- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 28, 2020 01:46:34 AM by Cristina M

Invoice to UW

Hi all,

I have read several messages about this topic but none of them answer my question.

The law of my country (Spain) asks me to present an invoice with this information about the client:

-name

-VAT number

-address

-amount for the service.

My client told me that the invoices that I need to present to the authority are with UW as client, and not them, since UW is the company that is paying me.

How can I know UW

-address

-VAT number

to generate the bill?

Also, I know that I can find the invoices in the "Report" section, but they don't work for me for two reason: they don't have the information that I need (e.g. VAT number) and also, the invoices that I need are not for the client, but for the authority, and, as I said before, my client is not the client itself but UW, since it is the one who is paying me.

Can anyone help with this?

Many thanks!

Cristina

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 28, 2020 03:24:16 AM by Jennifer R

Cristina M wrote:Hi all,

I have read several messages about this topic but none of them answer my question.

The law of my country (Spain) asks me to present an invoice with this information about the client:

-name

-VAT number

-address

-amount for the service.

My client told me that the invoices that I need to present to the authority are with UW as client, and not them, since UW is the company that is paying me.How can I know UW

-address

-VAT number

to generate the bill?

Also, I know that I can find the invoices in the "Report" section, but they don't work for me for two reason: they don't have the information that I need (e.g. VAT number) and also, the invoices that I need are not for the client, but for the authority, and, as I said before, my client is not the client itself but UW, since it is the one who is paying me.

Can anyone help with this?

Many thanks!

Cristina

You client is wrong. Upwork is only managing the payment process and is not your client. The invoice created by Upwork during this process can be found here.

The problem is that you no know if the client provided this information until you have access to the invoice provided by Upwork. This goes both ways. Depending on where the freelancer lives the clients do not receive an invoice with all the information.

Name: That should be on the invoice.

VAT number: Keep in mind that not clients are business clients and therefore do not have a VAT number, the important thing is your VAT number on the invoice. Besides the VAT is only important for clients within the EU.

Address: see above

Amount for the service: Can be found in the invoice issued by Upwork. With each each invoice Upwork issues on your behalf it also creates an invoice for you with the fees for that service.

I suggest you download the invoices on a regualar basis because in case you change your address in the future, all past invoices show the new address as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 28, 2020 03:55:39 AM Edited Apr 28, 2020 04:08:24 AM by Cristina M

Hi Jennifer,

thanks for your reply.

I'll ask my client.

Anyway I still have a problem: the amount I receive is not the same my client is paying (due to Upwork fees). I mean: I'll create a bill with the real earning that I got and not the one that the client paid, so the two amountS will not match!

Anyone from EU that can give me an example on how the invoices are, please?

Also, can the UW fees be considered as deductible expenses or how do you manage them?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 28, 2020 04:23:20 AM by Jennifer R

Cristina M wrote:Hi Jennifer,

thanks for your reply.

I'll ask my client.

Anyway I still have a problem: the amount I receive is not the same my client is paying (due to Upwork fees). I mean: I'll create a bill with the real earning that I got and not the one that the client paid, so the two amount will not match!

Anyone from EU that can give me an example on how the invoices are, please?

Also, can the UW fees be considered as deductible expenses or how do you manage them?

Thanks

Yes, Upwork fees are business expenses just like everything else you have to pay for in order to work. If you decide to pay for Freelanver Plus, these are business expenses. The deductable expenses are different in every country and you need to find out about it fo Spain.

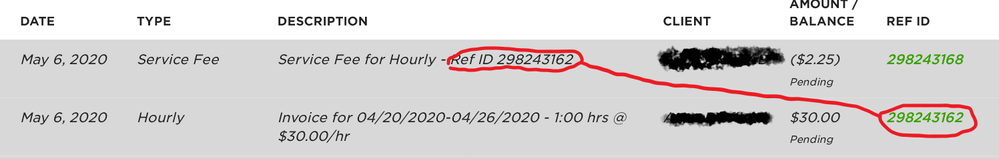

As for the difference between the invoiced amout and the amout you receive have a look at the screenshot below. Each invoice Upwork sends to the client on your behalf (lower row) has an invoice issued to you (upper row) and deducts the amount from the amount that is released to you. So you do receive the full amount but at the same time you pay your fees, just like the VAT.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 28, 2020 05:58:41 AM by Cristina M

Hi again,

I think I got it, so If I am not wrong, in my register I have to say that (using your screenshot):

1) I earned 30$ (the total amount that the client paid).

2) I "lost" 2.25$ as expenses (I know it depends on different countries, but I checked and in Spain I can do it).

In this way, the difference between 1) and 2) is the real earn that I have, and it matches with the one that the client paid.

Right?

Thanks 😉

| User | Count |

|---|---|

| 408 | |

| 283 | |

| 260 | |

| 162 | |

| 159 |