- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

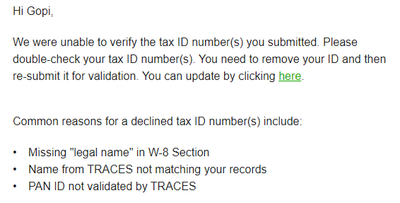

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 5, 2022 11:01:37 PM by Prateek R

Hii My pan is not verified yet and due to this issue i have to pay 5% tds. So please verify my pan as quickly as possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 5, 2022 11:26:43 PM by Annie Jane B

Hi Prateek,

Thank you for reaching out to us. I can see that you opened a support ticket regarding this issue. Please allow our team 24-48 hours to review your request and reach out to assist you further. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 28, 2022 01:41:31 AM Edited Aug 28, 2022 01:43:07 AM by Krupa V

My PAN card verification is always rejected. bcz of some personal reason, my all proof is of different surnames and my education documents have different surnames so I don't think it is the main issue. so could you please help me? I'm not able to get badge.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 28, 2022 04:21:57 AM by Annie Jane B

Hi Krupa,

Thank you for reaching out to us. I have checked your account and it looks like your PAN is currently on a pending verification status. Please note that we cannot directly verify your tax information. Once you add the information to your Upwork account, we submit it to the Indian Tax authorities for verification. If you added your PAN number, it was accepted, and you didn't get an error message, you're all set. There is no further action needed on your end.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 30, 2022 01:53:30 PM by Arjay M

Hi Tony,

Please ensure that the "Legal taxpayer name" on your Tax Information (ID) and your Form W-8BEN should exactly match the name registered on your PAN ID (can be found on the TRACES records). Let me know if you need further assistance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 31, 2022 08:30:34 AM by Utkarsh S

Why is it taking so long for PAN verification ? Can someone please help me and tell me the reason ? How many days does it takes usually ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 3, 2022 03:28:24 AM by Shantanu K

Hi, I have submitted my PAN Card for tax deduction and it's been verified but I have been charged with 5% instead of 1%.

I would appreciate your support, Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 3, 2022 06:49:50 AM by Annie Jane B

Hi Shantanu,

Thank you for reaching out to us. I shared your report with our team and one of our agents will reach out to you using a support ticket to assist you further. You can access your support tickets here .

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 28, 2022 04:08:54 AM by Anami M

I added PAN details a few days back. It is still showing pending verification. Due to that, I have been charged 5% TDS instead of 1%. Please help ASAP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 28, 2022 09:02:49 AM by Annie Jane B

Hi Anami,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 2, 2022 11:42:55 PM by Anami M

Hello Annie,

Thanks a lot for the support. PAN is verified. But now how can I get the refund of the WHT which was deducted @5% from my earlier bill (Ref. ID - 516776533)? Please help me with this as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 3, 2022 02:03:37 AM by Pradeep H

Hi Anami,

Thank you for your message. I see that one of our team members has already responded to you via a support ticket and confirmed that we are unable to reverse the prior charges on your account. Please don't hesitate to follow up with the team on the same support ticket if you have additional questions regarding your concern.

Thank you,

Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 5, 2022 08:29:31 AM Edited Oct 5, 2022 11:03:57 AM by Nikola S

Hi Team,

I am from India. I have added my PAN correctly in the tax info section. But I don't know why it got rejected. Please help me to resolve the issue.

Note: I have added my PAN again as requested in the mail.

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 31, 2022 05:41:35 AM by Nalina H N

I also having same issue pan verification pending?

Anyone tell me how to resolve it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 6, 2022 02:23:21 AM by Sankalan B

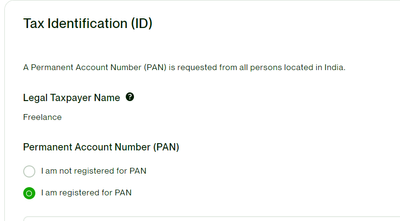

In my Tax Information segment, the Legal Taxpayer Name is shown as Freelancer. That is definitely not my name. My name is Sankalan Baidya as registered with the Tax ID (PAN) I provided. I need to have that Legal Taxpayer Name changed from Freelancer to Sankalan Baidya.

I don't see any option of doing that. I guess there should be a simple editing option. It appears that Upwork is just picking up my profile as a freelancer and putting it as the Legal Taxpayer Name.

Because of the name issue, my PAN card is not getting verified. I need help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 6, 2022 03:45:38 AM by Nikola S

Hi Sankalan,

Thank you for reaching out to us. I checked but I could not replicate the issue you experience. Could you please share a screenshot from your end so that we can assist you accordingly?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 7, 2022 03:34:13 AM by Mohammed Akbar A

I also face the same problem. Please help me with that to verify my PAN.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 7, 2022 08:28:29 AM Edited Nov 7, 2022 08:30:44 AM by Sankalan B

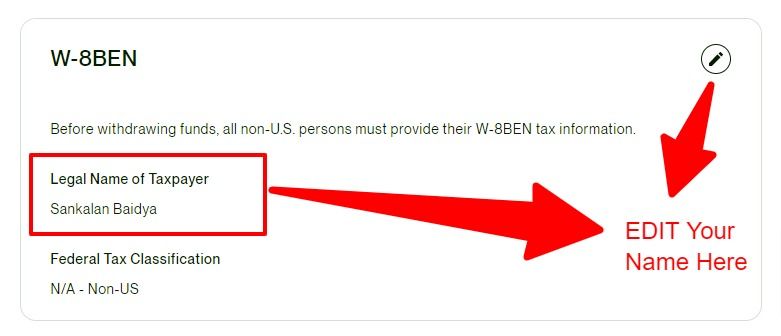

Go to Profile » Settings » Tax Information » Scroll Down to the bottom of the page to see the section W-8BEN. Click on the pen icon next to it and change your name there and save. It should work after that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 13, 2022 02:55:45 AM by kanika s

Hi. I am a freelancer and I am on Upwork since 2016. I am Indian and I have a valid Tax Identification ID (PAN No.). I have uploaded it multiple times but everytime Upwork backend fails to verify it and Upwork withholds 5% of the earnings. So, I am paying taxes in India and on top of that I am losing 5% of the amount earned. I have lost 5% of the amount earned in the last year. Plz help me to resolve this or escalate this issue.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 13, 2022 09:35:41 AM by Annie Jane B

Hi kanika,

Thank you for reaching out. It looks like our team informed you that the tax info on file was rejected due to name mismatch. To resolve the issue, please ensure that the details you added on file match the name that was indicated on your PAN card. In the Legal Name of Taxpayer under the W8, please add the name registered in your PAN.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 6, 2022 01:28:57 AM by Shashank A

Hello Upwork Community,

I have provided my PAN details. I also checked my PAN details on the Income Tax department website. The website says that PAN is Active and the details are according to the PAN.

Even though I have provided the same PAN details in the TAX information section on the Upwork platform, it still says to add my PAN details. And 5% TDS is already deducted from all my jobs even though I had provided my PAN details before my job started.

Can anyone help me with this? Still, I am getting the same notification to add my PAN details even though I have added the correct PAN details.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 6, 2022 05:44:42 AM by Annie Jane B

Hi Shashank,

Thank you for reaching out to us. I shared your report with our team and one of our agents will reach out to you using a support ticket to assist you further. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 1, 2023 12:55:50 AM by Mohit B

Hi,

I've recently created my profile on Upwork and I've started working on my first project. But, Upwork is withholding 5% tax from every payment even though I've filled out the W-8BEN form and provided my PAN details. I did not get any notification or email regarding the PAN verification. Please help me out in reducing the Withholding tax.

Thank you,

Mohit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 1, 2023 04:47:26 AM by Annie Jane B

Hi Mohit,

Thank you for reaching out to us. I shared your report with our team and one of our agents will reach out to you using a support ticket to assist you further. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 15, 2023 01:14:56 AM Edited Jan 15, 2023 06:58:04 AM by Annie Jane B

**Edited for Community Guidelines**

**Edited for Community Guidelines**

**Edited for Community Guidelines**

As you can see in the images attached, I've successfully added all my task details and there are no errors in that. But still in my contract, it has deducted 5 percent WHT although it is in pending state right now. Can you please help me get back the remaining 4 percent and also make sure it doesn't happen again in future.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 15, 2023 06:56:50 AM by Annie Jane B

Hi Chirag,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2023 12:46:42 AM Edited Jan 18, 2023 02:29:59 AM by Annie Jane B

**Edited for Community Guidelines**

Hello UPWORK, as you can see on my profile, I raised a request for tax id verification so that I dont get charged 5 percent extra and yesterday it was resolved. Your agent said that my account is now fully verified, and today I received a payment for a freshly created milestone after verification and I have been charged 5 percent AGAIN. I don't wanna talk and talk and talk, PLEASE DIRECTLY MAKE THE REFUND. You can do this because payments haven't been processed yet and are still in pending state. PLEASE GIVE MY MONEY BACK!!! FAST

AND PLEASE DON'T TELL ME THE SUPPORT TICKET AUTOMATED THING BECAUSE IK THAT IT'S ALREADY THERE. SIMPLY TELL ME WHY DID YOU CHARGE 5% AFTER TELLING ME THAT MY ACCOUNT HAS BEEN FULLY VERIFIED.

**Edited for Community Guidelines**

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2023 02:34:29 AM by Annie Jane B

Hi Chirag,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2023 02:41:47 AM by Chirag A

But can you please put some light on how the heck did this happen? After complete verification? I'm getting no response on tickets and upwork is charging me 25% mindlessly on each project

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2023 05:27:18 AM by Annie Jane B

Hi Chirag,

In general, if the payment was released before you got your PAN verified, the previous tax scheme will still be in effect. The changes should apply to the payments after your PAN got verified.

I suggest you follow up with the ticket so you can be properly assisted and they can check your account further. Your ticket is with the correct team and they should be able to assist you.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2023 09:33:55 AM by Chirag A

They are not responding, its been more than 24 hrs, please check

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2023 11:42:11 AM by Nikola S

Hi Chirag,

Thank you for reaching out to us. I reached out to the team handling your case and one of our agents will follow up with you on your support ticket as soon as possible to assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 22, 2023 07:17:58 AM by Dhruv A

Hi, my PAN has been verified but in my earnings it is still withholding 5% tds instead of 1%. Please help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 6, 2023 10:09:10 PM by Aayush T

Help me credit back the rest of the 4% of the TDS deduction. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 7, 2023 03:03:25 AM by Annie Jane B

Hi Aayush,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

~ AJ

| User | Count |

|---|---|

| 494 | |

| 484 | |

| 351 | |

| 332 | |

| 168 |