- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

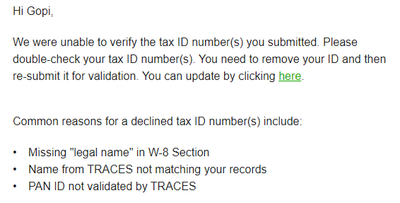

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 13, 2022 01:37:29 PM by Arjay M

Hi Abbas,

I have checked your account and it looks like your PAN is currently on a pending verification status. Please note that we cannot directly verify your tax information. Once you add the information to your Upwork account, we submit it to the Indian Tax authorities for verification. If you added your PAN number, it was accepted, and you didn't get an error message, you're all set. There is no further action needed on your end.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 14, 2022 06:48:45 AM Edited Jul 14, 2022 06:49:38 AM by Abbas Ali M

Thanks for the reply Arjay, I have seen this script before on other threads also but nowhere is mentioned how much time it exactly takes to get verified?

Some of them have been waiting for months as pending verification. Does that mean I'll end up paying 5% TDS for the rest of this life and 1% is just smoke and mirrors?

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 14, 2022 07:53:48 AM by Andrea G

Hi Abbas,

Please note that you already get the reduced withholding tax of 1% regardless of the PAN "Pending Verification" status.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 18, 2022 02:00:20 AM by Sunitha S

Hi,

Did anyone from India face an issue with PAN verification? I am not able to get my PAN verified, though my PAN was active until recently.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 18, 2022 03:18:13 AM by Joanne P

Hi Sunitha,

I've escalated your concern to the team. One of our agents will reach out and assist you directly via a support ticket.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 14, 2022 09:22:56 PM by Pradeep H

Hi Vaibhav,

Thanks for reaching out. Sorry, we cannot directly verify your tax information. Once you add the information to your Upwork account, we submit it to the Indian Tax authorities for verification. If you've managed to add either your PAN number successfully, i.e. it was accepted and you didn't get an error message, you're good to go! No further action on the Upwork platform is necessary.

Thank you,

Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 22, 2022 02:26:55 AM by Urwashi A

Hi

I am having the same issue. Can someone help to know how my PAN number will be verified on Upwork?

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 22, 2022 04:22:56 AM by Pradeep H

Hi Urwashi,

Thank you for your message. I checked and I see that you have not filled the Legal Taxpayer Name section. Could you please delete the PAN details and try entering the PAN number again along with the Legal Taxpayer Name that matches the name on the PAN card and Upwork account?

Thank you,

Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 22, 2022 04:18:20 AM by Neetu R

I have submitted the PAN Card twice with proper details. But it's not verified from last two months. It's causing extra deduction from my Available Money. What could be the reason for the PAN Card not getting verified as I have filled every detail with precision.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 22, 2022 05:36:05 AM by Andrea G

Hi Neetu,

I have checked your account and it looks like your PAN is currently on a pending verification status. Please note that we cannot directly verify your tax information. Once you add the information to your Upwork account, we submit it to the Indian Tax authorities for verification. If you added your PAN number, it was accepted, and you didn't get an error message, you're all set. There is no further action needed on your end and you get the reduced withholding tax of 1% regardless of the PAN "Pending Verification" status.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 5, 2022 11:01:37 PM by Prateek R

Hii My pan is not verified yet and due to this issue i have to pay 5% tds. So please verify my pan as quickly as possible.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 5, 2022 11:26:43 PM by Annie Jane B

Hi Prateek,

Thank you for reaching out to us. I can see that you opened a support ticket regarding this issue. Please allow our team 24-48 hours to review your request and reach out to assist you further. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 28, 2022 01:41:31 AM Edited Aug 28, 2022 01:43:07 AM by Krupa V

My PAN card verification is always rejected. bcz of some personal reason, my all proof is of different surnames and my education documents have different surnames so I don't think it is the main issue. so could you please help me? I'm not able to get badge.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 28, 2022 04:21:57 AM by Annie Jane B

Hi Krupa,

Thank you for reaching out to us. I have checked your account and it looks like your PAN is currently on a pending verification status. Please note that we cannot directly verify your tax information. Once you add the information to your Upwork account, we submit it to the Indian Tax authorities for verification. If you added your PAN number, it was accepted, and you didn't get an error message, you're all set. There is no further action needed on your end.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 30, 2022 01:53:30 PM by Arjay M

Hi Tony,

Please ensure that the "Legal taxpayer name" on your Tax Information (ID) and your Form W-8BEN should exactly match the name registered on your PAN ID (can be found on the TRACES records). Let me know if you need further assistance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 31, 2022 08:30:34 AM by Utkarsh S

Why is it taking so long for PAN verification ? Can someone please help me and tell me the reason ? How many days does it takes usually ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 3, 2022 03:28:24 AM by Shantanu K

Hi, I have submitted my PAN Card for tax deduction and it's been verified but I have been charged with 5% instead of 1%.

I would appreciate your support, Thank you.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 3, 2022 06:49:50 AM by Annie Jane B

Hi Shantanu,

Thank you for reaching out to us. I shared your report with our team and one of our agents will reach out to you using a support ticket to assist you further. You can access your support tickets here .

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 28, 2022 04:08:54 AM by Anami M

I added PAN details a few days back. It is still showing pending verification. Due to that, I have been charged 5% TDS instead of 1%. Please help ASAP.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 28, 2022 09:02:49 AM by Annie Jane B

Hi Anami,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 2, 2022 11:42:55 PM by Anami M

Hello Annie,

Thanks a lot for the support. PAN is verified. But now how can I get the refund of the WHT which was deducted @5% from my earlier bill (Ref. ID - 516776533)? Please help me with this as well.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 02:03:37 AM by Pradeep H

Hi Anami,

Thank you for your message. I see that one of our team members has already responded to you via a support ticket and confirmed that we are unable to reverse the prior charges on your account. Please don't hesitate to follow up with the team on the same support ticket if you have additional questions regarding your concern.

Thank you,

Pradeep