- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 10, 2023 04:40:58 PM by Jean-David O

Canada Sole Proprietor GST issue

Hi there,

I'm trying to open a ticket to move forward with this, but there doesn't seem to be any option to contact Upwork customer service anywhere. So here's the issue:

Upwork is asking me for tax information, which I understand for their W-9/W-8 forms to comply with the IRS on their end. However, it's also asking for GST information, which doesn't make sense in my case since I won't be registering for GST for the next few months as I don't legally have to (Validated by professional accountants). So I don't need to charge GST to my clients at all. That's the way it's going to be for the next few months.

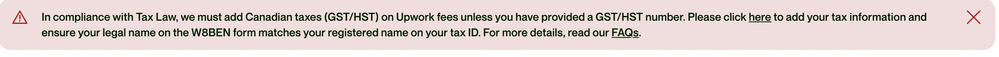

There was an option to say "I don't have a GST number", but now I can still see this message:

But I don't have to charge GST at all in my case. At least not for the next few months.

Can I still conduct business or are funds going to get frozen?

Please advise.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 10, 2023 09:17:16 PM by Joanne P

Hi Jean-David,

I have requested the assistance of our team. One of our agents will assist you directly via a support ticket.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 10, 2023 09:17:16 PM by Joanne P

Hi Jean-David,

I have requested the assistance of our team. One of our agents will assist you directly via a support ticket.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 12, 2023 08:53:07 AM by Jean-David O

So it was more or less explained that it won't affect the funds, just when I would purchase services from Upwork the GST will be calculated as I'm a consumer as opposed to a business (until I register for GST and add the number in the Upwork settings).

| User | Count |

|---|---|

| 471 | |

| 364 | |

| 290 | |

| 255 | |

| 247 |