- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 3, 2020 09:27:01 AM by Shannah M

Best way to setup account

Hi there! My husband and I are both developers and own our own web development company. We would like to utilize UpWork to find additional work when we have slow periods. Right now I just setup a freelancer account but we were talking and really want the payments for work completed to go to our company account (and not an individual). The only downside would be being taxed on the funds here and then the funds being send to our company account and then taxed again when we pay ourselves through our company...so I'm not sure if what we are wanting will actually work?

We just want to make sure that any income for work we complete goes through our company and not really sent to us as individuals. Does that make sense? Can anyone help us understand if this is something that we can do or is it best to just both sign up as freelancers and just deal with the money outside our business and it be more of a "side job" thing.

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 3, 2020 09:30:44 AM Edited Aug 3, 2020 09:38:16 AM by Preston H

Upwork doesn't care if you withdraw funds to a company account or an individual account. All that the payment withdrawal software does is check to make sure that the name on the Upwork freelancer account matches a benficiary name on the bank account.

Upwork doesn't care about how many people are co-account holders on a bank account.

And I'm sure you already know that you and your husband can not share an Upwork account. If you are caught using the same Upwork account, then that would be ground for suspension or permanent termination from the platform.

re: "The only downside would be being taxed on the funds here..."

Upwork does not levy taxes.

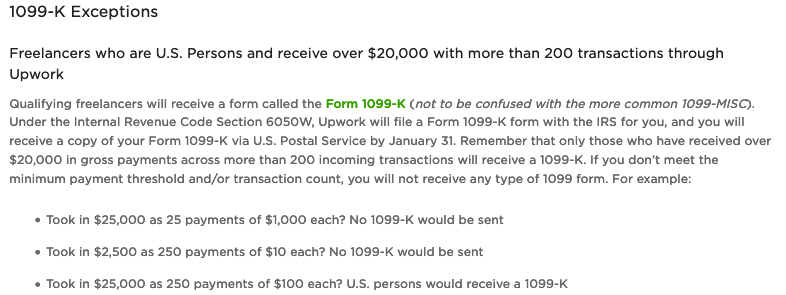

In fact, except in rare circumstances, Upwork doesn't even report your earnings to the IRS. That's your responsibility.

You may read:

https://support.upwork.com/hc/en-us/articles/211063958-Report-Income-from-Upwork

re: "We just want to make sure that any income for work we complete goes through our company and not really sent to us as individuals. Does that make sense? Can anyone help us understand if this is something that we can do or is it best to just both sign up as freelancers and just deal with the money outside our business and it be more of a 'side job' thing."

Yes, it makes sense. Can you do these things? Yes.

Will Upwork help you? No. Upwork doesn't get directly involved with people's tax filings in that way. You would work with your tax consultant and accountant to set up things correcly. Will you set up an LLC? S-Corp? File separately or jointly? These are all legitimate questions which Upwork will not answer for you.