- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 12, 2019 06:54:34 AM by Trasie S

California Assembly Bill 5 - Upwork Comment

I have not seen where Upwork has released a statement regarding how California Assembly Bill 5 (AB5) is going to effect freelancers who live in California. I am curious if, and how, this bill will impact my ability to use the site.

And, for anyone else in California who is following this, how many of you have looked into filing as a business so that you can conitnue to work as a contract worker? It is my understanding of Part C that creating a company may allow me to continue to freelance?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 12, 2019 07:20:26 AM by Miriam H

I am not a lawyer, however my understanding is this more directed at the type of services where the rate is set by the service provider (i.e. Uber). Putting aside contractors that Upwork may hire for their own services, I don't anticipate any changes to this platform. As Freelancers we set our rates and negotiate our terms directly with the client. In this way, Upwork functions as a lead generation site and an escrow company. The way the site functions (putting aside the silly talent specialists) doesn't, in my NON-LEGAL opinion mirror employment in any way.

Jessica S wrote:

Trasie S wrote:I have not seen where Upwork has released a statement regarding how California Assembly Bill 5 (AB5) is going to effect freelancers who live in California. I am curious if, and how, this bill will impact my ability to use the site.

And, for anyone else in California who is following this, how many of you have looked into filing as a business so that you can conitnue to work as a contract worker? It is my understanding of Part C that creating a company may allow me to continue to freelance?

Bumping this up.. being that Upwork is a California-based company who uses contractors itself, I am curious as well as to how this will impact this platform.

That said, as a CA resident, I'm not happy with this law. I would rather see market forces push down the Ubers and Postmates of the world vs. creating regulations around employment. Employers don't always want or need employees, and the more obstacles you create around hiring and managing the support you need (as an employer) the less inclined companies will be to follow ANY rules.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 12, 2019 07:13:06 AM by Jessica S

Trasie S wrote:I have not seen where Upwork has released a statement regarding how California Assembly Bill 5 (AB5) is going to effect freelancers who live in California. I am curious if, and how, this bill will impact my ability to use the site.

And, for anyone else in California who is following this, how many of you have looked into filing as a business so that you can conitnue to work as a contract worker? It is my understanding of Part C that creating a company may allow me to continue to freelance?

Bumping this up.. being that Upwork is a California-based company who uses contractors itself, I am curious as well as to how this will impact this platform.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 12, 2019 07:20:26 AM by Miriam H

I am not a lawyer, however my understanding is this more directed at the type of services where the rate is set by the service provider (i.e. Uber). Putting aside contractors that Upwork may hire for their own services, I don't anticipate any changes to this platform. As Freelancers we set our rates and negotiate our terms directly with the client. In this way, Upwork functions as a lead generation site and an escrow company. The way the site functions (putting aside the silly talent specialists) doesn't, in my NON-LEGAL opinion mirror employment in any way.

Jessica S wrote:

Trasie S wrote:I have not seen where Upwork has released a statement regarding how California Assembly Bill 5 (AB5) is going to effect freelancers who live in California. I am curious if, and how, this bill will impact my ability to use the site.

And, for anyone else in California who is following this, how many of you have looked into filing as a business so that you can conitnue to work as a contract worker? It is my understanding of Part C that creating a company may allow me to continue to freelance?

Bumping this up.. being that Upwork is a California-based company who uses contractors itself, I am curious as well as to how this will impact this platform.

That said, as a CA resident, I'm not happy with this law. I would rather see market forces push down the Ubers and Postmates of the world vs. creating regulations around employment. Employers don't always want or need employees, and the more obstacles you create around hiring and managing the support you need (as an employer) the less inclined companies will be to follow ANY rules.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 12, 2019 07:26:58 AM by Petra R

Miriam H wrote:I am not a lawyer, however my understanding is this more directed at the type of services where the rate is set by the service provider (i.e. Uber). Putting aside contractors that Upwork may hire for their own services,

Jessica S wrote:

Trasie S wrote:I have not seen where Upwork has released a statement regarding how California Assembly Bill 5 (AB5) is going to effect freelancers who live in California. I am curious if, and how, this bill will impact my ability to use the site.

And, for anyone else in California who is following this, how many of you have looked into filing as a business so that you can conitnue to work as a contract worker? It is my understanding of Part C that creating a company may allow me to continue to freelance?

Bumping this up.. being that Upwork is a California-based company who uses contractors itself, I am curious as well as to how this will impact this platform.

Upwork's own US based "freelancers" are generally already hired through Payroll (as employees) anyway, as are many / most / all (?) of the US (and many elsewhere) based people who work for Enterprise clients.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 12, 2019 07:30:48 AM Edited Sep 12, 2019 07:33:39 AM by Preston H

I agree with Miriam.

I'm not surprised at any Upwork freelancer who is interested in this bill. But I don't think it will affect me in any way.

The type of work I do (and I think that goes for most of us who are Forum regulars) simply can not be considered "regular employment." It really is freelancing. It is not like driving for Uber... Which IS freelancing, but which I can understand how some would see it as being similar to regular employment in many ways.

Having said that, I too believe that the people of California would be better off if free-market principles and freedom flourish. I have friends who are Uber drivers. They are not required to be Uber drivers. They like what they are doing, and they do not want governments telling them they can't do this, or micromanaging what it is that they do.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 12, 2019 10:35:42 AM by Wendy C

Miriam,my understanding of the bill is the same as yours in that ...

"my understanding is this more directed at the type of services where the rate is set by the service provider (i.e. Uber). Putting aside contractors that Upwork may hire for their own services, I don't anticipate any changes to this platform. As Freelancers we set our rates and negotiate our terms directly with the client. In this way, Upwork functions as a lead generation site and an escrow company. The way the site functions (putting aside the silly talent specialists) doesn't, in my NON-LEGAL opinion mirror employment in anyway."

Text in red is the relevant key clause.

@ Preston, are you not an AZ resident?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 12, 2019 10:47:12 AM Edited Sep 12, 2019 10:47:49 AM by Preston H

re: "are you not an AZ resident?"

I am an Arizona resident.

But Upwork has its headquarters in California.

So I understand if any Upwork user, regardless of where they live, is curious about whether or not this bill could affect Upwork users - if it was signed into law.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 13, 2019 05:57:14 AM Edited Sep 13, 2019 06:04:20 AM by Trasie S

Preston wrote:

I agree with Miriam.

I'm not surprised at any Upwork freelancer who is interested in this bill. But I don't think it will affect me in any way.

The type of work I do (and I think that goes for most of us who are Forum regulars) simply can not be considered "regular employment." It really is freelancing. It is not like driving for Uber... Which IS freelancing, but which I can understand how some would see it as being similar to regular employment in many ways.

My concern is not that I would like to be reclassified as an employee, just the opposite. I have been very successful as a freelancer and do not want that to change. This is also why I was wondering about any potential benefits to becoming a company, I want to continue to freelance the rest of my days.

Most of my work is now with local clients through word-of-mouth. The last two times I came to Upwork I was not able to find a good contract, but this platform has been great to me in the past and I am not ready to give up on it. I am just trying to figure out if I need to change anything in light of this new law to continue on as a freelancer as I do today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 13, 2019 05:50:05 AM Edited Sep 13, 2019 06:01:40 AM by Trasie S

Jessica S wrote:I am not a lawyer, however my understanding is this more directed at the type of services where the rate is set by the service provider (i.e. Uber). Putting aside contractors that Upwork may hire for their own services, I don't anticipate any changes to this platform. As Freelancers we set our rates and negotiate our terms directly with the client. In this way, Upwork functions as a lead generation site and an escrow company. The way the site functions (putting aside the silly talent specialists) doesn't, in my NON-LEGAL opinion mirror employment in any way.Trasie S wrote:I have not seen where Upwork has released a statement regarding how California Assembly Bill 5 (AB5) is going to effect freelancers who live in California. I am curious if, and how, this bill will impact my ability to use the site.

And, for anyone else in California who is following this, how many of you have looked into filing as a business so that you can conitnue to work as a contract worker? It is my understanding of Part C that creating a company may allow me to continue to freelance?

Bumping this up.. being that Upwork is a California-based company who uses contractors itself, I am curious as well as to how this will impact this platform.

That said, as a CA resident, I'm not happy with this law. I would rather see market forces push down the Ubers and Postmates of the world vs. creating regulations around employment. Employers don't always want or need employees, and the more obstacles you create around hiring and managing the support you need (as an employer) the less inclined companies will be to follow ANY rules.

Thank you for your response, your first paragraph explaining why certain companies are targeted is the piece of information that I am missing. That makes sense as to why I haven't been able to find information on how the Bill impacts other types of freelancers.

Have a fantastic weekend!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2019 06:52:00 PM by Trasie S

Please see my latest comment on this thread.

AB5 requires that clients and companies convert all California freelancers to W2 employees on January 1. I have put the details in the latest comment, but the correct answer is that for us to legally continue to use the platform after January 1 we need to become Upwork employees and receive W2 income from Upwork Payroll.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2019 06:54:25 PM by Miriam H

Trasie S wrote:Please see my latest comment on this thread.

AB5 requires that clients and companies convert all California freelancers to W2 employees on January 1. I have put the details in the latest comment, but the correct answer is that for us to legally continue to use the platform after January 1 we need to become Upwork employees and receive W2 income from Upwork Payroll.

I did see your comment, however I don't agree with your assessment (again, not a lawyer).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2019 07:04:52 PM by Trasie S

I have a meeting with a lawyer tomorrow to try to make real sense of this all.

What I wasn't aware of before I started digging is that what I wrote about Upwork offering clients and freelancers its Upwork Payroll W2 services has always been part of its offerings to help clients correctly classify the freelancers they hire. This wasn't a reaction to AB5, but a long term policy (even before AB5, California had pretty clear laws governing the difference between an employee and a contractor).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2019 07:11:37 PM by Miriam H

Trasie S wrote:I have a meeting with a lawyer tomorrow to try to make real sense of this all.

What I wasn't aware of before I started digging is that what I wrote about Upwork offering clients and freelancers its Upwork Payroll W2 services has always been part of its offerings to help clients correctly classify the freelancers they hire. This wasn't a reaction to AB5, but a long term policy (even before AB5, California had pretty clear laws governing the difference between an employee and a contractor).

Yes, I was aware of the W-2 offering from Upwork. If you are able to share any insights, post meeting, that would be great. The fact remains, for most freelancers on this site, Upwork is an escrow agent. Their normal course of business is connecting freelancers with clients, by that measure I would think any work I perform effectively passes test 2. Now, for larger enterprise clients, I have a different view.

Speaking for myself, so many of my projects have been short term and the majority (in my non-legal opinion) do pass the second test (i.e. not in the normal course of business - I provide technical/business writing) - I don't see how I would ever be an employee. Furthermore, I work with a lot individuals and entrepreneurs, who are paying out of pocket. It sounds like you and I may have different clients/backgrounds.

All this said, I am fully prepared that large companies, who want to work with me, will only do that via W2, which is fine with me. I recall from this thread, your prespective is different.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2019 04:29:21 PM by Elizabeth R

Do you have any more details, post-meeting? I just received an email from Upwork about this as well. I heard about the law earlier this year but kind of brushed it off, as most of my fellow freelancer pals in California didn't seem concerned and I don't really understand the law myself.\

Thanks so much!

Elizabeth

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2019 10:17:30 PM by Greg C

I came across this and believe that many freelancers on upwork should be covered by this exemption:

Professional Services Exemptions

AB-5 provides carve-outs for the following “professional services:” (1) marketing professional; (2) human resources professional; (3) travel agent; (4) graphic designer; (5) graphic artist; (6) fine artist; (7) freelance writer; (8) barber or cosmetologist; (9) esthetician; (10) electrologist; (11) manicurist; (12) payment processing agent; and (13) IRS licensed tax professional.

To qualify the professional service provider must:

- Have an established business location (may be home);

- Have any required business license or occupational license;

- Have the ability to negotiate rates;

- Maintain the ability to set hours outside of project completion dates;

- Engage in the same type of contract work with other companies, or must hold themselves out to other potential customers; and

- Exercise discretion and independent judgement in their work.

NOTE: There are additional restrictions. For instance, cosmetologists must set their own hours, set their own rates, select their clients, schedule their own appointments, process their own payments, be paid directly by their clients and keep their own book of business.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 6, 2020 04:02:17 PM by Penny P

This bill goes a lot deeper than what you see on the surface---you cannot take one aspect of the rules as tere are 3 biggies in the A,B,Cs and then the Borello Laws that determine employee or IC. What is the official statement by UpWork?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 9, 2020 09:54:49 AM by Preston H

re: "What is the official statement by UpWork?"

I'm not Upwork, but I regularly read the Community Forum and Upwork announcements.

I can't recall seeing an "official statement" from Upwork on this topic.

I don't think it is necessary for them to make an officail statement.

To be perfectly frank, only a tiny percentage of Upwork's freelancers actually live in California, and only a tiny percentage of those work in a way that could even conceivably fall under the jurisdiction of this California law.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 26, 2020 08:36:05 AM by Trasie S

Penny,

Upwork released a statement last winter basically saying that the law was going to go into effect and California freelancers need to do what they need to do to get their work done. It was a completely agnostic approach that threw the ball into the court of the California freelancers. I no longer remember exactly what it said, but the general idea was we need to figure it out.

More than a year has now passed since the legislation passed, and almost 11 months since it has gone into effect, and I would hope that by now everyone has structured their business in a way that allows them to continue to service their clients. I would assume that by now everyone understands the difference between the ABC test and the Borello law and bids on jobs accordingly.

Personally, I ended up getting a local business license as a sole proprieter and I have every client sign a contract that includes clauses that make clear my status as a freelancer / independent contractor (one of the Borello requirements). I had to pivot to technical writing from project management as the PM jobs I was taking are a huge grey area in the Borello test, but found that I can actually charge more as a Technical Writer. That pivot worked well for me, although it means more work finding new clients because I can no longer take on the long-term projects that I did in the past. Nor do I want to, I freelance for the flexibility, if I wanted to work for a client I would go back into an office...

I wish you well, between AB5 and Covid these are trying times for all of us.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 27, 2020 11:04:02 AM by Mary I

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 27, 2020 11:23:55 AM by Trasie S

"AB 5 was overturned by CA Legislators a few months ago. It is now defunct."

That is incorrect.

Governer Newsome provided exemptions for some types of workers, but it is still in place for many other types of freelancers, myself included.

If it were overturned then we wouldn't be voting on Prop 22.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 19, 2019 07:53:10 AM by Will L

Has anyone in California heard anything about the purported new law in this article?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 19, 2019 08:15:10 AM by Petra R

Will L wrote:Has anyone in California heard anything about the purported new law in this article?

Some opinions here

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 19, 2019 11:23:01 AM by Miriam H

Petra R wrote:

Will L wrote:Has anyone in California heard anything about the purported new law in this article?

Some opinions here

I clicked and saw I had commented on the thread you shared..saves me some typing 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 19, 2019 01:53:06 PM by Miriam H

Will L wrote:Has anyone in California heard anything about the purported new law in this article?

Out of cursoity, I read the article, I'm not sure where he is getting this 35 submissions per week. Does that mean to one publication? It wouldn't surprise me if there is a threshold by company, and already many companies in CA (I live here) will put you on W2 if you work a certain amount for them.

I would really be interested to see some legal interpretations of this new law and as stated in the other thread, i am 100% oppossed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 25, 2019 10:29:40 AM by Sara J B

AB-5 actually has a limit of 35 articles per year for a publication. However, "publication" isn't defined. It's not clear if that would apply to the subsidiary or parent company and all of their subsidiary publications.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 25, 2019 10:37:48 AM Edited Oct 25, 2019 10:38:44 AM by Miriam H

Sara J B wrote:AB-5 actually has a limit of 35 articles per year for a publication. However, "publication" isn't defined. It's not clear if that would apply to the subsidiary or parent company and all of their subsidiary publications.

Yes, I came across two interesting articles on the topic (the first one linked to the second):

Having read both, here is what is interesting to me. In a way, I see the argument regarding 35 articles to a publication, not that I agree, I just see the logic. Publications have a minimum quota of articles/words/whatever the metric is, they need to fill. They create the demand, and the demand has a floor (if you will). So I see the argument that should have more staff writers vs. relying on freelancers and provide those staff writers with stability/consistent income. Of course, there is so much content out there, I presume the value of that content has diminished considerably, hence the economics of freelancing vs. staff writers.

However on the Uber/Lyft example, consumers create the demand, not Uber or Lyft. And the drivers can reject fares as much as they want, which is not the case with a taxi that has "shifts."

Regardless, I am not happy with this law however I don't expect it to impact me significantly, at least not in the short term as I am willing to be paid as employee with taxes withheld if the company prefers that approach.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 25, 2019 02:54:44 PM by Preston H

I think California may be trying to put toothpaste back into the tube.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2019 04:35:23 PM by Mary I

I do freelance writing and write at several other online platforms besides Upwork. I got a notice from one of them that starting next year, CA freelancers will only be able to do 34 jobs per year for them and will no longer have access to most of the open available orders. But I have not recieved any notice like this from Upwork or the other platforms where I work. This law will really limit how much I can earn at this other site.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2019 06:46:57 PM Edited Dec 19, 2019 06:48:43 PM by Trasie S

I have continued to follow the story, and it appears as if everything we discussed in September is incorrect and doesn't apply to January.

All 1099 employees in California must be reclassified as W2 employees on January 1. You can continue to support your clients as an independent contractor if you can pass the "ABC Test".

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

- The worker performs work that is outside the usual course of the hiring entity's business.

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

Most freelancers and independent consultants will not be able to pass the #2 of the ABC test. There are exceptions to the law, but most of them are for doctors and certified professionals, not for project managers like me. The 34 limit rule for writers is an exception that was supposed to be fair to writers, but this is why California writers are being let go by their clients in large numbers this week.

Upwork's policy is that worker classification is the responsibility of the Clients. So, clients who want to hire freelancers who are based in California that cannot pass the ABC test above can pay Upwork to employ the freelancer through Upwork Payroll and the freelancer will receive W2 income, not 1099.

I have a feeling that clients on this platform will just start to hire non-Californians.

I have a meeting this week with an employment lawyer to understand this better, as I have mentioned, most of my clients are local and word of mouth and I need to understand this. I spoke to my CPA about this earlier, the state hasn't issued guidelines about how to enforce the new law, and his feeling is that we can continue with business as usual as the state will initially look to target the big Silicon Valley firms for enforcement and one-person shops like most of us will only be noticed when we file a complaint against an employer.

I will continue to update this as I learn more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2019 06:52:21 PM by Miriam H

Trasie S wrote:I have a feeling that clients on this platform will just start to hire non-Californians.

I have a meeting this week with an employment lawyer to understand this better, as I have mentioned, most of my clients are local and word of mouth and I need to understand this. I spoke to my CPA about this earlier, the state hasn't issued guidelines about how to enforce the new law, and his feeling is that we can continue with business as usual as the state will initially look to target the big Silicon Valley firms for enforcement and one-person shops like most of us will only be noticed when we file a complaint against an employer.

I will continue to update this as I learn more.

Thank you for updating, I've been following this closely as well.

I'll be curious what you hear from a lawyer. My understanding is the "freelancer" is the one who can bring a case, and I have every belief this will be tested in court against a large company.

That said, I'd like to know if size of company has any bearing on enforcement? For instance, if you are an LLC and have no employees, how does that work?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2019 04:41:54 AM by Rene K

Trasie S wrote:

I have a feeling that clients on this platform will just start to hire non-Californians.

Wait, while AB-5 applies to California based hiring companies, are you sure that the contractors have to reside in California for the law to apply to them? It was my understanding (but I may be totally wrong) that the location of the contractor doesn't matter.

I skimmed through AB-5, and haven't found anything that says contractors must be in California. Again, I may have missed it...

"Where darkness shines like dazzling light" —William Ashbless

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2019 06:21:58 AM by Mary W

My major client, located in California, who is NOT an Upwork client, has made me an employee as of 1/1/20. This was on the advice of his accountants and his own reading of the law. (Client is a well-respected California attorney). I am NOT in California. I don't much care either way although it's nice to know that I will now be paid by direct deposit every other Friday, although I will get less because of deductions for social security, etc. We'll see how it all shakes out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2019 01:08:03 PM Edited Dec 20, 2019 01:08:30 PM by Miriam H

Upwork has spoken. I just received an email from them, I would imagine it would be posted somewhere on the forums. Essentially they are summarizing the law and recommending that we consult an advisor to see what makes sense for our specific business.

They also say this applies to all independent contractors in CA, which is what I knew.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2019 02:48:24 PM Edited Dec 20, 2019 02:48:49 PM by Preston H

re: "I will get less because of deductions for social security, etc."

I'm very sorry to hear that.

It is unfortunate that you will receive less pay due to this law.

Even though you don't even live in California.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 26, 2019 09:23:55 AM Edited Dec 27, 2019 10:45:23 AM by Preston H

So maybe this law has an upside for freelancers (like myself and most of us) who do NOT live in California:

"Company owners with independent contractors must now decide whether to hire them as employees or look for help in other states."

Read: "California law will force small businesses to rethink staffing"

If businesses can save money simply by hiring freelancers OUTSIDE of California, this is a "win-win" situation for businesses and freelancers everywhere (except California).

CNBC's article on this topic quotes Upwork:

The article discusses freelancers who enter into talks with potential clients, and then end up NOT getting hired after the clients find out that the freelancer lives in California.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 27, 2019 11:42:26 AM by DJ B

This is the biggest concern for me. Employers are going to be confused by the law and default to either hiring as W-2 or simply avoiding Caifornia-based freelancers altogether.

I don't particularly mind being paid as a W-2 employee as long as I keep my independent status (i.e.; not report to an office or be subjected to annual reviews if that's not what I want). A previous commenter mentioned being paid less because taxes are taken out as a W-2 employee. This is true, but in reality you still pay those taxes when you file, as self-emplyment tax (sometimes more). So you don't really get paid less as a W-2, it's just taken out in advance of filing your taxes.

Forming a company as an LLC or S-corp can help, but in California, you pay a minimum $800 fee whether or not you did any business that year. Other states are easier to do business in that way. It's tempting to leave!

I believe that after January, the CA legislature will be meeting again to discuss AB5 and hopefully correct what's wrong with it. It originated from Uber drivers who were concerned they didn't have union representation or benefits, but they didn't think through the repercussions and how many people (who actually want to be independent) would be adversely affected.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 27, 2019 02:24:46 PM Edited Dec 27, 2019 02:38:47 PM by Preston H

re: "It's tempting to leave!"

You have read the news. You know that lots of people and businesses have already left.

Not just for this reason. Number one cause of people leaving California is cost of housing and rent. I was raised in California. I would not move back there. The numbers don't add up.

Any freelancer can "get a raise" just by leaving California.

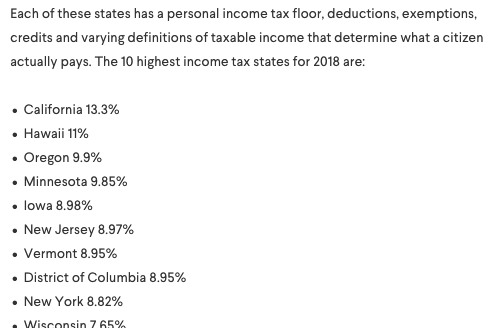

From "States with the highest and lowest taxes"

re: "Forming a company as an LLC or S-corp can help, but in California, you pay a minimum $800 fee whether or not you did any business that year."

It costs $150 in Wyoming.

In Arizona you do not need to pay annual renewal fees.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 27, 2019 05:09:34 PM by DJ B

I hear you. I grew up in Arizona, it's a much better state for business in general. The only wrinkle is that I've built a custom screen printing business here, so if we move to another state we could lose a lot of our customer base. It's a conundrum!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 30, 2019 09:48:23 AM by Rene K

Preston H wrote:

re: "Forming a company as an LLC or S-corp can help, but in California, you pay a minimum $800 fee whether or not you did any business that year."

It costs $150 in Wyoming.

No, it's $50 in Wy.

"Where darkness shines like dazzling light" —William Ashbless

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 30, 2019 10:20:40 AM by Jennifer M

my god $800 to form an LLC? lol

I would love to live in Commiefornia for the weather, but those laws, mang.