- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 9, 2024 06:37:54 AM by Sumeet M

Hello I don't have a pan card as I am not yet eligible for that and upwork keeps asking for it to withdraw money how do I solve this problem.

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 9, 2024 07:29:10 AM by Luiggi R

Hi Sumeet,

Having a PAN is an essential requirement for you to be able to withdraw your funds. If you do not have one, please consult a tax advisor or a local tax authority in your country on how you can obtain one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 17, 2024 04:33:22 AM Edited Feb 17, 2024 05:10:04 AM by Luiggi R

Hello,

I have provided tax number (PAN Number). All sections in "Tax Information" is set to "Completed". Please see screen shot below. But, still more than 1% tax is deducted. Please let me know if I am missing something.

**Edited for Community Guidelines**

Thank you,

Geetha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 17, 2024 04:54:35 AM by Johnlery C

It sounds frustrating to still have over 1% tax deducted despite providing your PAN number. Have you reached out to the tax authorities or your employer to clarify the issue? It's important to ensure accurate tax deductions to avoid any financial discrepancies."

"Dealing with tax deductions can be a headache, especially when you've already provided your PAN number. Perhaps there's an error in the system or some additional documentation required. Have you considered consulting with a tax advisor for assistance in resolving this matter?"

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 17, 2024 05:09:51 AM by Luiggi R

Hi Geetha,

Thank you for bringing this to our attention. We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 18, 2024 06:22:18 AM by Krishnan K

I am a freelancer from India. I have already uploaded my PAN details but they are being rejected and the chatbot support is really unhelpful. It'd be great if someone can help out with this.

I have already checked everything DOB, Name, Number and re-entered all the details to no avail.

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 18, 2024 07:46:56 AM by Luiggi R

Hi Krishnan,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 23, 2024 11:26:28 AM by Devanshi V

Why I am still paying 5% TDS on every payment (in India) when I already submitted all the details asked by Upwork including the Government IDs like Aadhar and PAN card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 23, 2024 12:17:26 PM by Ramesh Kumar K

Are you sure you've linked your PAN with your Aadhar before June 30, 2023, if your PAN was issued before July 1, 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 9, 2024 11:56:28 PM by Jitendra G

HI now i have one question : If i don't add my pan number and you will cut 5% tax from my job, now when i see on my Form 16 OR when i see on my income tax portal is this income shown ? without this pan ?

So i see if my pan is valid and you take 1% and my income is shown on income tax portal , now if i remove that pan number then is it shown in my income tax portal , i mean this earning income ?

I hope you understand my question.

Thank you

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 10, 2024 04:05:35 AM by Joanne P

Hi Jitendra,

Indian tax law requires everyone who had a PAN as of July 2017 to link it to their Aadhaar number by June 30, 2023. If you do not link your PAN and Aadhaar number, your PAN will become invalid and we will withhold 5% for TDS. You will need to add a PAN and link your PAN to your Aadhaar number in order to keep the withholding tax at 1% of your earnings or to claim a credit or refund. To enter your PAN, go here. You can check this page for more information.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2024 03:57:04 AM Edited Mar 11, 2024 04:44:14 AM by Luiggi R

Hi,

I'm Mahendra. I added my PAN card to Upwork two weeks back and it got approved and the Tax Identification Number status shows completed. But as it is showing withholding tax takes 5 percent of my earnings. kindly look into this issue. I checked with Aadhar also it was linked to my PAN card. Kindly resolve this issue and credit back my 4 percent of earnings that have been deducted from my earnings.

Thank you.

**Edited for Community Guidelines**

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2024 04:43:53 AM by Luiggi R

Hi Mahendra,

Thanks for bringing this to our attention. We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 15, 2024 06:43:51 AM by Rajeev K

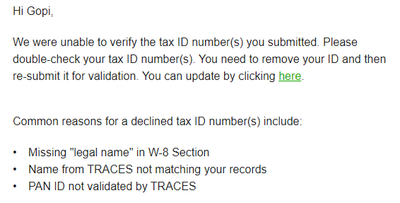

I have seen every information seems correct and updated but still getting mail "e were unable to verify the tax ID number(s) you submitted. "

kindly look after it asap,

Thanks

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 15, 2024 08:16:44 AM by Luiggi R

Hi Rajeev,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 9, 2024 07:08:28 PM by Surender K

I have already submitted my PAN number. But still 5% WHT tax is being deducted from my earnings instead of 1%. Please help.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 9, 2024 11:11:26 PM by Joanne P

Hi Surrender,

I checked your account and saw that you've indicated 'I don't have a GSTIN.' India requires Upwork to collect goods and services tax (GST) and remit it to India’s government unless we have a valid Goods and Services Tax Identification Number (GSTIN) on file for you. GST is a tax on goods or services, including our services to you, and “remit” means to send money for a payment. If you provide a valid GSTIN to Upwork, we will not have to collect this tax from you. You can enter or edit your GSTIN in your account’s Settings > Tax Information. For more information, please check this help article.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 14, 2024 07:07:28 AM by Surender K

I have PAN Tax id which is already verified and linked to my adhaar but still I have been charged 5%WHT Tax instead of 1%, I don't know why?

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 14, 2024 07:55:37 AM by Luiggi R

Hi Surender,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 16, 2024 11:41:45 AM by Jishnu N

I'm being Taxed at 5% even after My pan card details are submitted and verified,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 17, 2024 03:30:50 AM by Rahul J

It sounds like you're experiencing an issue with your tax rate in India even after submitting your PAN (Permanent Account Number)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 20, 2024 11:05:50 PM by Geetha P

Hi Upwork team,

2 Months back, I posted the same question. The solution was to get my PAN card approved. My PAN card is approved now. But, still in the recent transactions, total of 2.8 (GST: 1.8% + Withholding Tax: 1%) is reduced from my payment. Why is it so?

Please let me know.

With Regards

Geetha

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 21, 2024 12:59:48 AM by Pradeep H

Hi Geetha,

I understand your concern regarding the tax deductions from your payment. Let's clarify this issue for you. The tax deductions you mentioned consist of both Goods and Services Tax (GST) and Withholding Tax. Since you have updated your PAN number, your Withholding Tax is reduced from 5% to just 1%.

We’re required to comply with the tax laws of the countries where we operate to continue to do business in those countries. In India, it is mandatory for us to collect Goods and Services Tax (GST) on Upwork services and deliver it to the government, unless we have a valid GSTIN (GST identification number) on record for you. In the event that you do not provide a valid GSTIN, we are obligated to charge you GST and remit it to the Indian government. However, if you supply a valid GSTIN, we will be exempted from collecting the tax. To enter your GSTIN, go to your account’s Settings > Tax Information.

To get a clearer understanding of the specific deductions in your case, we recommend reviewing your transaction details or consulting with a tax professional who can provide guidance tailored to your situation. If you have any further questions or need assistance, feel free to reach out to us.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator