doesn't require that number on the invoice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 7, 2020 02:47:52 AM by Joachim M

Ionut Cosmin M wrote:Joachim, Romania doesn't require that number on the invoice.

The EU set it as a requirement. Never mind what Romania requires.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 1, 2015 04:36:58 AM by Krisztina U

Seriously, Upwork? You removed all items that make an invoice an invoice? What's next, changing the currency sign to an egg or mushroom? Is this even legal?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 8, 2015 03:05:50 AM by Joachim M

@Krisztina U wrote:Seriously, Upwork? You removed all items that make an invoice an invoice? What's next, changing the currency sign to an egg or mushroom? Is this even legal?

The contractors have the same problem. All necessary features are implemented on Upwork's other company Elance.com and Upwork seems to be unable to implement them. Same for VAT regulations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 8, 2015 10:41:36 AM by Anonymous-User A

I was shocked when I migrated my data from Elance to Upwork and realized that the features in regard of taxes and VAT ID that all worked well in Elance are not available in Upwork. I reported this to Upwork and asked for help and now I have realized when I follow the discussion here that a lot of people of Europe working with Upwork have the same problem. Why is something that works well in one system (Elance) not establised in the other system (Upwork) as well to help freelancers from Europe to do their work according tax regulations? If this will not be changed I will not see an change working on jobs where I have to apply VAT (mainly European countries) on the long term.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 10, 2015 05:34:50 AM by Joachim M

@Margarete M wrote:I was shocked when I migrated my data from Elance to Upwork and realized that the features in regard of taxes and VAT ID that all worked well in Elance are not available in Upwork. I reported this to Upwork and asked for help and now I have realized when I follow the discussion here that a lot of people of Europe working with Upwork have the same problem. Why is something that works well in one system (Elance) not establised in the other system (Upwork) as well to help freelancers from Europe to do their work according tax regulations? If this will not be changed I will not see an change working on jobs where I have to apply VAT (mainly European countries) on the long term.

Margarete, I took the simple way out of this dilemma. If a client also has an Elance account I suggest him to post the job on Elance where he and I will get invoices legal in Europe. If he can't do that or doesn't want to do it, I charge 19% more on Upwork than I do on Elance. That's the VAT I ahve to pay for all jobs on Upwork. Should a client complain about the higher price I'll inform him why I have to charge more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 14, 2015 11:55:12 PM by Anonymous-User A

Joachim, Thank you for the explanation. This is a way to deal with the problems. However, you will get less jobs then, the invoices are still not be suitable for the requirements of German taxation law and the opportunities for clients to post news jobs in Elance will be more and more limited in the next months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 23, 2015 03:53:52 AM by Joachim M

@Margarete M wrote:Joachim, Thank you for the explanation. This is a way to deal with the problems. However, you will get less jobs then, the invoices are still not be suitable for the requirements of German taxation law and the opportunities for clients to post news jobs in Elance will be more and more limited in the next months.

Hi Margarate,

Sorry for the late reply, I was on holiday.

True the invoices still aren't compliant with German law but the revenue service doesn't really care. They just want to see your turnover and if you can't prove otherwise take the 19% VAT. Hence for Upwork I simply raised my price accordingly. They didn't object to my filings for last year using this very pragmatic approach. It does affect the number of jobs I can acquire but then there are other sites and I already know of several clients that will take me down after the two years period and work directly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 1, 2015 06:30:54 AM by J R

Hello,

I use Odesk-Upwork from some time... spending about 7000 - 12000 dollars on it.

The invoices that they do are illegal. An invioce always needs the address of the party selling the service.

Becouse cannot declare that I spent this money and had to pay 3500 dollars for high benefits...

I need a valid invoice from Upwork to declare that I did not have these 7000-12000 dollars of benefits...

This is really bad for this big company, I can not believe it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 1, 2015 10:32:09 PM by Lena E

We are aware that the new invoice changes created problems for users in Europe. As a result, updates have been made that now display an address so the invoice will meet document requirements, as specified by various tax authorities.

Thanks for the feedback everyone!

-Lena

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 2, 2015 05:44:06 AM by J R

Hello,

No. It still only disply my address and my details. It not displays Upwork address and details.

Please we need this in Europe.

Thanks,

Juan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 7, 2015 10:40:58 AM by Lena E

J R,

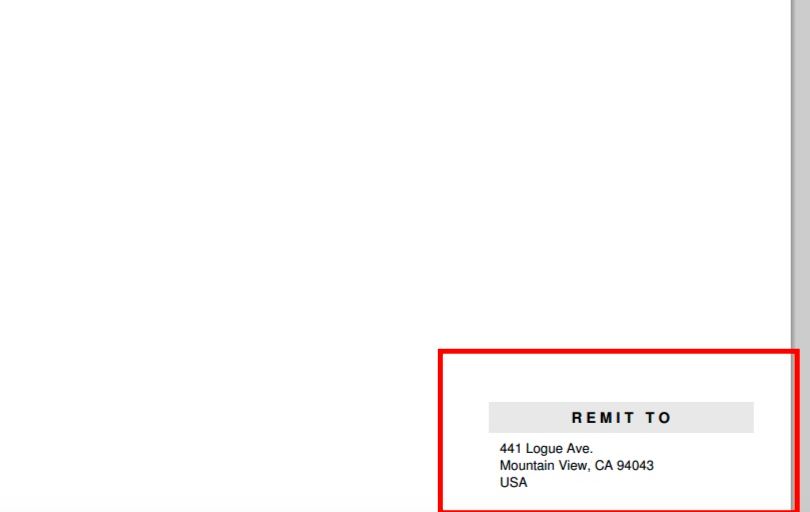

The invoice includes Upworks address on the bottom right hand corner, see below:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 10, 2015 05:53:34 AM by Krisztina U

@Lena E wrote:J R,

The invoice includes Upworks address on the bottom right hand corner, see below:

Lena, I don't expect you to publicly comment, but I am sure you would agree that this is the most ridiculous invoice you have ever seen. When can we expect to get a real invoice, at the very least for the past, pre-this ridiculous change? Part of the Upwork fee is for archiving our reports and invoices, it's not sound business practice to make changes that not only make our life harder moving forward, and quite frankly, outsourcing work on Upwork impossible, but also mess up our accounting retroactively.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 11, 2015 05:37:35 AM by Joachim M

@Krisztina U wrote:Lena, I don't expect you to publicly comment, but I am sure you would agree that this is the most ridiculous invoice you have ever seen. When can we expect to get a real invoice, at the very least for the past, pre-this ridiculous change? Part of the Upwork fee is for archiving our reports and invoices, it's not sound business practice to make changes that not only make our life harder moving forward, and quite frankly, outsourcing work on Upwork impossible, but also mess up our accounting retroactively.

Krisztina,

It's even worse. You correctly mentioned ...archiving our reports and invoices... You may want to add the messages regarding the contract too. By law I'm oblidged (German Commercial Code) to save invoices and all messages concerning each contract for 10 years (record rentention period). All other correspondence with clients or contractors for 7 years. In the case of electronic messages they have to be saved in their original format. And now Upwork is closing down Elance in 2016, access will no longer be possible some time in 2016... I'm sure similar commercial codes exist in other countries too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 19, 2015 12:11:43 AM by Pepita B

You added the address of Upwork, but on the top left corner it says that the invoice is from Freelancer XYZ.

The invoice is either from the Freelancer or via Upwork. I am paying Upwork, so it should be an invoice from Upwork. It also should have the tax number on it. This is not on there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 19, 2015 02:28:53 AM by Anonymous-User A

The Unites States have tough taxation regulations, I am sure they will never accept all these invoices and all three parties involved will have problems in the end with the fiscal authorities in their home countries and in the US. In the worst case somebody can be accused for money laundering (without VAT-ID, not clear to whom the money was paid for which services)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 25, 2015 09:19:49 AM by Ela K

@Pepita B wrote:You added the address of Upwork, but on the top left corner it says that the invoice is from Freelancer XYZ.

The invoice is either from the Freelancer or via Upwork. I am paying Upwork, so it should be an invoice from Upwork. It also should have the tax number on it. This is not on there.

No, that is not how it works. You set up contracts with freelancers, not Upwork. And you pay said freelancers. That's why they need invoices in their names.

Take a look at the user agreement. 4 parties are involved:

- Clients has a contract with freelancer. (fixed price or hourly rate + bonuses)

- Clients transfers 100% to EEC (Elance Escrow Corporation) for previous work of freelancer.

- EEC transfers 90% to the freelancer.

- EEC transfers 10% to Upwork as their service fee

Upwork is not really involved/responsible anymore... which is exactly what they want.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 8, 2015 03:07:37 AM by Joachim M

@Lena E wrote:We are aware that the new invoice changes created problems for users in Europe. As a result, updates have been made that now display an address so the invoice will meet document requirements, as specified by various tax authorities.

Thanks for the feedback everyone!

-Lena

Lena,

And what about the contractors? They also need an invoice showing the full address of the client and all necessary details regarding the VAT.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 19, 2015 12:04:53 AM by Pepita B

I have just received an invoice from Upwork and I was confused:

The data from the freelancer that are on the invoice are far from complete. It only has the name and no other information. Even though the answer above says that changes are being made.

Now what?

Pepita

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 14, 2018 08:32:10 AM by Peter A

What I usually do, is ask the freelancer to write the address into the settings menu, and make a screenshot when ready, then I pay only after this. So then address will be there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 2, 2015 05:57:54 AM by J R

Hello Upwork,

The question is easy:

Why don't you fill your invoices with your Name and Tax Id?

I really need invoices with Name (Upwork), address and tax Id. All the legal Europeans need this...

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 8, 2015 03:12:09 AM by Joachim M

@J R wrote:Hello Upwork,

The question is easy:

Why don't you fill your invoices with your Name and Tax Id?

I really need invoices with Name (Upwork), address and tax Id. All the legal Europeans need this...

Thanks

In this case Upwork would suddenly be our contractual partner, i.e. the client buys from Upwork and the contractor sells to Upwork. Upwork would no longer act as agent but take full responsibilty. I'm pretty sure that this is not what Upwork has in mind.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 5, 2015 03:49:32 AM by Gabriele D

i absolutely agree with this thread, you should take as example companies like ENVATO, that have successfully managed it, doing invoices that are splitted between the platform and the freelancer, but that are still totally valid for EU

your move - without any notice - has absolutely messed up things, specially for big spender.

i cannot trust a so dumb move, that could means hundreds of clients goign away

that was EXACTLY the reason why i switched from elance to odesk, years ago.

and now that odesk and elance are the same, i really hope can arise a new player that keep care of these issues. it will have immediately tons of clients.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 5, 2015 03:44:43 AM by Gabriele D

i noticed this week that UPWORK (probably after the odesk -> upwork passage) has totally changed - without any advise - the fiscal structure of their invoices

now the invocies i download are no longer "real" invoices, with company data, ecc..

but are sort of receipts, totally UNUSEFUL from the italian fiscal point of view, where is NOT clear who is taking my money

it was the same that happened on elance in the past, and the main reason why i switched to odesk. but now things here are getting messed up again.

I saw the job done by other big compamnies like ENVATO, that have changed the way to organize invoices (to manage the fact that some of the moneys are going directly to the freelancer) but have done it in a way that is manageable - fiscally - by european company

here it seems that this BIG change has been done without any advise, and without any care about the enormous difficultues that big spenders will have justifiyng these payments to european fiscal authorities

has anyone else noticed and discussed this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 8, 2015 03:14:27 AM by Joachim M

@Gabriele D wrote:i absolutely agree with this thread, you should take as example companies like ENVATO, that have successfully managed it, doing invoices that are splitted between the platform and the freelancer, but that are still totally valid for EU

your move - without any notice - has absolutely messed up things, specially for big spender.

i cannot trust a so dumb move, that could means hundreds of clients goign away

that was EXACTLY the reason why i switched from elance to odesk, years ago.

and now that odesk and elance are the same, i really hope can arise a new player that keep care of these issues. it will have immediately tons of clients.

Well, this works just fine on Elance. I work as client and contractor on Elance and all the documentation and invoices are EU compliant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 6, 2015 12:43:09 AM by Pawel K

I was aghast when I saw the last two invoices this morning. The way they are constructed is not valid in EU and means I cannot write off a few thousand USD I spent on Upwork in the past couple weeks! If this doesn't get fixed right away, I am going to cancel the contract and leave the platform. A valid invoice requires: seller's full name and address, seller's tax ID (since you're not a EU company, we could get away with it missing), date of purchase, names and amounts of products or services sold, buyer's full name and address and tax ID. Also, I need this to be fixed on the past two invoices as well, otherwise I will incur a great financial loss because of that change. It would have been great if you consulted with us first before making such changes. Also, although you're an American company, you have businesses working with you (through your platform) from all over the world - as a result, in my opinion, you should pay more attention to other countries' tax laws. Make use of what you have already and hire local accountants via Upwork and ask them to help you prepare valid documents worldwide, make the business owners working via Upwork feel secure. The thing that just happened is terrible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 7, 2015 05:10:10 PM by Garnor M

Hi Pawel and others,

We hear your concerns and requests to add freelancer's addresses to the invoice and we've raised this to our team so they can evaluate the best way to include this information.

Please note we have not previously had freelancer addresses included in these invoices so while the invoice has changed, this was not something we removed.