- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2022 01:07:59 AM by Amanpreet S

After re-adding the PAN number, give some time to Upwork; within a few days, it gets verified.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2022 03:38:37 AM by Annie Jane B

Hi Paresh,

Thank you for reaching out to us. The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

You can find more information here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2022 03:37:19 AM by Jalpa C

Hi Team,

Hope you are well.

I have uploaded my PAN in Upwork profile since a two weeks but my Pan card showing still in Pending verification.

Can you please check asap?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2022 07:04:34 AM by Annie Jane B

Hi Jalpa,

Thank you for reaching out to us. The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

You can find more information here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 7, 2022 11:34:12 PM by Jalpa C

Hi Annie,

I have resubmitted PAN 3 to 4 times still i did not get stataus of PAN. i am loosing my money of tax.

How much time did take for a Manual verification?

Hope you are understand.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 8, 2022 02:12:40 AM by Annie Jane B

Hi Jalpa,

When you initially added your PAN and the status was pending, no other actions were needed on your end. You automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 18, 2022 09:33:13 PM by Krishna M

Hi Team,

I have added the PAN number. But still, it shows PAN pending verification.

Any other methods to complete this verification?

Regards,

Krishna Maurya

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 18, 2022 10:29:46 PM by Annie Jane B

Hi Krishna,

Thank you for reaching out to us. The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

You can find more information here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 09:24:32 PM Edited Mar 1, 2022 10:23:22 PM by Avery O

I want to update my Tax Identification and I am not able to update the Legal Taxpayer Name it's auto-filled from the client profile I want my name on Legal Taxpayer Name

Also, how can I close my client profile?

thanks

Vishal

**edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:30:09 PM by Avery O

Hi Vishal,

Please edit your Form W-8BEN first by clicking on the pencil icon. Once edited, please delete your Tax Identification (ID) and re-add it again.

As for closing the client account, I'll go ahead and close your client account as requested.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 11:05:38 PM by Sahil B

I am also facing the same issue. I have deleted my Tax Identification (ID) and re-added it again. I have done that twice. I have also been receiving my tax certificate properly from Upwork all these years at my provided PAN ID.

The added legal to your Tax Information (ID) and the Form W8-BEN both match the registered name on the PAN ID.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

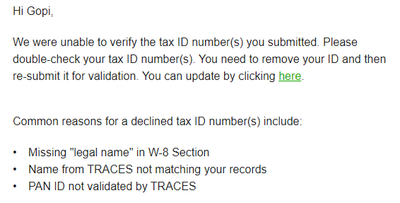

Mar 1, 2022 06:33:13 PM by Sahil B

Received email, which says "We were unable to verify the tax ID number(s) you submitted. "

But the Tax number (PAN) is correct. What do I do? I'm in India. I have already removed my ID and resubmitted it. And, I am still receiving the same mail.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 4, 2022 12:20:42 AM by Meera T

Hi

do I have to submit PAN? if it is then how? please help me on this regard as i am new here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 4, 2022 12:25:22 AM by Goran V

Hi Meera,

You will need to add a PAN in order to keep the withholding tax at 1% of your earnings. To enter your PAN, click here. To learn more about this as well, check out this help article. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 9, 2022 02:53:04 AM by Raj C

I need a certificate from Upwork for all Indian TDS Tax Withholding Upwork has deducted so far. Where to get this from?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 09:51:55 AM by Siva K

Hi,

My PAN was verified.

TDS was credited from Jul 2021 to Dec 2021 so far for current financial year.

But Apr 2021 to Jun 2021 quarter is missing. Anyone got this issue?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 5, 2022 05:05:28 AM by Trisha B

I got a mail this week that they couldn't verify my PAN ID. It is an unique number designated to Indian citizens for tax proposes.

Without this verification I'd be charged 5% TDS instead of 1%. I've been using Upwork regularly for about 9 months now and never had an issue. Please fix this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 5, 2022 06:02:26 AM by Nikola S

Hi Trisha,

Thank you for reaching out to us. Could you please try to remove your ID and then re-submit it for validation? You can update by clicking here. Please double-check your tax ID number(s).

You can find more information in this help article.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 5, 2022 06:50:44 AM by Trisha B

I have tried removing and adding the PAN number, it's been more than two days as promised but it's still not verified. Please expedite the process.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 5, 2022 08:44:53 AM by Vineet K

I am an India based freelancer.

One of my client which is also India based is curious to know if they require to file TDS from their side. Since me as a freelancer is already subjected to 1% TDS, I am not sure if my client too needs to file TDS.

Can we get any help on this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 8, 2022 05:16:12 AM by Vipul N

Hi,

I have not received any Form 16 for TDS filing till date. I need the certs for the FY21 for. Please provide the same ASAP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 9, 2022 09:00:00 AM by Ashish A

Hi There

I have Freelancer Account as well as Agency Account.

My PAN number is verified in my Freelancer Account , recently i received an email that its not verified in my Agency Account.

My Legal Taxpayer Name is same in my Freelancer and Agency account as i am sole proprietor.

Same reason by PAN is going to be same in my Individual Account and Agency account

I have verified and found my informatio correct on Traces.

Looking forward for support here

Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 9, 2022 09:41:00 AM by Nikola S

Hi Ashish,

Thank you for reaching out to us. I shared your report with the team handling your case and one of our agents will follow up with you on your support ticket as soon as possible to assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 9, 2022 09:17:03 AM by Ankit S

Hello everyone,

I am Indian citizen and we have PAN ID as our Tax Identification. I been doing freelancing for about last 9th months and my PAN ID was verified. But few days back suddenly my PAN ID got unverfied on upowrk and a message poped up stating the same. I tried to remove and then adding it again it showed pan verifcation pending but after some days I got same message. What should I do in this situation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 9, 2022 09:41:35 AM by Nikola S

Hi Ankit,

Thank you for reaching out to us. I shared your report with the team handling your case and one of our agents will follow up with you on your support ticket as soon as possible to assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 9, 2022 11:29:01 AM by Ankit S

I have gone thorugh this article and that is fine for me but the verification suddenly disappreared, and now it is not verifying. So that's issue.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 10, 2022 12:26:08 AM by Ankit S

Sir I think I got the issue, it is due to tax name on my pan card I think. Now I have changed the name to name on PAN ID and also verified it with trace. Thanks a lot for helping out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 10, 2022 04:57:59 AM by Denis V

I am registered as a proprietor and I have GST and PAN numbers. due to proprietor, my personal PAN is my Business PAN number. but in Upwork, my PAN is not verified. Every time I add my PAN detail it gets rejected due to a miss-match name. Please give me the solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 10, 2022 06:01:46 AM by Andrea G

Hi Denis,

Someone from our team will reach out to you via support ticket in order to assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 10, 2022 10:06:38 AM by Vipul N

Hi, I am raising this issue for the second time. My TDS certificates for the last financial year were not delivered and are needed for fillling the return.

Any assisstance form UW would be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2022 06:11:55 AM by Rohit R

I am uploading my PAN no. for TAX purpose and every time it got rejected. My PAN no. Is correct. Then why this is happening.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2022 07:01:14 AM by Andrea G

Hi Rohit,

It looks like you were able to re-add your PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2022 08:04:25 AM by Rohit R

Hi Andrea

But it is showing " PAN could not be verified. Please remove and Re add number to update' status every time i update it again. Please check the screenshot.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2022 08:56:03 AM by Andrea G

Hi Rohit,

I checked your account and I'm not seeing that message on my end, could you please check again? You can also try clearing your cache and cookies or logging in with a different browser to see if the issue persists.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 14, 2022 12:16:21 AM Edited Mar 14, 2022 02:00:52 AM by Pradeep H

Hello Upwork team,

Hope you all are very well.

I have my freelancer account. As well as an agency account. **Edited for Community Guidelines** . But I don't know why the Tax Identification > PAN is not verified. I added before once. And they are not verified. I again added. But still, after 4-5 days, it's not verifying.

I hurry about this because of charges. So, can you please check out why it's taking too long?

I look forward to hearing from you.

Thank you so much.

| User | Count |

|---|---|

| 470 | |

| 366 | |

| 290 | |

| 252 | |

| 250 |