How to Update Your Tax Information (U.S.)

How to Update Your Tax Information (Non-U.S.)

Tax Forms for Clients

Form W-8BEN and W-8BEN-E

Reporting Income from Upwork and Form W-9 (U.S.)

How to Update Your Tax Information

To update your tax information, you’ll need to fill out and complete the following tax sections in your Upwork account:

• Tax residence: Ensure you have a real, permanent tax address on file

• Taxpayer identification: Verify that you are a U.S. taxpayer

To complete both sections, go to Settings and then select Tax Information. From there, you'll see two sections to choose from: Tax residence and Taxpayer identification. Select the pencil icon on the section you'd like to complete first.

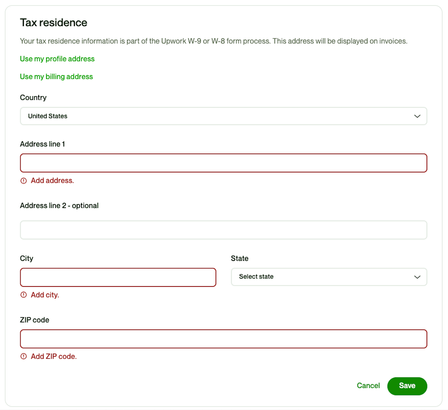

Tax residence

To complete this section:

- Select your country

- Enter your address and city

- Select your state

- Enter your zip code

- Select Save

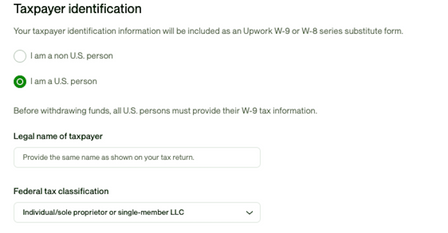

Taxpayer identification

To complete this section:

- Confirm that you are a U.S. taxpayer

- Enter your legal name

- Select your federal tax classification from the drop-down box

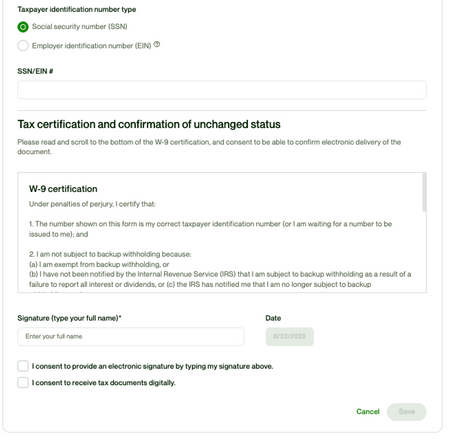

Taxpayer identification number

The next section is Taxpayer identification number. You'll need to complete this section to finish and certify your W-9 form. To complete this section:

- Select your taxpayer identification number type

- Provide your social security number or employee identification number

- Read Tax certification and confirmation of unchanged status, which includes reviewing the information you provided

- Once you've thoroughly read through, you'll type out to sign your legal name

- Check the box to consent to signing electronically

- Select Save