- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 01:00:55 PM by Tanveer S

Upwork's Horrendous Chargeback Protection

Hello everyone,

I've unfortunately had to come across my first chargeback situation with Upwork. A client, after losing a dispute decided to chargeback the transaction 2 months after the fact. Thus the dispute process it self doesn't matter. You just have to chargeback the amount to 'win'.

I didn't realise the fact that Freelancers aren't protected against chargebacks. Naively, I was under the impression that much like PayPal/Venmos Seller Protection, if there was a chargeback they would cover the difference and dispute the claim themselves. Instead I was told by the support team to pay back the amount owed...

It's just made me disappointed, as I love working on Upwork and have met many wonderful clients on here. But this incident really demoralized my motivation. By this logic any one of my clients could chargeback, whether its $1000, $10,000 or even more. I'm utterly shocked that Upwork advertises it self as a mediator/third party, whilst also promoting "payment protection", "escrow secured" to entice freelancers to come in under the false notion that their pay is secured.

I don't understand how Upwork is better than simply getting your transaction done via PayPal's seller protection plan (probably a lesser % fee). Their business model has to change in the future (I hope), as this is very unsustainable.

Anyways just wanted to share my frustration/disappointment about Upwork's No Chargeback Protection.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 03:07:24 PM by Jonathan L

The simplest solution to the chargeback situation (and fraudulent payments) is to prohibit the use of credit cards. But it seems likely that many good clients need to use credit cards and many will be unable to purchase freelance services without them. It is not unusual for companies to operate exclusively on credit, either because they need high business credit scores or they do not have capital for the services upfront but will after their own profits come in from the project.

But prohibiting credit cards would likely tank the number of scam jobs, since it is likely that those clients only use credit cards - often someone else's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 01:08:44 PM by Will L

Hi, Tanveer.

Yes, Upwork does need to find client payment methods that are much more difficult for clients to reverse.

There is no enforceable payment protection on fixed price projects.

Keep in mind that there is true payment protection on hourly projects, as long as the freelancer follows the requirements of that protection to the letter.

Good luck on your future projects.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 03:07:24 PM by Jonathan L

The simplest solution to the chargeback situation (and fraudulent payments) is to prohibit the use of credit cards. But it seems likely that many good clients need to use credit cards and many will be unable to purchase freelance services without them. It is not unusual for companies to operate exclusively on credit, either because they need high business credit scores or they do not have capital for the services upfront but will after their own profits come in from the project.

But prohibiting credit cards would likely tank the number of scam jobs, since it is likely that those clients only use credit cards - often someone else's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 03:20:15 PM by Will L

I wish Upwork management would explain why it isn't forcing, or even allowing, all US clients to make bank-to-bank payments via Zelle or similar payments services rather than credit cards, which would reduce the likelihood of chargebacks.

For the three months ended June 30, 2022 74% of Upwork's revenue came from US clients, most of whom could easily use these common US payment methods. And the US government says it will introduce an even cheaper option for retail bank-to-bank money transfers in 2023, so it's about time that Upwork find a more secure way to get paid so both it and freelancers lose less money to payment-related client fraud.

Upwork could even make the use of these more reliable payment methods optional and mark each new project with the type of payment method the client is using. Freelancers can then decide whether they want to submit a proposal to work on that project. I imagine some projects would receive more proposals than others (and maybe even lower freelancer pricing) based on this information, but both freelancers and Upwork would make more money overall. And freelancers who currently avoid fixed price projects would be more likely to accept work under fixed price contracts, which at least some clients would appreciate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 15, 2022 12:56:17 PM Edited Dec 19, 2022 04:44:40 AM by Will L

Not at all, Mark. US government systems handle money movements of many billions of dollars every day. What do you think the Fed is, if not a central bank and payments clearing house (of which it is certianly not the only one)?

Madness is continuing to require clients to use credit cards and expecting the problem of chargebacks to go away.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 03:38:33 PM by William T C

If you go through Upwork's 3 step arbitration and you win, there are no charge backs.

Did you use Upwork's recording app as proof?

I have had a few disputes during the past 5 years and 290 projects, however always won.

Sure you didn't lose in the dispute process?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 03:45:46 PM by Will L

Hi, William T C.

From your experience, what prevents a client from telling his / her bank to issue a chargeback when the client loses at arbitration?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 03:48:25 PM by William T C

That become Upwork's issue to deal with if you won the 3 rounds of arbitration IE Upwork's Terms of Use.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 04:02:21 PM Edited Nov 11, 2022 04:22:18 PM by Will L

That's interesting. I was not aware Upwork guarantees to pay freelancer for the full amount won at arbitration.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 06:34:06 PM Edited Nov 11, 2022 06:37:49 PM by Jonathan L

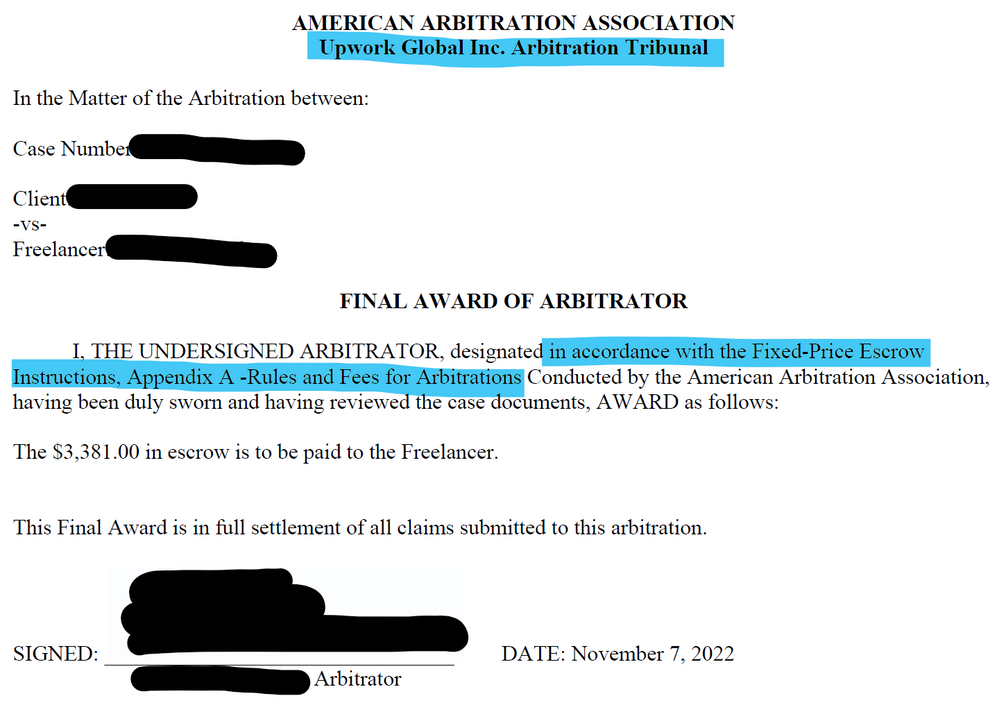

Arbitration is legally binding. Literally everyone is statutorily required to adhere to the decision (so long as the decision is within scope). If someone violates it, they can be reprimanded in a court of law. I just finished a round of arbitration as a freelancer, which I won, and Upwork is patiently telling my former client (I've fired him) at every turn that he has no recourse, that they are required to send me the money awarded by the arbiter.

That client is now screaming fraud and scam at the top of their lungs. They believe that arbitration violated their rights as a client! Which is the one of the most laughable claims they have made so far (among many).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 06:58:08 PM Edited Nov 11, 2022 07:00:23 PM by Will L

OK, arbitration is legally binding on client and freelancer.

But if the client has his bank issue a chargeback against the amount in Upwork escrow during arbitration, will Upwork make payment to the freelancer for the arbitrated amount and then pursue the client for reimbursement of that payment?

I doubt it, but I don't use fixed rate projects and have never used the arbitration option offered by Upwork.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 07:06:04 PM by Jonathan L

Like William said, that is Upwork's problem to resolve. But they have excellent teeth in those cases, because they can provide a legal document to the bank. The only exception is if the card was fraudulently used, in which case the card owner will obviously not match the client. I suspect that Upwork will just have to eat that cost, although maybe the bank will have to? That's beyond my knowledge pool.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 07:12:57 PM Edited Nov 11, 2022 07:14:00 PM by Will L

I don't think it is Upwork's problem to resolve. Upwork is not a party to the arbitration, which solely involves client and freelancer. If either doesn't perform as decided by the arbitrator they should do, then the other can go to a court of law to enforce what the arbitrator decided. But in no case would either party have a claim against Upwork, which would only be liable to release any funds available in escrow as instructed by the arbitrator. But if there are no funds...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 07:35:22 PM by Jonathan L

Reading my arbitration award ruling, Upwork is party to the proceedings and decision (they also pay 1/3 of the costs). Of course, a party would only have claim against Upwork if the award was not disbursed according to the award instructions.

And its not like Upwork wants more arbitration - it costs them money to do mediation, case management, and they even pay part of the arbitration service. And if the client wins arbitration, most of the money Upwork would have made goes down the drain, because of the loss of the freelancer's fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 07:40:10 PM Edited Nov 11, 2022 07:42:41 PM by Radia L

I read your other thread (which is cricket). I guess not many people with arbitration experience in this forum.

So both parties simply provide evidence, and arbitrator provide decision? No more debate etc.?

And I also have no idea about the chargeback part, especially when the card is stolen (if not stolen I guess the bank can and must follow the AAA).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 08:15:01 PM by Jonathan L

Radia L wrote:I read your other thread (which is cricket). I guess not many people with arbitration experience in this forum.

I've seen some members mention they have multiple won disputes under their belts. I just don't think the time of day that I posted the discussion helped 😅.

Radia L wrote:So both parties simply provide evidence, and arbitrator provide decision? No more debate etc.?

There are different types of arbitration. In my case (I presume due to the size of the disputed amount), we operated under "expedited arbitration" rules, which only pays the arbiter for a single hearing day, no pay for study/research, and extra hearing days must be negotiated with the case manager. Our case manager supplied the claims and Upwork Contract Room messages to the arbiter (sans images). The client (plaintiff) was allowed to submit a statement and I submitted a Response statement. Then, if the arbiter needed/wanted more information, they could ask for it. In my case, the arbiter didn't request any and submitted his decision.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 12, 2022 05:13:52 AM Edited Nov 12, 2022 05:16:44 AM by Will L

Jonathan L.,

That verbiage does not make Upwork a party to the arbitration. It just defines the rules that both freelancer and client have agreed to use. It also doesn't make Upwork liable to pay either client or freelancer any amount beyond what is available in Upwork escrow.

From that information I see no reason to think Upwork itself will pay the freelancer if insufficient good funds from the client are in escrow. To its great credit, Upwork does pay out of its own pocket, if necessary, under hourly payment protection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 29, 2023 09:58:27 AM by Will L

Jonathan L.

Upwork's Terms of Service Section 11.RELEASE specifically states that all users (clients and freelancers) "...agree not to hold us responsible for any dispute you may have with another User."

Upwork has set up a structure for client and freelancer to agree to (or refuse) arbitration, which will result in Upwork taking actions that each user has had to agree to before even using Upwork's services.

That does not make Upwork a party to any arbitration activity that takes place.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 04:22:59 PM Edited Nov 11, 2022 04:24:18 PM by Will L

I didn't know there were 3 rounds of arbitration. How does that work?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 11, 2022 06:35:13 PM by Jonathan L

I think by 3 rounds, William means the three steps of the dispute process. Arbitration through the AAA is the last step - and the only legally binding one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 17, 2022 08:49:09 PM by Tiffany S

Please point us to that provision.

This one seems to contradict your interpretation:

In addition, except as expressly provided in the Terms of Service or the Escrow Instructions and to the extent permitted by applicable law, we reserve the right to seek reimbursement from you, and you will reimburse us, if we: (i) suspect fraud or criminal activity associated with your payment, withdrawal, or Project; (ii) discover erroneous or duplicate transactions; or (iii) have supplied our services in accordance with this Agreement yet we receive any chargeback from the Payment Method used by you or your Client despite our provision of the Services in accordance with this Agreement. You agree that we have the right to obtain such reimbursement by instructing Upwork Escrow (and Upwork Escrow will have the right) to charge your account(s), offset any amounts determined to be owing, deduct amounts from future payments or withdrawals, charge your Payment Method, or use other lawful means to obtain reimbursement from you. If we are unable to obtain such reimbursement, we may, in addition to any other remedies available under applicable law, temporarily or permanently revoke your access to the Services and close your Account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 18, 2022 09:44:27 AM by Jonathan L

Tiffany, I hate the fact that you are right. (Would have been nice if you mentioned what section that was. Took awhile for me to locate it. User Agreement, S-6.3, P-6)

Unfortunately, even the section (User Agreement, S-6.4, P-4) that refers to both chargebacks and disputes is in accordance with your referenced passage.

Upwork does not guarantee that Client is able to pay or will pay Freelancer Fees, and Upwork is not liable for and may reverse Freelancer Fees if Client is in default or initiates a chargeback of funds with their financial institution. Freelancer may use the dispute process as described in the applicable Escrow Instructions in order to recover funds from Client in the event of a default or may pursue such other remedies against Client as Freelancer chooses. If Upwork recovers funds from a Client who initiated a chargeback or who is in default pursuant to this Section 6.4, Upwork will disburse any portion attributable to Freelancer Fees to the applicable Freelancer to the extent not already paid by Client or credited by Upwork through any Payment Protection program.

It appears that the dispute award, under US federal law (United States (or Federal) Arbitration Act, Ch. 1, S. 9) has to be brought before a court within 1 year to be confirmed, at which point it becomes enforceable. The good news is, that a client can only appeal on the grounds listed in S. 10 & S. 11 of same.

If the parties in their agreement have agreed that a judgment of the court shall be entered upon the award made pursuant to the arbitration, and shall specify the court, then at any time within one year after the award is made any party to the arbitration may apply to the court so specified for an order confirming the award, and thereupon the court must grant such an order unless the award is vacated, modified, or corrected as prescribed in sections 10 and 11 of this title. If no court is specified in the agreement of the parties, then such application may be made to the United States court in and for the district within which such award was made. Notice of the application shall be served upon the adverse party, and thereupon the court shall have jurisdiction of such party as though he had appeared generally in the proceeding. If the adverse party is a resident of the district within which the award was made, such service shall be made upon the adverse party or his attorney as prescribed by law for service of notice of motion in an action in the same court. If the adverse party shall be a nonresident, then the notice of the application shall be served by the marshal of any district within which the adverse party may be found in like manner as other process of the court

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 17, 2022 08:44:12 PM by Tiffany S

You're confusing two different issues.

A chargeback is when the client reports the charge as fraudulent or for some other reason improper and the bank or card issuer reverses it. This is a challenge all merchants face, and brick and mortar businesses face losses from chargebacks as well. When a chargeback is issued, the bank calls the money back from Upwork. Upwork does have an opportunity to fight the chargeback, but I've seen no indication that they take advantage of that opportunity, since I've never seen a single freelancer who complained about a chargeback say that Upwork requested information from them to help fight the chargeback.

The dispute process has absolutely nothing to do with chargebacks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 18, 2022 09:59:47 PM by Amanda L

Tiffany S wrote:You're confusing two different issues.

A chargeback is when the client reports the charge as fraudulent or for some other reason improper and the bank or card issuer reverses it. This is a challenge all merchants face, and brick and mortar businesses face losses from chargebacks as well. When a chargeback is issued, the bank calls the money back from Upwork. Upwork does have an opportunity to fight the chargeback, but I've seen no indication that they take advantage of that opportunity, since I've never seen a single freelancer who complained about a chargeback say that Upwork requested information from them to help fight the chargeback.

The dispute process has absolutely nothing to do with chargebacks.

Tiffany, a previous FEATCON did report about having a chargeback and winning. It's somewhere here in the forums.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 18, 2022 10:39:18 PM by Jonathan L

Tiffany, I don't know how common it is, but I've attached a discussion from today where the OP posts a message from Upwork requesting that he authorize them to dispute the chargeback.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 15, 2022 01:20:22 PM by Tiffany S

This and Amanda's comment above are encouraging. I have seen the occasional freelancer mention being asked to authorize a dispute in the past. What has troubled me is the large number of freelancers complaining in detail about their chargeback experiences who never mention having been asked for the type of documentation that would be required to fight a chargeback. In some cases, Upwork may have sufficient information in the account history to do that, but that can't be true across the board.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 12, 2022 04:08:14 AM Edited Dec 15, 2022 01:33:25 PM by Phyllis G

Tanveer S wrote:Hello everyone,

I've unfortunately had to come across my first chargeback situation with Upwork. A client, after losing a dispute decided to chargeback the transaction 2 months after the fact. Thus the dispute process it self doesn't matter. You just have to chargeback the amount to 'win'.

I didn't realise the fact that Freelancers aren't protected against chargebacks. Naively, I was under the impression that much like PayPal/Venmos Seller Protection, if there was a chargeback they would cover the difference and dispute the claim themselves. Instead I was told by the support team to pay back the amount owed...

It's just made me disappointed, as I love working on Upwork and have met many wonderful clients on here. But this incident really demoralized my motivation. By this logic any one of my clients could chargeback, whether its $1000, $10,000 or even more. I'm utterly shocked that Upwork advertises it self as a mediator/third party, whilst also promoting "payment protection", "escrow secured" to entice freelancers to come in under the false notion that their pay is secured.

I don't understand how Upwork is better than simply getting your transaction done via PayPal's seller protection plan (probably a lesser % fee). Their business model has to change in the future (I hope), as this is very unsustainable.

Anyways just wanted to share my frustration/disappointment about Upwork's No Chargeback Protection.

Have you read Paypal's Seller Protection Program terms? Eligibility hinges on a number of criteria (starting with the primary address of your PayPal being in the US) and is ultimately at PayPal's discretion. The bar is pretty high for intangible goods.

Freelancing essentially amounts to operating a small business and it is up to each of us, the business owners, to look past the marketing messages of the tools we use and make sure we understand their terms of service. If we take what we pick up from advertising or word-of-mouth at face value, hearing what we want to hear without investigating further to protect ourselves by fully understanding the terms, that's on us.

Chargebacks are a potential risk with any credit card payment. UW can't change or control that. It can and does (1) provide the bank with relevant information to challenge the chargeback, and (2) kick the client to the curb. Fees collected from FLs are to cover the costs of operating the marketplace including facilitating contracts and payments. UW is not a party to project contracts nor is it a party to financial transactions. Those are between client and FL. (Someone commenting in this thread claims that UW was "a party to" his arbitration but the document he shared clearly indicates the arbitration is "client vs. freelancer". If a client refuses to comply with arbitration by refusing to pay up or by filing a chargeback to recover funds already paid, I'm sure UW will kick them to the curb and in the case of a chargeback, challenge it at the bank. But I don't see UW suing the client because UW is not a party to the transaction. It would be up to the FL to pursue a legal remedy if it's feasible given the amount of money in question, jurisdiction(s) involved, and other factors.)

There's no way to risk-proof freelancing. There are payment processors that claim to offer more protection against chargebacks but to the extent they do so, their systems are rife with fraud and scams. (Google "zelle + fraud" for a taste of what goes on.)

FLs who are completely risk-averse and want guaranteed payment protection on UW must confine their activity to hourly contracts and use the desktop time tracker precisely as directed. Even then, protection is limited to around $2,000-2,500 per contract per client(I recently learned).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 17, 2022 05:05:34 PM by Mark K

Not to mention PayPal's intention to fine me $2500 for writing or saying something they consider to be "misinformation".

Closed my PayPal account that day --

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 17, 2022 04:23:30 PM by Nare A

Over the years Upwork made it harder for freelancers to register and seems to be vetting them more, but has done NOTHING, to do the same with clients.

I had this situation as well. And it's even worse than just teh simple chargeback. The client charges back teh full amount, while we get only 80%. So absically the freelancer works, Upwork amkes money, client gets free work, freelancer should earn 120% of the amount to be able to work and earn again.

2 of my clients recently did that (both with 5 star reviews and work delivery evidence), but guess what, after 3 months, the bank has decided to stil go through with it and meanwhile Upwork still takes my 20%. And it's not even small amount, it's 3000$

So yeah, each day I regret spending 7 years on this website, building teh profile and such, to then get this. I'm done and I hope that with all those chargeback stories happening more and more often, that there will be a massive freelancer exodus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 14, 2022 07:17:53 AM by Muhammad A

Hi! Miss Nare A

I understand the situation, would you like share some experience about this. How can you manage this, either through pay charge back fully in one go or got adjusted through your future earning.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 15, 2022 10:40:29 AM by Nare A

Considering, that usually those chargebacks happen way later, when the funds aren't there anymore, you basically have to earn 120% of the amount to pay it back or you won't have any way of releasing your funds to your bank account. You would be lucky to pay it on one go, if the chargeback happened sooner than you've taken the money to your bank account.

In my case, as the amount is pretty big: 3000$, I have decided to say goodbye to the amount that resides on my account, that won't go anywhere and just stop working on this horrible website, warn everyone about not working here and just get some emotional satisfaction out of seeing their annual losses and stocks going down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 16, 2022 02:20:24 AM by Christine A

The thing is, if you want to use any other freelancing website to look for jobs, there will still be the risk of a chargeback. If you find clients on your own, you're also risking chargebacks, unless they all pay you in cash or a bank transfer. That will be quite a limitation on your business. How do you plan to get around this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2022 08:22:36 AM by Nare A

The difference is that 1. Upwork is notorious of not vetting clients at all. Over the years they made it harder for teh freelancers and easier for schammers. Many other websites don't have such a history. 2. Most other websites don't charge such high fees. If I'm getting chargebacks, while paying 5-9% fees to website, then it's neither as infuriating, when the website isn't helpful at all. And secondly, then it isn't as hard to earn the chargeback amount as it is, when you have to earn 120% of big amounts like 3-10k.

So my problem isn't as much that the chargebacks are possible. My problem is that upwork hasn't done anything over the years to try to filter clients, started some innovations that will make freelancers to spend more on connects and such, charging extremely high fees, while providing 0 security. So far the ONLY "pro" for me is that I've spent 9 years on building my profile, but the "cons" are so much, that it's just isn't worth it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2022 01:38:39 PM by Jonathan L

Please provide examples of marketplaces that only charge 5-9% that are not industry-specific websites. Because when I searched in May 2022 before choosing Upwork, everyone was a minimum 10%, across the board, no opportunity for lower fees.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2022 02:11:33 PM by Jeanne H

There are some out there, but the amount and type of jobs tends to be pathetic.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 18, 2022 05:34:55 AM by Nare A

guru.com for example (Also they don't allow clients to post very low wage jobs unlike Upwork). Also 10% is also way lower than 20%.

Also why doesn't industry specific count?

Also for some types of jobs (not just 1 industry specific) there's also Behance that doesn't have many job postings per day, but also applying to those is free absolutely.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 18, 2022 03:47:21 AM Edited Nov 18, 2022 03:48:18 AM by Will L

All of this kerfuffle about unjustified chargebacks could be largely avoided if Upwork allowed/forced clients to use less reversible methods of payment than credit cards. Nearly three-quarters of all Upwork's client revenue for the first nine months of 2022 came from US clients, substantially all of whom have more reliable payment options available to them.

If I owned a company that lost $73 million in the same time period, $19 million of which was due to fraud and other "transaction losses," I'd be working hard getting that problem resolved.

However, to its great credit Upwork does provide real payment protection on hourly projects, which is no doubt a significant portion of that $19 million.

I'm rooting for you finding a solution soon, Upwork.

| User | Count |

|---|---|

| 454 | |

| 427 | |

| 333 | |

| 269 | |

| 169 |