- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 11, 2020 04:41:15 AM by Kostya B

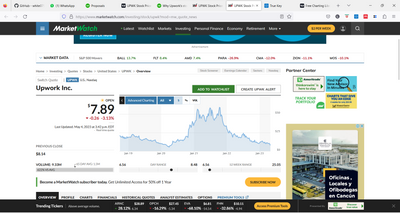

Why Upwork's stock price is falling continuously ?

Who can explain why upwk stock quote falling trend is so continuous ? It's kind a discouraging how weakly the upwk performs.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 12, 2020 10:59:38 AM by John B

we get past this frantic run to stock up with contractors - the wave will

pass. Once it does, contractors are the first to go. They half-life of

on-demand resources is short and sweet in market contractions. Upwork on

the other hand, is in the peach position. They run in essence a monopoly on

global talent provisioning. Not so much from the contractor side - it is

easy to sign up a global talent base in essence. The secret sauce is the

capability to attract, globally, the hiring firms. They play the game for

security, choices of talent up and down, security within the platform.

Fiver, for example, will lop off the low-dollar work. The quickie

projects. Upwork makes their money on larger-scale, lengthier projects.

We'll see continued efforts to get them away from the administrative

intensive, short-duration projects. Now is the time to figure out how to

position differentiated services, play the game for larger project wins,

invest more time in responses to such styles of projects and compete

without mercy.

Upwork stock will peak at a 3:1 of past selling price, then begin a plateau

period is my guess. And that is what it is.

I enjoy our exchange of concepts of such strategic mindsets. You think in

advanced ways for a young person. Bravo. It indicates an advanced mind.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 20, 2020 03:34:02 PM Edited Mar 20, 2020 03:45:56 PM by John B

It happens to be distressing to me, because I am a casual investor in Upwork stock. I like to own a part of companies I work with closely. Or work within. It gives me a reason to stay tuned into the company performance. Which I consider valuable information so I do not have to wonder about such things.

Upwork stock price is falling because it has not yet figured out how to make substantive profit. For the history you see - Upwork has generated, at most, cents per share on stock price. This has occurred for a number of reasons.

- It declared an enormous number of shares when it IPO'd. When it IPO'd at a favorable price, many share owners made a fortune. Which is fine. We expect that in our business. But the downstreams were then: create a profit to sustain a profit that is way more than cents per share... because if not:

- Share prices will get pounded over time, as the firm has not yet turned the corner to create profit potential for institutional investors and casual investors.

The cost to the company management has been high. The CEO of Upwork was recently relieved of his duties. One reason maybe: this is the #1 reason CEOs get relieved. But that is a theory, not fact. Obviously the company's Board believes in the model -- and promoted internally. The new CEO was the former head of Products and Marketing -- meaning -- the Board believes the company can turn the profit corner and specifically in relationship to the earnings-per-share.

All of this information is publically available. You can do research and gain this information but perhaps it is new knowledge that cents per share will depress stock prices. All questions are valid. Researching your own questions will be a business attribute that will help you in the future. I encourage this practice.

What will happen? Of course Upwork will turn the corner. In its acquisition of Elance, it cleared out its primary competitor and gained the primary position of global talent provider in the upperscale ranges of services and holds its own in commodity services for lower-dollar projects.

We are seeing competition in one-off specialied services for smaller, packaged projects. Even then we see Upwork's competitive response - which is why we have specialized profiles and packaged projects that are recommended. That is a competitive move on Upwork's part we encouarge. The firm is a full-in competitor. That is why I am engaged with them.

I believe casual investment will end up being a great investment. With global dominance, a sharp, fully-engaged employee group, and a competitive spirit - it is only a matter of time. Currently, I am tired of losing more money if I cashed out than I make on the platform.

I believe in Uwork for three reasons. The business model is sound. It's compeitive position cannot be matched, and the employees deliver excellent products and services in every way they touch me.

Time, patience, which is always the key to successful investing.

Any more questions?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 25, 2020 01:48:09 PM by Bill H

Royce's list is great; it's missing something. Yes, analysts don't understand companies similar to Upwork. I'm not sure that's critical. Individual investors and investment clubs who do understand the Upwork business know that businesses that need work typically done in house but can be done remotely should be flooding UW and its competitors with lucrative job postings. They're not.

Those who don't understand aren't recommending the stock. Those that do unerstand aren't buying the stock when they should be. I hope Upwork takes that second case seriously and pivots quickly to marketing itself as the savior of businesses. We'll just wait and see.Then again, when has Upwork ever taken the advice of a freelancer about anything?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 26, 2020 12:09:59 PM by John B

Bill. This is perhaps the net that analysts understand that cents-per-share earnings. The company got energetic in its decision of shares declared at IPO and investors were expecting a closer match to earnings and share count. I think the analysts understand that perfectly! We do!

Royce said it beautifully. Market "monopoly". I love that word when I am on the monopoly side of the house two different ways. Bodes well for the future in a couple of ways.

I hope you are doing okay!

John.

John.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 26, 2020 03:11:38 PM by Bill H

John,

I, too, understand cents-per-share and relationship to market cap/value. odesk and elance were struggling for a long while before Upwork was spawned. When cents-per-share remains below zero with no credible plan to fix that, the stock is not going to rise. There is no guidance for investors, and I do not see any remarkable intellectual capital to entice buyers and/or providers.

Upwork is the best of breed without doubt. Its business model might succeed at some point. The most successful online freelancing job brokering board in the US was ProSavvy, which had a very different business and operations model. It charged freelancers a significant sum to join, which was the foundation of its revenue and profit. Beyond that it had a high minimum for jobs, the lowest being "$5,000 or below." Its operations model eschewed algorithms and included human intervention stating with the job posting. It was profitable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 26, 2020 03:23:53 PM by John B

It is good to hope the Upwork business model succeeds. Otherwise, we are out on Fiver or whatever low-end platforms support projects du-jour. Or, go back to how I started my freelancer career, before I figured out oDesk and Elance existed.

I found a way to log into Craigslists across seven major cities. And looked in their business services want-ads for Upwork style projects.

That strategy was actually surprisingly effective "back in the day" (circa 2010 to 2012). Along with me, hiring clients had not figured out oDesk and Elance were the places to be. Fortunately, our platforms caught up to Craigslist (lol...) as the most viable place in which to seek, win, and darn sure charge for work.

Monopolies succeed. And we operate inside a living, breathing monopoly that obviously is not so very easy what-so-ever to replicate.

I predict massive success for the firm, the contractors who figure out how to operate within its environments successfully, and long-term, buy-and-hold investors. The point, to note. Is to make more money on firm ownership than one could ever make working for it.

Good goal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 29, 2020 02:12:56 AM by Irina I

Because the stock market is falling altogether.

There's a video on youtube, but I don't know if I can link to it, or say on which channel it is. It is on a "conspiracy' channel, but the speaker is a financial expert.

The bottom line is that we will all be enslaved because of the virus, staying at home, and the billions being pumped into the stock market every day, forever. But do your own research and draw your own conclusions, because I don't really understand finances. I only "understand" printed paper money.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 11, 2020 05:44:11 PM by Aziz U

Upwork stock is soaring after hours today and has been on a 110% run since April. would have been a perfect time to buy when OP started this thread haha.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 11, 2020 05:58:37 PM by John B

My buy-and-hold strategy worked through the drought. The effort to make more money on the company's stock than I do working for the company seems imminent. Always, always, always take a buy-and-hold strategy measured in years - unless one is a speculator. Which I am not because there are others who are a lot better armed with data and smarter than me doing tihs.

We can now disregard the poo-pooers, bad-sayers, no-faithers -- who, quite recently to note -- poo-pooed the stock. They have now missed it by a mile in trajectory..

John.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 11, 2020 06:18:50 PM by Aziz U

Absolutely. Reminds of that quote by Jesse Livermore:

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine--that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.”

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 11, 2020 06:34:38 PM by John B

strike price has doubled from the purchase price stock price has doubled I

figure then is a good time to get out. Individuals who know when an unusual

win is at hand -- and it is time to get out -- are common. That most do

not, is equally common.

My profit goals are met when the strick-to-purchase price has doubled. I'll

sell when it is has doubled and I had forgotten to check so this email is

incredibly valuable. Along with a 110% increase in share price, my

invitations have increased 8-fold. Busy focusing on that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 4, 2023 12:45:27 PM by Lucio Ricardo M

Like to have kept these messages in a bottle. Upwork was not in a bad moment, neither in a bad perspective. Now is when Upwork looks bad. see the graph. Now that I am studying for a trade-related job, it looks as a head-shoulders tendency, tilted downside.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 7, 2023 04:50:10 AM by Sarah S

I am into technical analysis, so from my analysis I feel the price is stagnant, it's neither falling nor rising and could be a sign of renewed investor confidence,

the decrease in price could be because investors were worried about the growing competition in the freelancing business, many new players had entered the field and the increasing competition from companies like Fiverr led investors to believe Upwork won't be profitable in the long term.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 11, 2023 05:48:32 AM by Jonathan L

Upwork has more than double Fiverr's marketshare. I don't think they are particularly worried.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 11, 2023 12:56:51 AM by Sergei T

UPWK reached all time highs during the pandemic but failed to maintain momentum and has been selling off ever since. Why?

Investor Expectations : Upwork's earnings reports have often been weaker than expected, this could be a reason for a decrease in stock price. Latest earnings report last week was okay but the stock still went lower.

Market Trends: The pandemic led to an increase in remote work, which could have caused an increase in Upwork's stock price. As more companies move back to in-person work, the demand for freelance work may decrease, leading to a potential decrease in Upwork's stock price.

Economic Conditions: Recession is looming. If there's economic uncertainty, investors might be more risk-averse and pull out of stocks, leading to a decrease in stock prices.

Competition: If competitors are performing better or offering more attractive products or services, this could lead to a decrease in a company's stock price. Upwork (aka odesk and elance) used to be the only real game in town but now there are other freelance services.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 27, 2024 12:02:01 PM by Ignacio S

Upwork´s shares keep going down cos they´re awful at keeping happy their freelancers, plus they´re greedy as hell: they should charge us a monthly fee, not an outrageous 15% of each project PLUS connects....... that´s why less and less freelancers and clients are using this crap. Check their stock price in 2024, it will probably their last year operating.

- « Previous

-

- 1

- 2

- Next »