How to Update Your Tax Information (U.S.)

How to Update Your Tax Information (Non-U.S.)

Tax Forms for Clients

Form W-8BEN and W-8BEN-E

Reporting Income from Upwork and Form W-9 (U.S.)

How to Update Your Tax Information

To update your tax information, you’ll need to fill out and complete the following tax sections in your Upwork account:

• Tax residence: Ensure you have a real, permanent tax address on file

• Taxpayer identification: Verify that you are a non-U.S. taxpayer

To complete both sections, go to Settings and then select Tax Information. From there, you'll see two sections to choose from: Tax residence and Taxpayer identification. Select the pencil icon on the section you'd like to complete first.

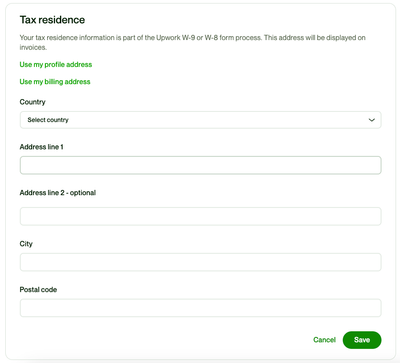

Tax residence

To complete this section:

- Select your country

- Enter your address

- Enter your city

- Enter your postal code

- Select Save

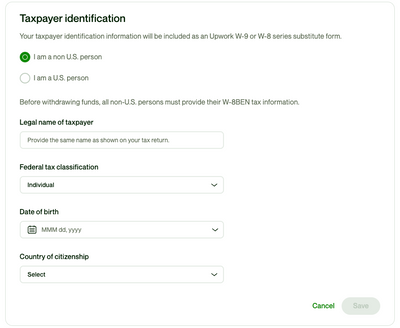

Taxpayer identification

To complete this section:

- Confirm that you are a non-U.S. taxpayer

- Enter your legal name

- Select your federal tax classification from the drop-down box

- Enter your date of birth

- Select your country of citizenship

- Select Save

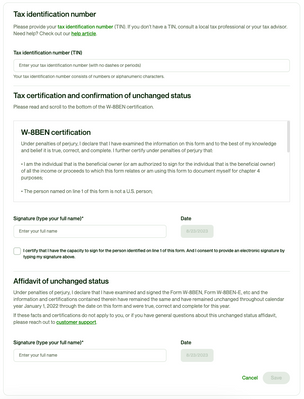

Tax identification number

Once you select Save after completing the Taxpayer identification section, a new section will appear called Tax identification number. To complete this section:

- Provide your tax identification number (TIN). TIN is a number you use for reporting taxes in your country and may be referred to by a different name such as PAN in India

- Read Tax certification and confirmation of unchanged status, which includes reviewing the information you provided

- Sign with your legal name

- Check the confirmation box at the bottom of the page

- Sign the affidavit with your legal name to confirm your status has not changed

- Select Save