- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

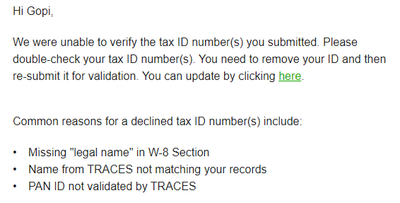

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 25, 2022 06:52:25 AM by Andrea G

Hi Karunagaran,

Someone from our team will reach out to you via support ticket in order to assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 29, 2022 06:55:36 AM by Racha gundla prasa b

hI Valeria, can i please request a legal name change as i am unable to get my pan details verified

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 29, 2022 08:07:44 AM by Andrea G

Hi Racha,

I checked but it doesn't look like you've added your PAN to your account yet. Could you please try it and let us know if the verification fails?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 17, 2022 08:08:40 PM by Krishna Chaitanya K

I am from india, i am unable to update the Legal Taxpayer name.

Due to this always my PAN verification failed.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 17, 2022 10:45:51 PM by Joanne P

Hi Krishna Chaitany,

I checked your account and it looks like you have submitted a ticket to our team about this issue. Please allow time for our team to check and get back to you on the same ticket to assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 20, 2022 10:07:34 AM by Brijesh K

Hi,

The wrong TDS is about to charged for my transaction and I like to update it before the transaction happens

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 20, 2022 10:54:00 AM by Andrea G

Hi Brijesh,

It looks like you were able to add your PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 25, 2022 06:43:39 AM by Taylor M

Hi Gopi, My legal business name is too long for the "business name" box and so my tax number is not being verified. How do I solve this?

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 25, 2022 07:41:42 AM by Harmin P

Please Help me with PAN ID verification. I tried 4 times it still cannot be verified I have checked W-8BEN form as well, It is still pending. Please Help!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 2, 2022 01:19:55 AM Edited Jun 2, 2022 03:47:38 AM by Pradeep H

I have added valid PAN number and legal tax payer name in tax information section but pan number showing "Pan Pending Verification". Please check attached screenshot and let me know how to verify pan detail.

**Edited for Community Guidelines**

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 2, 2022 03:50:21 AM by Pradeep H

Hi Nirmala,

Thanks for reaching out. If you've managed to add either your PAN or Aadhaar number successfully, i.e. it was accepted and you didn't get an error message, you're good to go! No further action on the Upwork platform is necessary.

Thank you,

Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 13, 2022 09:43:30 AM Edited Jun 13, 2022 10:04:34 AM by Qasim M

Why upwork is not verifying my PAN ID?I added it second times and still it shows pending.I am not getting any response from contact support too.

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 13, 2022 11:12:44 AM by Nikola S

Hi Mohamad,

Thank you for reaching out to us. Please allow more time for our team to review your case and respond accordingly to your ticket. You will be notified of their response.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 24, 2022 06:01:24 PM by Harsh A

Hey there,

I am a freelancer based in India, Acc to the rules, upwork needs to pay 5% TDS if the freelancer has not added a PAN ID, but only 1% if the freelancer has added PAN.

I added my PAN ID, which has also been verified, yet 5% withholding tax was deducted. Can anyone look into this?

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 24, 2022 08:53:36 PM by Annie Jane B

Hi Harsh,

I shared your report with our team and one of our agents will reach out to you via a support ticket to assist you further. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 3, 2022 10:42:11 AM by Zeeshan K

For some reason, in my Tax Information section, I see PAN pending verification for the past 3 days.

I have already added the pan cart details when I created the account but for some reason, pan card verification is still showing me pending then 3 days back I updated the pan card again but it is still showing pending.

I check from this link

if I did not provide a pan cart withholding tax will be 5%.

withholding tax is deducted from my account again and again.

I would greatly appreciate any help or advice.

Thank you.

Zeeshan

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 3, 2022 11:49:18 AM by Andrea G

Hi Zeeshan,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 13, 2022 01:37:29 PM by Arjay M

Hi Abbas,

I have checked your account and it looks like your PAN is currently on a pending verification status. Please note that we cannot directly verify your tax information. Once you add the information to your Upwork account, we submit it to the Indian Tax authorities for verification. If you added your PAN number, it was accepted, and you didn't get an error message, you're all set. There is no further action needed on your end.