- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 15, 2016 04:41:13 AM by Joao S

Declaring earnings in Portugal (or similar in UE)

Hello all,

I just started in Upwork, I have a lot of doubts about declaring my earnings here.

I'm from Portugal, and we have to declare earnings for everything, and make a receipt with the vat number and so on.

I've consulted a tax expert that told me to ask Upwork. Upwork told me to ask here in the community forums, so I'm going around in circles.

I'm thinking if I should create the receipt from Upwork, from the money I receive in the bank every month, or if I have to do it in the name of my clients.

If so, I will be paying taxes for the full amount, including the 20% fee that Upwork took already, so I'm not sure. Is someone here from Portugal or a EU contry that has similar structure that can help me? And also, do we have to pay VAT on that value?

Thanks in advance,

João

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 15, 2016 04:52:45 AM by Vladimir G

Hi Joao,

Please refer to the information and instructions our agent provided in your chat conversation, Joachim shared here and consult a local tax advisor or accountant who specialises in IT business/law.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 15, 2016 04:52:45 AM by Vladimir G

Hi Joao,

Please refer to the information and instructions our agent provided in your chat conversation, Joachim shared here and consult a local tax advisor or accountant who specialises in IT business/law.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 15, 2017 01:45:37 AM by Wendy M

Hi Joao,

I would be interested to know if you sorted this out. I am also in Portugal and want to know how to do the declarations for Tax.

Message me if you can please.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2021 05:26:40 AM by Donna T

I would also like to know this. If you could message me if you find out

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2021 09:42:35 AM by Wendy M

Register with Finanças as self employed and submit Recibos Verdes for any income withdrawal from Upwork.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 12, 2022 05:35:32 PM by Liliana A

Hey Donna!

So you only make a invoice once a month? in the name of upwork?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2021 10:12:57 AM by Wendy M

I am registered for Recibos Verde. I do a recibo when I withdraw funds from Upwork.

Company Upwork Inc

Tax code 999 999 990

You can register with IVA then you don't pay the VAT on the Upwork fees.

Wendy

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 8, 2021 05:35:55 AM by Aixa C

Thanks, Wendy, it is my first time doing my taxes in Portugal, so I will follow just the withdrawals amount from Upwork then.

Best.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 27, 2021 03:45:39 AM by Carolina C

Hi Wendy!

So, when you do a recibo verde you fill it out with Upwork information and not the actual client's info?

Also, do you declare the amount that the client paid or the amount that you receive (after fees and all that)? Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 24, 2022 07:06:00 AM by Marta L

Hi Carolina!

I know it's long time you did this comment but I decided to reply to it anyway.

The invoices we create (recibos verdes) needs to be with the complete value the client pays you! So, imagine that the client pays $100 and Upwork takes $20. You create and Invoice for the $100, but in Euros (you can use a conversion tool online to put the date of the payment and the value and it will tell you how much was $ in to €) and the $20 you need to declare as "Commission" (income) paid to Upwork through Modelo 30 and also find out 23% of the $20 (everything after conversion), will be $4,6 and declare it on VAT declaration and pay it in Portugal.

I know all of this sounds new, difficult and wierd, but this is the right steps a freelancer that works online should do legaly

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 21, 2022 05:58:58 AM by Joao E

Hi Marta,

But don't we need the Upwork Portuguese NIF for Model 30 ? Do you know it ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 21, 2024 03:22:37 PM by Angela Kris W

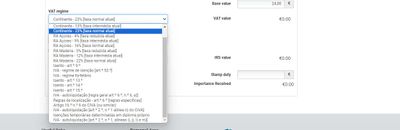

hi Marta L. if my client is in UK what artcle number shoulld i choose for reverse charge mechanism? should it be

IVA - autoliquidação [regra geral art.º 6.º, n.º 6, a)] or

IVA - autoliquidação [art.º 2.º, n.º 1, alíneas i), j), l) e m)]?

its abit confusing for me which is if inside EU but outside Portugal.

thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 24, 2022 06:57:24 AM by Marta L

Hi Wendy,

I was looking around on the community and I saw your comment here about the way you do your invoices (recibos verdes).

I just wanted to advise you that the Invoices are in name of the clients and not UpWork, so you need to do the recibos verdes mentioning the client location and the NIF you put "-" unless you have that information from the client.

Another thing, even though freelancers in Portugal may not need to charge VAT to clients, they need to pay VAT in Portugal for the Service Fees and UpWork Subscriptions, that's why the "Reverse Charge" on UpWork Invoices and also fill in Modelo 30 declaring "Comission" (Income) paid to UpWork.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 19, 2021 01:13:06 AM by Donna T

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 19, 2021 01:43:07 AM by Wendy M

You don't issue Recibos Verde to Upwork, they are just for tax and Segurace Social quarterly declarations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 28, 2021 01:01:44 PM by Donna T

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 24, 2021 12:52:03 PM by Donna T

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 25, 2021 10:37:09 AM by Wendy M

fees.

The amount going into you bank and on green receipts is what counts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 25, 2021 01:50:09 PM by Donna T

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 22, 2024 04:14:06 PM by Rohan Sanjeev K

Hi Donna,

Do I have to pay extra tax to the Portuguese auhtorities after VAT is deducted by Upwork. Also to not pay VAT do I have to register as a company.

Warm regards

Rohan Kale

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 3, 2022 04:35:18 AM by Julia L

Hey guys!

I have also problems with tax system here in Portugal.

I thought I have to write a fatura/recibo maximum five days after I have received the money, but I can only see the exact amount once it is transfered from Upwork to my bank account (because this is the amount I must declare, right?). So my question is do the five days of time to write a recibo/fature start from the day I receive the money on upwork or on my bank account?

It all seems so complicated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 3, 2022 05:46:58 AM by Donna T

I always do mine the day I receive into my Portuguese bank account as I only transfer across once a month

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 15, 2022 05:27:32 PM by Donna T

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 16, 2022 04:53:47 AM by Hs S

Hey Donna, I read all the comments and it helped me to make my further decision. I have a few things that I would like to ask, please answer if you can.

I would like to ask you I have a Temporary residence permit in Portugal So can I also register as a self-employed?

I do handle my client's website(Blog) and the work I do for him is, Finding new keywords, content writing (I outsource it) formatting content, adding images and publishing, etc.

So Let's say I registered as a self-employed and I made $5000 a month that I received on Upwork.

As I do some of the work outsource and imagine it costs me $2500.

So can I also show my expenses to the Tax authority or do I have to pay taxes for $5,000?

If you can suggest to me any good accountant please suggest me.

Thanks and regards

HS Saini

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 24, 2022 07:26:01 AM by Marta L

Hi HS Saini,

As a person under the temporary residence permit law in Portugal it's for your best interest to register as an Independent worker in Portugal and declare and pay taxes here in Portugal so you can prove that you're doing your duties and so they can keep give you permission to stay.

If your yearly income gets over 12500€ you will be informed that you need to start charge VAT (23% for Services) to your clients the next year after passing that value.

Now, here it gets a little bit more difficult to explain, but I'm going to try my best.

The first year as a Self-Employed you do not need to pay Social Security or charge VAT (even if you do more then the 12500€ on that year) it will only start after 1 year registered.

According with VAT law, if you're obliged too, you charge VAT to clients inside Portugal. To clients outside Europe you do not charge VAT in any circumstances! When you do your invoice you put there that your not obliged to charge it according with Article 6 that is related with Location of the client. If it is a client inside EU but outside Portugal you do the VAT Reverse Charge (as UpWork do when creating an invoice to us) and if it is a commun client you need to charge VAT according with the VAT law in the client country inside EU and then you need to use the right Articles when filling in your Invoice here according with the situation.

I don't know any accountant at the moment, but not many know that well the VAT laws when working with clients all over the world. So, pay attention to that if you hire one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 23, 2024 02:25:20 PM by Angela Kris W

Im a bit confused on this. after one year, do i need to start charge VAT (23% for Services), this mean on the recibo verde-vat regime section i choose continente 23% not IVA - autoliquidação [regra geral art.º 6.º, n.º 6, a)]?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 3, 2022 11:38:34 AM by Pedro F

Hey guys, I also have some doubts regarding this matter.

I currently have a full-time job working for a company, and I've decided to start making some small side jobs to increase my income by a bit.

I've already made two small jobs on Upwork(~150$) but now I'm not sure what I need to do to get paid, do I also need to register as self-employed even though I have another job? Will I get in trouble for that or is it ok?

After that, do we just need to create a recibo verde for each payment Upwork does to us, or one for each job completed? Should it have the client's information or just the Upwork information is enough?

Let me know if you have any doubts, this is still a bit confusing to me, so if you need extra information to help me, just let me know

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 3, 2022 12:53:09 PM by Luiggi R

Hi Pedro,

Just to provide some clarity, on Upwork, you'll be working with clients using either Fixed-Price or Hourly contracts. On fixed-price contracts, you'll be paid for the completion of milestones, and said payments become available to you after a five-day security period. On hourly contracts, your clients are billed every Monday for the hours you logged the week prior, and those funds become available to you after about 10 days.

To withdraw your funds, you must complete the Form W-8BEN on Settings > Tax Information, and add a disbursement method in the Get Paid section. I'd suggest you get in touch with a local tax professional for any tax-related inquiry, as we're unable to provide advice on this.

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 3, 2022 02:23:01 PM by Donna T

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 3, 2022 11:23:30 PM by Wendy M

Hi

to do Recibo Verdes you need to register an Activity with the Finanças.

You will need to do an annual tax declaration so now is a good time to get an accountant to help with this.

Wendy

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 19, 2022 08:45:43 AM by Joao E

Hi,

I'm starting Upwork and could need some help in this subject.

After doing a job for CompanyX I got 2 invoices issued:

1) One for the full amount of the job from me to company X

2) Other from Upwork to me regarding 20% fee plus VAT taxes

I understand that we should do a Recibo Verde for 1) (my work to CompanyX), but I am not sure when (invoice, payment received ?) or what to do with 2) (Upwork services) and if I have to declare the VAT.

Can someone help, please ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 24, 2023 07:12:41 AM by Barbara L

URGENT!!!!

Good afternoon.

If I issue a green receipt for the amount to be received, am I still obliged to pay the fee to Upwork?

If yes, the value of my receipt is only on what I receive in the end, right? Or do I declare the upwork fee as well?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 25, 2023 11:50:24 PM by Donna T

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 28, 2023 04:26:48 AM by Alyona G

But then you need to pay tax in Portugal on this amount.

I did a small job on Upwork for 140 USD but after all the fees I only received 82,83 EUR to my Portuguese bank card. If I just issue a recibo verde to 82,83 EUR, I will have to pay more tax on it? Which basically makes the time/effort spent on the job not worth it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 12, 2023 12:43:30 PM by Maria Francisca A

Hey Donna! So I do the declaration to who? Upwork?

Still very confused with all the taxes situation since I´m new here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 24, 2023 03:04:03 PM by Abdessamad B

Hello Joao,

I just moved to Portugal,

I'm self-employed and I can issue green receipts but I don't know what to issue to Upwork, and what to issue exactly!

I'm stuck, and I want to know how you handled this, if anyone else could help I would appreciate it.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 23, 2024 05:09:26 AM by Naiara B

Hey guys,

Thank you for sharing your experiences. This subject has caused a lot of doubt, so I would appreciate some help with my question.

I am Portuguese Brazilian and at the moment my activity as an Independent Worker is closed, as I am receiving unemployment benefits.

I signed up for Upwork to try the platform as a possible source of extra income, including professional relocation. I recently got a job and I'm unsure about receipts. Should we issue green slips for all work done on UpWork?

Since it is a marketplace, would you know if UPWORK provides a receipt/proof of payment for the company that hires the freelancer?

Thanks,

| User | Count |

|---|---|

| 408 | |

| 283 | |

| 260 | |

| 162 | |

| 159 |