- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

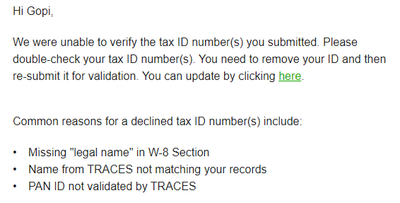

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 9, 2024 05:16:14 AM by Anandg K

I am also facing a same problem. My PAN has been added and verified by Upwork before I starts freelancing job. But still upwork charging 5%. Can someone help on this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 30, 2024 11:17:06 PM by Jay V

I completed all the information required for tax verification and provided all the valid information, but Upwork deducted 5% of WHT from my payment.

Not able to figure out the problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 1, 2024 09:25:34 PM by Panchadev C

Hello Community!

I've been noticing for so long that Upwork has been keeping 5-6% of withholding tax (Indian Resident) although I have supplied authorized PAN Details to Upwork. So, why is Upwork keeping this money in the name of the Withholding tax though PAN details are provided? Is the withholding money something that we can get back? If yes, how?

Please help me understand withholding tax and how can we get back if we can. If not, why can't?

Thanks,

- Panchdev Singh Chauhan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 2, 2024 12:05:38 AM Edited Aug 2, 2024 12:06:32 AM by Ashraf K

The tax withholding is TDS, so whatever is deducted from your payment will be deposited by Upwork with tax authorities. You will be able to claim an adjustment toward tax payable or get a refund is they have deducted more than your tax liability! You can check Form 26 to verify all deductions.

Upwork should deduct tax witholding @ 1% of your earnings, but if your PAN and Aadhar card is nor linked they will deducated at 5%. If your Pan and Aadhar is linked write to support and inform them, if not you have to link Pan and Aadhar. Then Upwork will deduct @ 1% rate

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 2, 2024 01:00:03 AM by Ronna P

Hi Panchadev,

Thank you for sharing your concern about the withholding tax on your account. I have escalated this to a support ticket so they can look into it for you. One of our agents will reach out to you shortly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 10, 2024 03:20:48 AM by Monis A

I am an Indian - my PAN details are added in Upwork but even then i am seeing a 5% WHT charge held by upwork.

Is there a reason for this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 10, 2024 07:04:30 AM by Ramesh Kumar K

A moderator will assist you to create a support ticket and this will get resolved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 10, 2024 07:07:33 AM by Pradeep H

H Monis,

I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 15, 2024 02:04:50 AM by Aniket S

Hi ,

I have been trying to speak with someone regarding tax information. I have input all information and it is marked as compelte. However, I still get the message that I need to complete my tax info.

I had raised a concern , probably over chat , Mridula Sharma from the tax team replied to me . I wanted to ask a few more questions but i just dont find any way to connect with the support team. The chatbot doesn't help in my matter.

I was asked to upload my PAN card , but there is no instruction as to where i need to do that .

Would it be possible to kindly route my request to the tax department which can provide me with precise isntructions.

Sorry , i understand this might be the wrong forum to ask about tax queries , but as of now this is the only way i find to send my query accross.

Thanks,

Aniket Shende

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 24, 2024 02:46:07 AM by Sanjay L

Hi,

Can anyone explain me that why total of three deduction are done on my payment where my pan card is available and also approved.

1. GST => GST (IN) - Service Fee - which is 18% of my Service Fee

2. Service Fee => 10% of my total pay upwork

3. WHT => Withholding Tax 5% percent of total

My concern is the third one.

Kindly help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 24, 2024 03:18:28 AM by Ronna P

Hi Sanjay,

Thank you for sharing your concern about your Withholding Tax. I have converted your post to a support ticket to look into this for you. One of our agents will reach out to you to assist accordingly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 26, 2024 10:52:30 AM by Sanjay L

Is there any update on this as my hard earned money is getting deducted for no reason.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 26, 2024 03:02:06 PM by Ivygail J

Thank you for following up, Sanjay.

I am stepping in for Ronna. I checked, and it looks like the agent handling your case has updated your support ticket, provided further information and instructions, and is waiting for your response. You can access your support ticket here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 26, 2024 10:55:07 AM by Sanjay L

WHT => Withholding Tax 5% percent of total

This is getting deducted in every pay which should be only 1 percent but in my case it is 5%.

And i'm indian and i've uploaded my pan card. Please help me

- « Previous

- Next »

| User | Count |

|---|---|

| 537 | |

| 480 | |

| 369 | |

| 297 | |

| 276 |