- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 10:13:41 AM Edited Jun 9, 2021 01:34:18 PM by Lisa J

Canada Goods and Services Tax

Hey guys,

Any Canadians here? I just added my BN on Upwork: https://support.upwork.com/hc/en-us/articles/4401838411283

I remember we had a discussion around this last year but I can't seem to find the topic anymore. Canadians were asking how it would be possible for us to pay GST/HST.

And that's from the government just FYI: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/digital-ec...

It doesn't seem like we will be able to fix the issue though. Upwork won't automatically charge our Canadian clients with GST/HST so it won't really solve anything. If a mod is checking this topic, could it be added as a request from Canadian freelancers on top of being able to add the name of our company at the settings level? (So that our invoices do display the name of our company) It's currently NOT possible and a real headache for freelancers looking to incorporate their business in Canada!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 17, 2021 01:38:52 PM by Valeria K

Hi All,

We'll be closing this thread from further replies and invite you to check out the most recent announcement and discussion here, as well as this Help article, for more information about the collection of Canada taxes.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 10:54:53 AM by Sandra T

I contacted Upwork support asking how they expect us to register for sales taxes when we don't even have an option to collect sales taxes from our Canadian clients, but haven't heard back from them yet.

Once we're registered for taxes, we must collect sales taxes from Canadian clients, there's no way out of it, and I don't understand how Upwork expects us to do that.

The majority of freelancers from other countries on Upwork are already able to collect sales taxes, and have been able to do so for years, yet here we Canadians are.

Lisa, you have a BN, but are you also registered for taxes? If you are, have you found a way that sits well with both the CRA and Upwork's ToS to do so? And do you know if it's possible to register for just a BN without registering for taxes? I was told one cannot go without the other, but my sources may have been wrong.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 11:33:18 AM by Lisa J

I agree. It seems that we need to do it manually....

I do have a BN and I am registered as a Sole Proprietorship (once you have a BN, you are basically a sole proprietorship unless you decide to incorporate which requires another BN. You need to then close your Sole Proprietorship account in order to get a BN for your company). Unfortunately and after talking to many CPAs in Canada, there is currently no way of being incorporated and operate on Upwork. The CRA requires all the invoices to display the name of your company + your BN and as it stands, we are now able to display the BN but NOT the name of our company. I believe the name that is being displayed is always our own name and it doesn't work with the CRA. (Unless they change how things work since last year!)

The only way to get Upwork to work with the CRA is to fill out form T2125. I have been doing that for many years now. Except that it's not ideal tax-wise. (You are being taxed a lot more than with a corporation, basically)

Sorry, unsure what you mean by "just getting a BN without registerting taxes"? Well, yeah, when you set up a BN, you ARE a company and you then need to fill out the GST/HST form every single year. You access it via CRA My Business Account.

That page explains what Sole Proprietorship means: https://www.canada.ca/en/revenue-agency/services/tax/businesses/small-businesses-self-employed-incom...

Yes, you are a business. That's the simplest kind of business structure that exists in Canada.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 12:38:59 PM by Sandra T

Thanks for clarifying and sharing your knowledge, Lisa. I was asking because I was wondering if somehow one could register as a business without registering for taxes (due to the less than 30K a year rule). That answered my question.

It's really frustrating that Canadian freelancers get the short end of the stick when it comes to Upwork being government-compliant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 01:30:34 PM by Lisa J

Oh yes, I see what you mean. It won't be possible indeed.

I have the feeling that as the number of FT Canadians freelancers grow, Upwork may be willing to make things work for us. Ie: being able to add the name of our company at the settings level + automatically charge GST/HST for Canadian clients.

I only have Canadian clients from time to time so it hasn't been bothering me too much (at least for the GST/HST porting of it) but it's definitely NOT ideal.

Regarding the BN, it's extremely easy to set it up. You simply call the CRA and done! They will create the BN for you and then you will be able to add it on Upwork. You'll only need to then fill out your GST/HST return once a year. If you charged $0 then you put $0. That's very easy, it's just an extra form to fill out each year 🙂 You'll also need to add the amount for when you fill out the T2125 form. Just FYI, your sales to US clients would remain “zero-rated” for GST purposes, so no need to charge GST on those sales.

If you have more specific questions, happy to help 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 02:19:17 PM by Dr. Elizabeth W

Thanks for that discussion about Canada and GST. I have a slightly different problem on top of all that.

I am a self-employed professional in BC, and I have operated for many years like that. As you know, people are like me are not classed as Businesses, so we don't have a Business Number. So I can't give Upwork a Business Number as requested, and I have no idea what to do next.

Suggestions welcome,

Elizabeth

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 02:23:00 PM Edited Jun 9, 2021 02:24:37 PM by Jenny G

Hi everyone!

I'm pretty new with Upwork World. I just need an opinion coming from you all freelancers especially in Canada.

Because I want the Upwork to collect taxes for but I am not sure, if that means I don't have to register and also file any taxes but the end of the year.

Please let me know.

https://support.upwork.com/hc/en-us/articles/4401838411283

thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 10, 2021 01:30:40 AM by Christine A

Jenny Lou G wrote:Hi everyone!

I'm pretty new with Upwork World. I just need an opinion coming from you all freelancers especially in Canada.

Because I want the Upwork to collect taxes for but I am not sure, if that means I don't have to register and also file any taxes but the end of the year.

This is a discussion about GST, whereas it sounds like you might be talking about your income tax? If your income is above the threshold (around $12K), then you do need to file taxes yourself; if it's above 30K, then you also need to charge your clients GST/HST. If you're new to running a small business, it would be a very good idea to hire an accountant, at least for the first few years until you learn how to do your taxes on your own. They can help you reduce the amount of tax that you pay by deducting any eligible expenses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 02:36:25 PM by Sandra T

Elizabeth, from my understanding we currently have two options:

1. Either Upwork charges us taxes on our service fees

or

2. We register for sales taxes and charge our Canadian clients sales taxes outside of Upwork

Lisa, if you don't mind sharing, how do you charge taxes to your Canadian clients? Do you charge them based on the amount minus service fee, or the full amount?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 07:27:15 PM Edited Jun 9, 2021 08:00:01 PM by Lisa J

Elizabeth, as indicated, if you don't have a Business Number, then Upwork will automatically collect the taxes for you:

If you don’t have a tax ID, we will assess the tax on the following:

- Freelancer service fees (not on your earnings)

- Connects purchases

- Membership fees, such as for our Freelancer Plus plan

- The payment processing fees you pay for Direct Contracts

You will not be assessed GST on any earnings or on any withdrawal fees.

You are supposed to get a BN once you make at least $30K a year being self-employed. I am also self-employed, I have a BN and fill out the form T2125 + GST34. In Canada, you are either an employee or self-employed and when you are self-employed, then you have a business. It's simple as that.

Here is a good article that explains how it works in Canada: https://blog.wagepoint.com/all-content/paying-your-taxes-as-a-self-employed-sole-proprietor-in-canad....

As for how to collect taxes yourself when you have Canadian clients, it's a grey area and no one knows how to approach it! When you deal with Canadian clients, you add it based on how much you charge them. So for example, let's say I charged my client $1K and the client is located in Alberta, the GST amount would be $50 (There is no HST in AB). The client pays for it and NOT the freelancer. Also, since we are being paid in USD, I don't even know how that works because the GST/HST is collected in CAD.

Unless Upwork allows us to automatically charge our Canadian clients based off where they live, I have no idea how to collect the GST/HST.

If someone knows, please let us know 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 05:56:29 PM by Nathan D

Hello,

I am looking to hire some one for a family project. I see a banner about the new Canadian taxes. I am seeing if you have to have a Canadian Business name and tax number to use Upwork.com to hire someone?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 07:18:06 PM by Joanne P

Hi Nathan,

In Canada, a Business Number is a business identifier meant to help simplify dealings with provincial and federal governments. To learn more or to register for a Business Number, click here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 05:39:51 PM by Renata S

I noticed this message today, and I found it somewhat confusing.

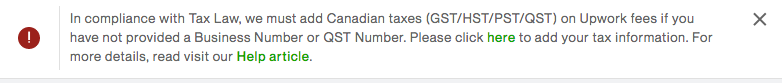

In Canada, if you are self-employed and your (worldwide) taxable income is less than CDN$30,000 in a 12-month period, you are considered a small supplier. People in this situation aren't required to register for an account to charge GST/HST because they aren't required to charge sales tax; therefore, they may not have Business Numbers or QST Numbers to supply to you.

The message above seems to suggest that Upwork will charge GST/HST on behalf of freelancers who may not even be required to charge these taxes. How does that work?

Can someone clarify what this means?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 07:32:46 PM by Joanne P

Hi Renata,

Thanks for asking. A law was passed in Canada which requires GST, and similar provincial-level taxes, to be collected from individuals and businesses operating in Canada when they purchase electronic services. To comply with this law, we need to collect these taxes on the services we provide to freelancers, agencies, and clients in Canada and forward this tax to the Canadian tax authorities.

Canada’s GST is assessed on transactions made by consumers. If you have a Business Number or QST Number, you are not considered a consumer by the Canadian government. Add your valid Business Number or QST Number here and we will not have to assess this tax.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 12, 2021 06:06:52 AM by Renata S

Thanks Joanne! That cleared up one aspect of the confusion. 🙂 The posts from Lisa, Sandra and Dr. E. are helping me sort through some others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 10, 2021 02:05:05 PM by Lisa J

Renata, that's what the new law is all about and Upwork IS required to collect taxes from you unless you are a business already registered with the CRA: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/digital-ec...

Just a reminder, you can get a BN without making $30K a year. If you end up never collecting any GST/HST, then you simply put $0 on form GST34.

I have explained how the process works on page 1.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2021 08:47:12 AM by Renata S

Thanks, Lisa

I actually posted the question as a separate thread, and I see now that my question has been combined with an ongoing discussion. I was a bit confused when first saw it because I thought it referred to the fees charged on the client end. But now I see that it refers to the Upwork freelancer fees.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2021 09:10:55 AM by Lisa J

There is indeed also a fee being charged to the client if they don't have a business number. (I also have a client account on Upwork)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 10, 2021 10:05:30 PM by Dr. Elizabeth W

Yes there are a lot of grey areas, but I'd like to correct one thing you said, Lisa:

"In Canada, you are either an employee or self-employed and when you are self-employed, then you have a business. It's simple as that."

You can be self-employed as a professional or as a business owner. Professionals such as teachers, artists, freelancers of all kinds can just operate under their own name and do not need a business number. It seems that Upwork doesn't know this, so I will be penalized and I doubt whether I'll be able to do anything about it.

Elizabeth

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2021 09:16:55 AM Edited Jun 11, 2021 09:32:45 AM by Lisa J

You can operate under your own name and have a Business Number. That's what I do. Sorry, unsure what you are referring to. Can you share the official CRA guidelines that says that you don't need to set up a GST/HST account when you make over $30K a year as a self-employed individual? Or are you saying that in your case, you don't need a BN because you make less than the $30K threshold as a freelancer? (A BN is automatically created once you register for the GST/HST program account)

Most businesses need to register a GST/HST account once they meet the treshold. (Including Sole proprietorship (self-employed))

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2021 07:06:34 AM by Joanne H

On our earnings.

I have been on UpWork for 10 years (previously ODesk). Since I earn over $30 k annually (Canadian) I have a Business numbers and charge Canadian clients the GST or HST for whatever province they are in.

My hourly rate reflects that - so if they say we don't want to pay you $50 US I let them know I have to pay GST/HST and the Upwork service fees, so at the end of the day I am making about $50 CDN.

When I do my annual HST return I split all my earnings by country (Canada or not) then by province and pay the GST/HST for Canadian clients. I am in the data business so not a big issue working with the numbers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2021 08:17:32 AM by Sandra T

Joanne H wrote:

When I do my annual HST return I split all my earnings by country (Canada or not) then by province and pay the GST/HST for Canadian clients. I am in the data business so not a big issue working with the numbers.

That's interesting Joanne, it's probably the best way to approach it, since clients don't have to pay you taxes outside of Upwork. Do you send your taxable clients some sort of statement with the taxes on it, for your and their records?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2021 09:43:42 AM Edited Jun 11, 2021 09:44:42 AM by Lisa J

Thanks Joanne for your input.

The only problem with that approach is that if you get audited, the GST/HST tax needs to be completely separate from say your hourly rate. So that would be an issue and hence, a grey area.

Unless Upwork automatically includes a line for us, the CRA will likely say that you didn't charge GST/HST to your Canadian clients on Upwork.

Upwork needs to include that line on all invoices automatically. And my guess is that they will (at some point and hopefully they are working on it!) since Canada is passing that new law on July 1st. Those new GST rules are more targeted at non-Canadian entities selling digital products/services to clients in Canada.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2021 10:24:49 AM Edited Jun 11, 2021 10:25:37 AM by Sandra T

Lisa J wrote:

The only problem with that approach is that if you get audited, the GST/HST tax needs to be completely separate from say your hourly rate. So that would be an issue and hence, a grey area.

That's a good point. If I understand correctly, by deducing taxes from your hourly rate, you're actually not taxing your full earnings, and that won't sit well with the CRA.

So I guess in the end the most CRA-compliant way of doing this is to tax outside of Upwork after all...

But technically, under the new law, aren't international freelancers registered as businesses, that are working with Canadian clients, also under obligation to collecting taxes from their Canadian clients?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2021 12:44:59 PM by Lisa J

Well, it's more how you present your invoices to the CRA.

Typically, there would be a line for your fee and a line at the bottom for the GST/HST. The GST/HST tax is NOT part of your fee. It's on top and paid by the client. It's not you charging more to make up for it.

Only Canadian clients need to pay that tax (Clients/freelancers or agencies). https://support.upwork.com/hc/en-us/articles/4401830150675

However, since most of them are probably registered as a business, Upwork won't charge them anything.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 16, 2021 08:25:34 AM by Vanessa M

This is for the service asked. It's no grey area, Canadian client are still on a US platform and from the understanding when talking to professionals here, it's still consider a non taxable form, I do not work outside Upwork with the Canadian clients so it's still consider US. And their law (Upwork) state that you should not work outside the platform either. So yeah it's sorta grey area but still considered to not be taxable since it's a US service though. It's deposited in US and what not. Canadian companies are no fool though. It would be different if you were to work outside and bill them outside of here but they haven't yet given us the option to Tax Canadian clients and as long as they're not enabling this, we are not provided to do so BUT we are provided to pay our own taxes and make our declaration every year ( and yes, we are charged a bunch ).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 2, 2021 06:32:43 AM by Doug S

You don't technically have any Canadian clients.

You have a contractual agreement with Upwork to provide them your freelance services for a fee. In turn, Upwork has a contractual agreement with another Canadian to provide a service to them.

Taxes flow where the money and the work flows. Your work product leaves Canada and is delivered to a foreign entity, who in turn is delivering it back to a Canadian.

I am not an accountant or a lawyer, and the rest of my notes are my opinions, but I have read and researched this quite a bit, for the CRA certainly has the power to make you pay if they feel you forgot to collect their GST/HST amounts.

When you report GST/HST, you do not say, I sold $100 therefore I owe the CRA $13 in HST. Rather, you report how much GST/HST you collected, how much GST/HST you paid to others in order to earn that money, and the difference you remit. If you sold $100 to a U.S. firm, you would not collect HST and you would not remit HST. Upwork is a U.S. firm.

That "Canadian Client" you mentioned, is not your client at all. You cannot contact them directly, You cannot work with them outside of Upwork. If you did (which violates their agreement with Upwork and your agreement with upwork), then, and only then would your work product be remaining in Canada and GST/HST is collectable/remitable, assuming you earn > $30,000 per annum or you are a corporation.

Its a bit complicated, but you are not paying HST, you are remitting to the CRA, the HST you collected on their behalf, from Canadian taxpayers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 9, 2021 07:14:15 AM by Christine P

Thanks Doug, that clarifies the issue I was having and it makes total sense. After all, you don't necessarily know where the client is located geographically and even if you know they are Canadian, you don't necessarily know which province or territory they are from so how would you know how much tax to charge... ? I am new to Upwork, so when comes tax time, I will put all my earnings with them under "US client" for CRA purposes. Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 14, 2021 03:10:23 PM Edited Sep 14, 2021 03:15:41 PM by Lisa J

You absolutely do. It's indicated on the invoices.

Again, PLEASE, do work with a CPA who knows what she/he is talking about when it comes to Upwork. Do not assume that you don't need to pay GST/HST because you don't know the platform well. As indicated by Vladimir, the relationships are between the client and the freelancer and YES, a client can sue YOU. So if you are serious about freelancing on Upwork, I also advise to work with a lawyer that can explain everything to you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 9, 2021 01:20:18 PM by Vladimir G

Hi Doug,

There is a contractual relationship directly between freelancers and clients. More information about the relationship can be found in our User Agreement. It is important to understand that freelancers do not work for or provide services to Upwork - Upwork simply makes our work marketplace available to you to enter into agreements with clients directly.

Due to the complex nature of the Federal and Provincial transaction tax rules, we strongly recommend you find a qualified professional to help you with tax matters in Canada.

While we cannot provide specific tax advice and you’ll need to talk to your own advisors as every situation is different, here is some general information on what freelancers can expect starting out in Canada. New freelancers should evaluate whether their business (regardless of the form of the business, individual vs legal entity) is subject to registration requirements in Canada (including provinces). Federal requirements can be found here. Please refer to each province's Department of Revenue/Finance websites for province specific information.

If a freelancer does not have a requirement to register, then there is no need to account for GST but the freelancer should continue monitoring registration requirements and comply once they meet the requirements.

If a freelancer is a GST registered business in Canada, but provides services to clients outside of Canada, export of services are in most cases zero-rated services in Canada. If the freelancer is a GST registered business in Canada and provides services to clients in Canada, the total amount of the project (whether fixed-price or hourly) should generally be treated as tax-inclusive pricing, and appropriate tax amount from the project should be remitted to the tax authorities.

For example: For $100 Fixed price project in Alberta (5% GST), $100 ÷ 1.05 = $95.24 would be pre-tax sales plus $4.76 GST)

Before you submit a proposal or begin the work with the client, the location of the client is visible and you should be aware that working with Canadian clients could impact the after-tax value of the project and should be considered in your proposal.

As of today, our platform does not have the functionality for freelancers to include a separate charge for tax, and the invoices may not meet specific tax requirements of the country you or the client is in. Some freelancers choose to issue a tax invoice outside the platform, and it also may be requested by Canadian clients that need a supporting document to substantiate GST Input Tax Credit on the transaction.

We hope you find this information helpful, please reach out to us if you have any further account specific questions that we may be able to assist with.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 14, 2021 03:07:07 PM Edited Sep 14, 2021 03:17:08 PM by Lisa J

Except that when they'll ask you for invoices, they are going to see the address of your client located in Canada. (And only "Invoice created via Upwork") So yes, they are your Canadian clients. And I have a CPA that can confirm that as well. I have the feeling your research didn't go as far as checking your invoices?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 16, 2021 08:27:08 AM by Vanessa M

That's a good answer. I think it's super complicated but once i spoke to a professionnal i begin to understand the matter is that this is a US company. No matter if the client is in France, Germany or what not, they are still on a US platform and it stays like that. So at some point they may add some options but i do not think so. It's been running for decades.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 02:52:12 PM by Valeria K

Hi Lisa and Sandra,

Thanks for sharing your concerns and feedback. I'll forward this thread and the information you've shared to the team for consideration.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2021 07:37:51 PM by Lisa J

Valeria,

Do you have someone on the Upwork team that could help us understand how to technically charge the GST/HST or that's not something you guys offer atm?

Also, how do we know if our VAT number has been accepted? I added it and it seems to have been accepted. I don't see any confirmation or anything. I just see the VAT section with my Business Number. Thanks 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 10, 2021 07:48:09 AM by Sandra T

Indeed, Valeria, please share with us what is Upwork's stance on this.

What is Upwork's recommended method for collecting sales taxes from Canadian clients, that is both in compliance with Upwork's Terms of Services and the CRA's laws?

Because any Canadian freelancer that registers for a Tax ID MUST collect sales taxes from their Canadian clients, that's the law.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 16, 2021 04:43:19 PM by Valeria K

Hi All,

We want to provide an update on our pending collection of Canadian GST and related taxes. Our tax advisors have provided new information and we are working with them to review the requirements. For now, we have paused collecting tax ID information and will remove the option to add these numbers to your Upwork account.

We will provide another update as soon as we know more. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 16, 2021 07:26:52 PM by Lisa J

Thank you Valeria,

Guys and Valeria, just FYI, that's the compliance I found on https://turbotax.intuit.ca/tips/self-employed-taxes-collecting-gst-hst-8730

"After you have registered for the GST/HST, and begin collecting and charging the GST/HST, you are required to let your customers know that GST/HST is either included in pricing or will be added separately. This information must be clearly indicated on your invoice, contract or posted on a sign easily visible to customers and must include the GST/HST rate being charged along with your registration number."

The current Upwork setup DOES NOT WORK with the CRA and is NOT compliant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 2, 2021 04:29:02 PM by Bernedette T

Hi Valeria, it's been 3 months since you last posted about Canadian GST/HST, are there any updates you can share with us? What can Canadian freelancers do in the meantime? Avoid taking on Canadian clients?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 23, 2021 01:39:42 PM by Lezli H

For the past several weeks there was an alert on our Freelancer home pages about an upcoming change on July 1. It asked us in add our GST number if we had one and had a link to a support article.

I read the article when the alert first popped up, and now I've just attempted to add in my GST number as asked. Except the alert and the support articles are gone. I can Google the support article, which started "Starting in July, Upwork will be required by law to collect Goods and Services Tax (GST) from freelancers in Canada," but that leads me nowhere.

Okay, I'm not an idiot--typically--and I should be able to add my GST# without a support article. I head to my Settings >Tax Information, and there isn't anywhere to add my info--that I can see.

So if someone could advise as to what's going on, it would be much appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 23, 2021 02:41:03 PM by Valeria K

Hi Lezli,

I've merged your post into this thread where the topic of Canadian GST (and other taxes) has been discussed. I apoloigize for the confusion and encourage you to check out the update I've provided here.

Valeria K wrote:

We want to provide an update on our pending collection of Canadian GST and related taxes. Our tax advisors have provided new information and we are working with them to review the requirements. For now, we have paused collecting tax ID information and will remove the option to add these numbers to your Upwork account.

We will provide another update as soon as we know more. Thank you!

| User | Count |

|---|---|

| 450 | |

| 396 | |

| 325 | |

| 248 | |

| 176 |