- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 07:53:17 PM by Avery O

Hi Gopi,

Please ensure that the "Legal taxpayer name" on your Tax Information (ID) and your Form W-8BEN should exactly match the name registered on your PAN ID (can be found on the TRACES records).

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 04:56:53 PM by Ravindra B

Hi,

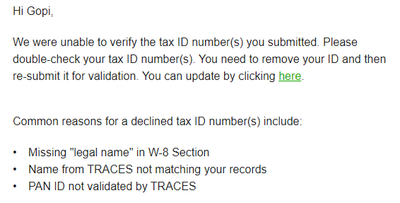

I know my PAN number is valid as I file my ITR every year.

Today, I received an email from Upwork that my Tax ID could not be verified.

I have attached a screenshot of the email received.

There is a suggestion that my name could be different in Upwork and TRACES.

What is TRACES?

BTW, I have not had TDS deducted for several years now as my income has fallen below the taxble limit.

I would greatly appreciate any help or advice.

Thank you.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 07:44:33 PM Edited Mar 1, 2022 09:05:57 PM by Avery O

Hi Ravindra,

TRACES (TDS Reconciliation Analysis and Correction Enabling System) is an online facility provided by the Income Tax Department of India. If you have an account on TRACES, you can see your year-to-date tax info by logging in on the website. Here's a link to their website.

Please make sure that the legal name you add to your Tax Information (ID) and the Form W8-BEN must match the registered name on the PAN ID. If you have a question about paying TDS, we suggest you reach out to a trusted tax expert or advisor to learn more about Indian TDS and your tax obligations since we cannot offer specific tax advice. You may find more information on Indian TDS here.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 08:36:00 PM by Ravindra B

Thank you, Avery.

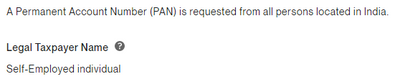

I had not looked at the name under W8-BEN.

I just found that the name there was “Self-Employed”

I honestly don’t recall entering that.

I have now enterd the correct full name.

Hopefully, that will solve the problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 09:29:32 PM by Abdul Latif Ahmed M

Hi Avery,

I am also facing the same issue.

The issue is when we delete and re-submitt the tax information id, there is no way to add a name. The below name comes by default. We can only add our tax id.

And the same information is seen in W-8BEN. However, under W-8BEN we are able to add the tax payer name.

Not sure what is the requirement? If we put our proper name under W-8BEN, then obviously it wont match legal tax payer name in the above field. And in the above field there is no way to edit the legal tax payer name.

Pleae advise.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 09:53:29 PM by Avery O

Hi Abdul,

Could you please try editing your Form W-8BEN first by clicking on the pencil icon? Once edited, please delete your Tax Identification (ID) and re-add it again.

If this doesn't solve your issue, please let us know, and our team will assist you further.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:03:48 PM by Abdul Latif Ahmed M

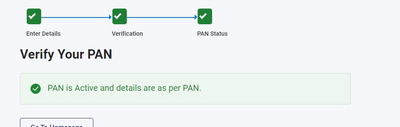

Avery, thank you for your quick help. Yes, that did re-solve the name issue. However, I am still an unverified user as it says PAN pending verification.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 09:58:03 PM by Abdul Latif Ahmed M

Hello,

Further to my message above. I have been receiving my tax certificate properly from Upwork all these years. So how come the same tax id suddenly becomes invalid today?

I have cross verified my id with efiling (govt of India website). It says its valid.

I have deleted my tax id and resubmitted on Upwork as was asked in the email. However now it says PAN pending verification. Till this is not verified, my tax will be deducted at 5% vis-a-vis 1% (for verified users.), which I was till one day ago.

I am unncessarily getting hit on the tax rates.

Kindly provide a solution to this issue.

Thanks for your help.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2022 08:13:54 PM by Kshitij S

Hi Avery,

For Individual this worked well for us. But for agency this is not working even after updating twice as instructed.

In India there is a concept of Priopriotership business, where PAN will only reflect the name of the individual and business name is only reflected in Income tax return. In such case, You may agree that the name of individual and PAN to be mentioned in Tax information and W-8BEN. I did so, but still it did not verify my PAN.

Now Please guide me how do I resolve this for my agency? Thank you.

Moderator

Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2022 11:25:00 PM by Pradeep H

Hi Shah,

Thank you for your message. Could you please confirm if you have tried removing and re-adding the PAN details?

Thank you

Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 12, 2022 01:07:42 AM by Kshitij S

Hi Pradeep,

Yes, I already tried it twice and in both attempt I mentioned different name in W-8BEN. Once my name on PAN and once the name the agency name registered with Upwork but both got rejected without any reason.

I hope that's useful info. Thanks.

K**bleep**ij Shah

Moderator

Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 12, 2022 04:17:48 AM by Kshitij S

Hi Nikola,

Thank you for taking it up. I will be waiting for support ticket.

regards,

K**bleep**ij Shah

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 17, 2022 09:11:39 AM by Sarannian S

Hello Team,

I am facing the same issue currently , I have added my PAN details twice and I get the same "Unable to verify your Tax ID number on Upwork". Please assist

Moderator

Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 17, 2022 10:14:53 AM Edited Jul 17, 2022 10:15:12 AM by Luiggi R

Hi Sarannian,

I can see that you've managed to add your PAN number successfully. No further action on the Upwork platform is necessary. Note that we cannot directly verify your tax information. Once you add the information to your Upwork account, we submit it to the Indian Tax authorities for verification.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 27, 2022 07:34:34 AM by Amlan B

Dear Pradip,

I am also unable to validated and verified my PAN no. As per IT department is already validated and verified. But, Upwork is telling the different. I don't know how to get my payment. So, please let me know. Thanks, Amlan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 22, 2022 07:16:26 AM by Gagan B

I have added PAN card information on the upwork but still shows verification pending and deducting 5% tax from the amount that I received from the client. It should be 1%. Could you help me with this? Or what else do I need to do?

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 22, 2022 08:24:19 AM by Andrea G

Hi Gagan,

It looks like you added your PAN after the payments you're referring to were released. Please note that you should start being charged 1% after there is a PAN on file for your account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 24, 2022 10:35:55 AM by Gagan B

Hi Andrea,

But I did not withdraw the money, Technically it is with Upwork so it should take 1% holding.

Could you please clarify or elaborate on this point "Please note that you should start being charged 1% after there is a PAN on file for your account?"

Thanks,

Gagan Bhatia

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 5, 2022 11:39:50 PM by Anami M

Hello Avery,

Quoting you - I will get a "reduced withholding tax of 1% regardless of the PAN "Pending Verification" status." I added the PAN details on 22nd Sep 2022 which was showing "pending" status till 28th Sep 2022. (which was more than your standard 3 days time) and when I got my invoice (on 27th ) in this time frame only with a 5% deduction than on the 28th, I searched your community and read somewhere to delete and re-add the details, so I did the same.

Avery, Now my concern is why in the first place it was 5%. And second, how can you help me get the refund?

Looking for a positive response.

Thanks

Anami.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 29, 2022 10:48:55 AM by Nisha D

Hi There,

I have registered a sole propritership business and provided my GST/HST number on upwork However I have received emsil saying my TAX ID is unable to verified although my business legal name is similar as on Upwork.

Kindly assist

thanks

Nisha

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 29, 2022 12:13:56 PM by Andrea G

Hi Nisha,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 8, 2023 07:05:19 AM by Neetu S

I have added my agency details with PAN card number. It's still taking 5%. It should take 1%.

Could you please help me on this?

| User | Count |

|---|---|

| 500 | |

| 487 | |

| 453 | |

| 365 | |

| 256 |