- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 8, 2023 07:05:19 AM by Neetu S

I have added my agency details with PAN card number. It's still taking 5%. It should take 1%.

Could you please help me on this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 9, 2023 09:30:33 PM by Neetu S

What is the PAN verification process? I have added PAN details at agency account but it still took extra 5%.

Whom should I reach out for this?

( Note - I am writing the same thing 3rd time but no one resolved the issue )

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 10, 2023 12:05:16 AM by Pradeep H

Hi Neetu,

Thank you for your message. I see that the PAN details were added on August 1st, 2023. All earnings before adding the PAN details will be charged at a 5% Withholding Tax. Your Withholding Tax will be reduced to 1% for all earnings after August 1st.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2023 08:15:30 AM Edited Oct 3, 2023 08:16:11 AM by Sajiya S

I am beginner and recently I have completed my first contract and got to know that we need to add tax information and pancard. I added. But still I got that red line saying verify your tax details or else you will get 5% tds. I thought it was a glitch but from my client payment 5% tds was taken. What should I do? How should i verify now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2023 08:18:38 AM by Faraz A

Dear Sajiya S:

If you have provided the tax information, it will take some time to reflect it to your profile. If you have urgency you can log off and log in again, I think it will work.

Regards.

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2023 09:33:56 AM by Nikola S

Hi Sajiya,

I’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 21, 2023 12:16:08 PM by Debasis M

Hi Avery,

My TAX details are already updated and verified however Upwork is still withholding 5% instead of 1% from my payments. Could you please look into this issue.

Regards,

Debasis Mishra

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 26, 2024 05:36:24 PM by Raju K

Hi AveryO,

I already added my pan number and its verified but now its showing tax deduction/TDS Is 5% and i already linked my aadhar number (identification number in india).

Please help me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

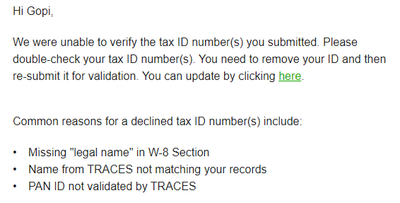

Oct 31, 2024 08:47:12 PM by Divya S

Hello,

Upwork was unable to verify my PAN because it was inactive. I have fixed the issue by activating my PAN on the government site. Now I want to re-submit my PAN to Upwork for validation. Upwork says I need to remove my PAN information and then re-submit it for validation. How do I 'remove' my PAN and re-add? I only see an EDIT option in the Tax Information page. I don't see a DELETE option for removing my PAN.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:23:58 PM by Jitesh D

My tax id is verified but I receive an email from upwork saying that your Tax id is not verified. I can see my deducted TDS in my traces.

One day before, I got an email from upwork saying that your tax id has been verified.

What should I do? Please suggest.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 3, 2022 05:54:46 AM by Avery O

Hi Jitesh,

I apologize for the delay. We are still looking into this further, and we'll come back here once we have more information regarding your concern.

~ Avery

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 6, 2022 10:43:44 PM by Avery O

Hi Jitesh,

This should now be resolved. Thank you for patiently waiting.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 9, 2022 11:02:58 AM by Sutapa D

Completely frustrated situation with my PAN verification process. Anyone facing like the same problem, which was happened with me? I received one email that my PAN was verified (8.31 PM, IST), few minutes later I received another email that "Upwork was unable to verify my PAN" (8.48 PM, IST), Yes, this was happend today, just few hours before. Please check attached both screenshots. How it is possible, once my PAN was verified and few minutes later that was going to unverify status?

Already contacted with Upwork Support Agent, she suggested "Kindly reenter your details on your Tax Information page so we can validate it again." My question, how many times, I need to delete and re-enter my PAN details? As already I have deleted and re-entered my PAN details two times. Note that, Those who will not remediate their ID status will be charged a higher 5% withholding tax in India starting April.

Expecting your opinions.

Sutapa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 12, 2022 01:37:28 AM by Chandra Sekar V

In India we're supposed to pay taxes in each quarter, There is a TDS amount of 1% deducted(Pan number verified account) by upwork on each client payments.

Now when I'm trying to pay advance tax to India Government, the TDS amount with holding from upwork is not reflected in India government tax portal against the PAN number, also the form 16 is also not available in Upwork for Indian freelancers, How can I claim that this 1% is deducted and paid by upwork, So that I can pay only the remaining amount during advance tax payment

Please help us with more details

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 22, 2022 10:51:13 AM Edited Mar 22, 2022 10:51:59 AM by koral k

I am facing the same issue here..It was verified before..for some reason i got email to verify it again..I have added thrice but it keep failing. It would be great if someone could help here. Thansks in Advance!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 2, 2022 11:31:42 PM Edited May 2, 2022 11:32:49 PM by Paresh R

I have faced issues with verifying a PAN number. I have readded my PAN number a few times but each time the verification has been failing. A few days ago I readded a PAN number. The verification is still pending. Can somebody please help me to verify the PAN detail?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2022 01:07:59 AM by Amanpreet S

After re-adding the PAN number, give some time to Upwork; within a few days, it gets verified.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2022 03:38:37 AM by Annie Jane B

Hi Paresh,

Thank you for reaching out to us. The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

You can find more information here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2022 03:37:19 AM by Jalpa C

Hi Team,

Hope you are well.

I have uploaded my PAN in Upwork profile since a two weeks but my Pan card showing still in Pending verification.

Can you please check asap?

Thanks.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2022 07:04:34 AM by Annie Jane B

Hi Jalpa,

Thank you for reaching out to us. The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

You can find more information here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 7, 2022 11:34:12 PM by Jalpa C

Hi Annie,

I have resubmitted PAN 3 to 4 times still i did not get stataus of PAN. i am loosing my money of tax.

How much time did take for a Manual verification?

Hope you are understand.

Thanks.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 8, 2022 02:12:40 AM by Annie Jane B

Hi Jalpa,

When you initially added your PAN and the status was pending, no other actions were needed on your end. You automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 18, 2022 09:33:13 PM by Krishna M

Hi Team,

I have added the PAN number. But still, it shows PAN pending verification.

Any other methods to complete this verification?

Regards,

Krishna Maurya

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 18, 2022 10:29:46 PM by Annie Jane B

Hi Krishna,

Thank you for reaching out to us. The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

You can find more information here.

~ AJ