- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 3, 2021 08:42:15 AM Edited May 3, 2021 08:43:07 AM by Zaki M

Payment Method Inactive !

Hello ! It's been five days since i added payment method to local bank. But it's still inactiave. No Response or Verification email from upwork.Can you please tell me how long it will take to active ?

Solved! Go to Solution.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Sep 28, 2021 01:01:07 PM Edited Jul 12, 2024 03:16:40 AM by Luiggi R

Hi Zaki,

If your payment method is inactive, it can be because of one or both of the following reasons:

It was added in the last three days: For security reasons, any new payment method will become active in three days.

You need to provide your tax information: In order to access their funds, all freelancers who are U.S persons should file a Form W-9 with Upwork. You sign electronically by submitting the form.

If you’re not a U.S.taxpayer you’ll need to file a Form W-8BEN instead. The Form W-8BEN is a form used to confirm you’re not a U.S. taxpayer and that Upwork is not required to withhold taxes from your earnings. Tip: You can use your own legal name as it appears in your passport or other official documents.

Update:

Hi all,

This thread has been closed from further replies due to its size. We appreciate your participation in the Community and welcome you to continue the conversation on this new thread.

Thank you!

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 27, 2023 04:48:17 AM by Annie Jane B

Hi Edin,

Thanks for reaching out. I checked your account and can confirm that the name mismatch has already been resolved. However, your payment method is not yet active as you still need to fill in your tax information on this page.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 27, 2023 08:10:05 AM by Edin O

Thank you for reply,

I filled in tax residence, taxpayer identification(non US) but when i try to save tax identification number after filling TIN and entering my full name in both inputs, and hitting save i get this response:

"Please read and scroll to the bottom of the content of the W-8BEN certification to confirm electronic delivery of document.".

Can you please help me with this?

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 27, 2023 11:00:53 AM by Arjay M

Hi Edin,

It looks like you're almost done. You need to read and re-sign the W-8BEN certification and Affidavit of unchanged status. To complete the process:

- Select the✎ edit icon in the Tax identification section and then select Update

- Enter your updated information if needed

- Review the Tax Certification and Confirmation of Unchanged Status and Affidavit of Unchanged Status information, which includes confirmation that you are not doing work in the U.S., and provide your electronic signature.

- Read and sign the Affidavit of unchanged status, then choose Save.

Feel free to review AJ's help article for more details about the form and instructions on completing your Tax Information. Let us know if you need further assistance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 1, 2024 11:12:03 AM by Syed U

Hello ! I am new to upwork, just got my client and now facing issue in withdrawaling the payment. It's been five days since i added payment method to local bank. But it's still inactiave. No Response or Verification email from upwork.Can you please tell me how long it will take to active ?

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 1, 2024 01:12:56 PM by Arjay M

Hi Syed,

We saw your post in the community and converted it into a support ticket to give it the attention it deserves. Rest assured that one of our agents will contact you on this page with more information and further assistance with your payment method issue.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 3, 2024 10:10:21 PM by Monday Omorodion U

I added my Payoneer account to my Upwork account, but it's still not active. All information I provided are correct. Please advise me on what I should do.

Thank you.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 4, 2024 12:33:40 AM by Pradeep H

Hi Monday,

I checked your account and I see that your payment method is already accepted. Please complete the Tax Information page to activate your payment method.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 4, 2024 11:22:37 AM Edited Jan 4, 2024 11:29:58 AM by Monday Omorodion U

Kindly check again, everything is sorted now.

Will my payment method be active now??

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 4, 2024 04:04:30 PM by Arjay M

Yes, Monday Omorodion! I can confirm that your payment method is not active and ready for use. Best of luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 9, 2024 02:57:08 PM by JAAFAR B

Hello ! It's been 2 weeks or so since i added payment method to local bank. But it's still inactiave. i am a tunisian student and can prove my age and identity but i dont know how to pass the W-8Ben. please help me .

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 9, 2024 06:19:16 PM by Joanne P

Hi Jaafar,

I can see that you've successfully added a payment method; however, you did not fill in the W-8BEN form.

The W-8BEN and W-8BEN-E are U.S. tax forms for non-U.S. Persons. We and the IRS use them to determine whether you live in the U.S. and what taxes, if any, we need to collect from your earnings on Upwork. You must have this form on file before you can withdraw earnings from Upwork.

Without these forms as proof that you are a non-U.S. Person, Upwork will be required to withhold up to 30% of your future earnings on Upwork and send that withholding tax to the IRS. As long as a valid W-8BEN/W-8BEN-E form is filled out completely, we are not required to withhold U.S. income tax.

To complete the W-8BEN or W-8BEN-E, you’ll need to complete three cards in the Tax Information section of your settings.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2024 05:07:54 AM by Amir A

Hi,

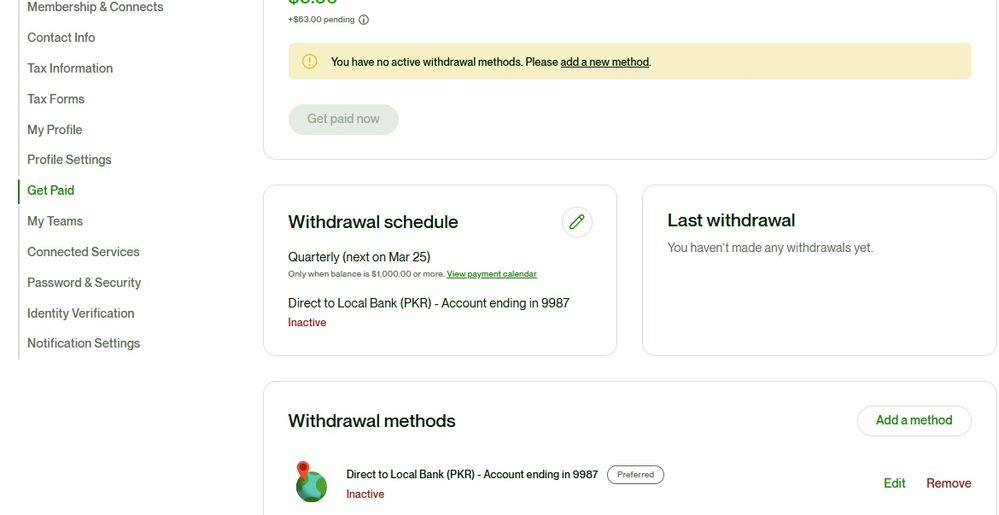

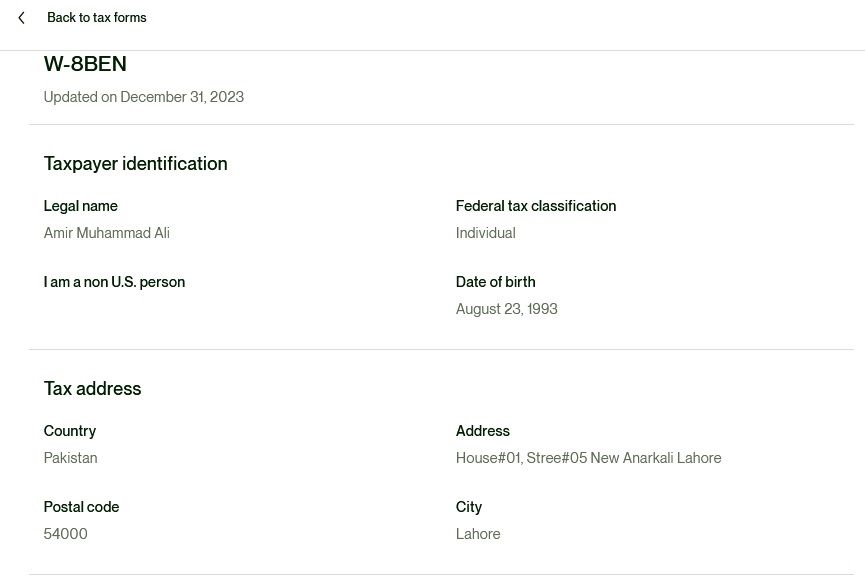

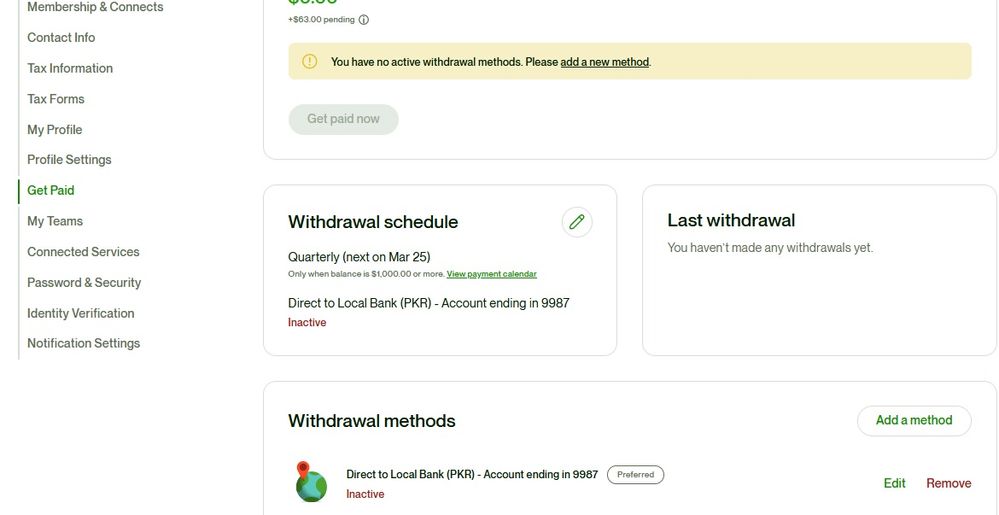

I added my bank account details to preferred Payment Method (Direct to Local Bank) quite a time ago. Per Upwork policy, it should've activated after three days of submission but still it shows as inactive (screenshot attached). I double-checked all the details again and submitted, still it is showing as Inactive. I also filled Tax Infromation and Completed Form W-8BEN

Please note that I have No received email from Upwork regarding any dispute or issue with my bank accoutn details either.

Kindly, help me get it activated.

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 18, 2024 07:00:37 AM by Luiggi R

Hi Amir,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 19, 2024 02:29:24 PM by Anton F

Hi, approximately a week ago, I submitted the requested W-8BEN-E form, but unfortunately, I have not received any response or confirmation yet. As a result, all functionalities under the "Get Paid" section remain inactive. I resent the form once again 3 days ago, but still no response. The dashboard consistently displays a badge with the message: "Action required: Withdrawal methods are currently inactive. Please provide your tax information to withdraw earnings."

I also have a freelance account, and the verification process for all required documents, including tax forms, VAT, and bank information, was completed within 1-2 days.

How can I open a support ticket about this situation to know if there are any issues with my tax form, account, or any other relevant information causing this delay?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 19, 2024 02:50:25 PM by Mame Khadim M

Hello!

If you have submitted the W-8BEN-E form on Upwork and are experiencing issues or delays, here are some steps you can take to resolve the situation:

1. Check Accuracy of Information: Ensure that all information provided on the form is correct and up-to-date. Errors or inconsistencies could lead to delays in processing.

2. Refer to Upwork's Help Center: Upwork has a Help Center that may contain articles or FAQs regarding tax documentation and common issues. Consult this resource to see if there are solutions or useful information.

3. Check Your Upwork Dashboard: If you are using Upwork, check your dashboard for any notifications, messages, or sections dedicated to tax documentation. Upwork often uses notifications to alert users to required actions.

4. Contact Upwork Customer Support: If you cannot find a solution in the Help Center or on your dashboard, reach out to Upwork's customer support. You can usually do this using the live chat feature, sending an email, or creating a support ticket.

5. Explore Community Forums: Online forums or discussions can also be helpful. Other Upwork users may have encountered similar situations and shared solutions.

6. Resubmit the Form if Necessary: If you believe your initial form might have been lost or not processed correctly, consider resubmitting it. Make sure to keep a copy of the confirmation of submission.

7. Legal or Tax Assistance: If the issue persists, consider consulting a legal or tax professional for advice specific to your situation.

By following these steps, you should be able to obtain answers or assistance in resolving any issues related to the W-8BEN-E form on Upwork.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 19, 2024 05:22:14 PM by Annie Jane B

Hi Anton,

Thank you for reaching out to us. I shared your report with our team and one of our agents will reach out to you via a support ticket to assist you further. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 27, 2024 01:53:42 AM by Arjay M

Hi Dunyagozel,

I've confirmed that you can still complete your tax information by filling out the W-8BEN or W-8BEN-E form. The W-8BEN and W-8BEN-E are U.S. tax forms for non-U.S. Persons. We and the IRS use them to determine whether you live in the U.S. and what taxes, if any, we need to collect from your earnings on Upwork. You must have this form on file before withdrawing earnings from Upwork.

To complete the W-8BEN or W-8BEN-E, go to Settings> Tax Information and complete the three cards in that section. Let us know if you need further assistance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 30, 2024 05:30:12 AM by Syed H

Hello,

I've added a Payoneer account as my payment method on January 27TH. It got approved.

It's January 30th and the payment method is still inactive.

Can you please tell me when it'll be active? Like how many days it takes? Or is there any issues with my Payoneer?

I added Payoneer on Sunday, does the security period of 3 Days are Working days? I need a brief guide on activation and about any mistake I made while adding my payment method!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 30, 2024 05:52:30 AM by Arslan A

Yes 3 Days means 3 working days. you can wait 2 more those days, and later open ticket.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 30, 2024 07:01:47 AM by Luiggi R

Hi Syed,

Your payment method is still inactive because you haven't completed your Tax Information page. Please visit the page to fill out the missing details, and check out this article to learn more about what you need to add.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 5, 2024 08:14:05 AM by Faty F

Hello, I'm a student and I don't pay taxes yet. I have to fill the Tax Identification Number in the Tax information section.And since I don't have one , I don't know what should I fill it with. Can someone please help ?