- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 03:17:49 AM by Farshid J

GST for Australian Freelancers

Hi,

I am a Freelancer based in Australia. I have my ABN number and also have registered for the GST.

I also have a Tax agent.

But, no one helps me with my GST. What should I do? How can I issue GST amount in my invoices for my client?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 04:24:19 AM by NikolaS N

Hi Farshid,

Thank you for reaching out to us. You can add your 11-digit ABN and confirm that you are registered for GST by going to Settings › Tax Information.

Until you enter your valid ABN and you’ve acknowledged you’re registered for GST, Upwork will charge GST. This means that a GST charge will show up on any invoices occurring before your valid ABN is successfully saved to your profile and you’ve acknowledged you’re registered for GST. We can't refund you this amount. If you have an ABN and are registered for GST, please enter your Tax Information as soon as possible to avoid being charged.

We display your GST on the invoices from Upwork to you, which can be found in your Reports › Transaction History.

You can find more information in this help article.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 05:03:58 AM by Farshid J

I think you got me wrong.

I have entered my ABN and and I have acknowledged that I have been registered for the GST. It's all fine and already done!

Upwork is not charing me the GST and that's totally fine.

My problem is something different. In Asutralia, every quarter I have to pay my GST to the government because I am considered as a sole trader in Upwork. I am looknig for a way to get this money from my client in Upwork. How can I issue GST in my invoices for my client?

If I can do this, then my client can pay GST, and then I will pay my GST to Australia governemt. This extra money doesn't go into my pocket. I am just looking for a way to get this money from my client and pay that to the governemt.

How can I do that now?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 07:22:53 AM by NikolaS N

Hi Farshid,

Thank you for following up. Under law, we’re only required to collect the Goods and Services Tax (GST) for the services Upwork provides users. You will not be charged this tax on the payments you receive from your clients, only on the service fees we collect from you. That means the 10% tax will apply to the sliding service fee you pay when you earn on Upwork, the fee you pay for a Freelancer Plus membership (if you have one), and the cost of purchasing additional Connects.

Please consult your tax advisor to determine your GST obligations to clients.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 05:56:41 PM by Farshid J

I think we're a bit confused. I try to explain the situation again:

So, all the invoices that the Upwork issues on my behalf to the client, should have the GST component inside that.

How can we manage this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 07:58:24 PM by Arjay M

Hi Farshid,

We truly appreciate your feedback and suggestions. Please note that we display your GST on the invoices from Upwork to you, which can be found in your Reports › Transaction History. The invoices between you and your clients will not change. As Nikola mentioned, you may want to consult your tax advisor to determine your GST obligations to clients.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 09:45:46 PM by Farshid J

Thanks.

I have a TAX agent and he suggested me to reach out to you. Because Upwork is my business now.

Basically, when you have a business in Australia (For example: a freelance deigner in Upwork) you need to pay GST to the government. Australian business people usually charge their clients with the GST on their invoices and this is how they collect their GST.

Now, in my case, my client is in Upwork. Every week they pay me based on the issued invoice betwenn us. This is actually the Upwork who controls everything and our invoices.

I need to charge my client with the GST too. This is legal and mandatory.

How can I do that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 4, 2022 01:49:49 AM by Annie Jane B

Hi Farshid,

AJ here stepping in for Arjay. While we do collect the Goods and Services Tax (GST) from freelancers to meet our own tax obligations, if you have clients in Australia, you would have to do it separately since this tax is separate from the services you provide to your clients within the Upwork platform. To learn more about registering for GST, you can visit the Australian Taxation Office site at https://www.ato.gov.au/Business/GST/Registering-for-GST/.

As Upwork is not acting as your GST agent or intervening between what’s required between you and your clients, please consult your tax advisor who is familiar with the nature of your business setup, to determine if you’re responsible for collecting GST for the services you provide to your client.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 25, 2023 04:17:51 AM by Camilo Andres P

I know This is old AF, but still Valid, Did you ended paying on your own pocket?, the only way is upcharging the Clients by 10% on the contract prices knowing at the end you will pay from your pocket?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 4, 2022 04:28:10 PM Edited Oct 4, 2022 04:28:34 PM by Farshid J

Thanks a lot Annie for your response.

I have contacted my Tax agent again and he said that according to Australian Taxation Law, I need to collect GST from my client.

My client is not an Australian client and they are based in Europe. But, I am based in Australia as a freelancer and I am working for my client via Upwork. I am sure that I need to collect the GST from my client but I don't know how to that in my profile.

How can I issue Tax invoices to my client from now on?

Should I ask the client to do that? How does it work?

Or maybe the functionality is missing from the Upwork platform at the momnt, right?

Regards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 4, 2022 09:04:39 PM by Alper D

Hi Farshid, actually upwork provides nothing in regards to complying with your own tax / legal responsibilities. They just cover their own responsibilities because they are "selling" you a service. I live in Turkey and i create my own invoices according to local law (not because client wants it). In my invoices customer is not upwork, it is the end customer that is using my services.

In your case you'll have to consider all your responsibilities and adjust your pricing accordingly. Clients won't care / need to know how much local taxes are taking from that gross price.

I hope this helps,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 26, 2023 06:30:30 PM by Shieryl N

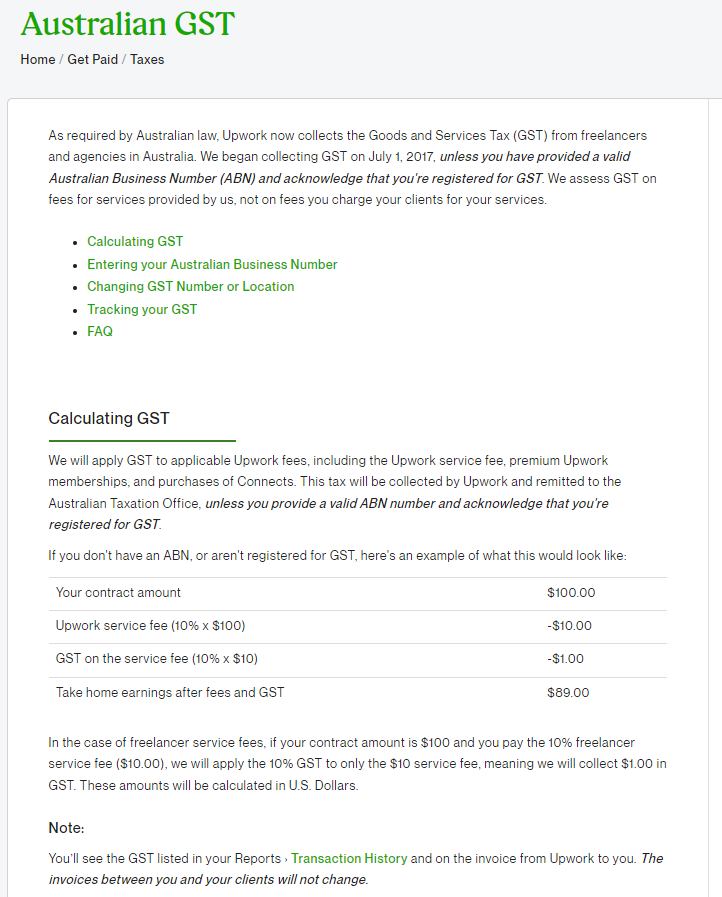

Hi Farshid, I am new to Upwork and also was confused about how ABN and GST work in Australia. And I found this link https://support.upwork.com/hc/en-us/articles/115008309168-Australian-GST#tracking.

Upwork began collecting GST on July 1, 2017.

| User | Count |

|---|---|

| 408 | |

| 283 | |

| 260 | |

| 162 | |

| 159 |