- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 20, 2020 01:25:47 AM by Nodar K

Which tax form to fill for non US LLC

Hello,

I'm registeres on Upwork as a freelancer and would like to use my LLC.

How do I fill the tax information?

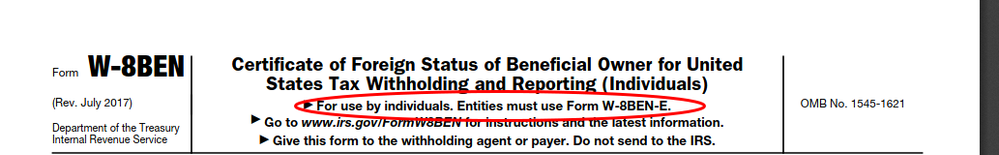

I know that I need to fill-in the W8BEN form as a non-US person, but is it the same form form for the non-US LLC?

From the information that I have found, for the LLCs the form is W8BEN-E but that form is not mentionned on the "Tax Information" page on Upwork.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 20, 2020 06:13:18 AM by Vladimir G

Hi Nodar,

I'd like to clarify that the purpose of the W-8 form on Upwork, under Settings> Tax Info is to confirm you're not a US taxpayer. You can use your own legal name as it appears in your passport or other official documents or your company name.

If you have questions about reporting your Upwork income to your country's tax authorities please consult a local legal advisor.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 20, 2020 01:37:35 AM by Goran V

Hi Nodar,

To learn more about the W-8BEN for and how to fill it out, check out this Help Article. I`m not sure what you meant by non-US LLC, but you can add your full legal name or your company name in the form and save it. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 20, 2020 05:36:17 AM by Nodar K

Hi Goran,

Thank you for your answer.

By non-US LLC I mean a company that is registered in a country that is not US.

So if I want to withdraw the funds from my Upwork account to my company's account should I indicate the company's name or my personal name in the "Tax Information" page?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 20, 2020 06:13:18 AM by Vladimir G

Hi Nodar,

I'd like to clarify that the purpose of the W-8 form on Upwork, under Settings> Tax Info is to confirm you're not a US taxpayer. You can use your own legal name as it appears in your passport or other official documents or your company name.

If you have questions about reporting your Upwork income to your country's tax authorities please consult a local legal advisor.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 25, 2024 05:27:04 AM Edited Feb 25, 2024 05:52:53 AM by Oleksandr K

Hi Goran V, VladimirG

By non-US LLC he meant non-US resident who is US LLC owner.

Actually LLC owner (US or non-US) will be the disregarded entity in case you're sole owner (owing 100% units of entity). And in case you're non-US owner then you're about to fill W-8BEN (for individuals) as you're disregarded entity. Explanation: How to Complete Form W-9 or Form W-8BEN for a Foreign Owned Single Member LLC?

However when you do taxes you have to fill two more other forms as explained here What Forms Do Foreign-Owned Single Member LLCs Have to File?

Note also, as per LLC Taxation for Non-US Residents

If the LLC generates non-US sourced income, the LLC owner pays no income tax, LLC members pay no income tax.