- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 30, 2015 04:53:53 AM by Quang N

Name on a received invoice?

I have a quick question on the invoices you receive from Upwork. As a client, when receiving an invoice from Upwork whose name and address is shown on that invoice? Is it Upwork itself or is it the name and address of the freelancer that was hired by you? So who are you paying according to the invoice, Upwork or the freelancer?

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 29, 2015 05:22:05 AM by Edgar F

Understood! Really good. What if I ask my client to send me the invoices they get from Upwork? Would this work?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 29, 2015 05:34:29 AM by Joachim M

@Edgar F wrote:Understood! Really good. What if I ask my client to send me the invoices they get from Upwork? Would this work?

Depends on what the invoice looks like. In the past this was no good as the invoices issued were not compliant to EU regulations. If they now correctly display the name and address of both parties that should work.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 29, 2015 07:30:31 AM by Ela K

I for one don't want Upwork to issue invoices on my behalf. At all.

What I would like to see is Upwork providing a standard invoice template in my profile settings, which I then can amend to include a client's VAT number when necessary.

That way, I have access to the invoices I need for my own tax declaration, and I have control over what's being sent to MY clients.

The email says:

- Separately, if your client also has a VAT number and is located in a different EU country than you, Upwork will print “VAT Reverse Charged” on the invoice from you to your client.

- If you provide services to a client in the same EU member state, you should consult your tax advisor to determine if you must separately send a VAT invoice to your client.

I have said this before - I don't have access to the info I need to properly invoice a client. I want and need access to that client information which only Upwork is privy to. Once Upwork makes it available, I shall happily send my own invoices and make sure they comply with my country's tax laws. But I want there to be ONLY ONE invoice in my name!

I am already chasing clients to close contracts - I don't even want to contemplate chasing and asking them for the data I need to issue a valid invoice...

And what I really don't want is Upwork sending something on my behalf, without having access to it, and then being asked to make sure I send an additional invoice to adhere to national/EU tax laws.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 29, 2015 11:45:23 PM by Steven S

Aaah - we now have a nice FAQ.

With some interesting answers, such as:

"8. How are you charging VAT on my behalf?

We’re not. VAT is being assessed on services provided by us, not on services you provide your clients."

Combined with the fact that I never get to see the invoice that is sent on my behalf, or the VAT-number of the client, that kind of closes the door for me. For now, I will have to decline all offers from clients located in the EU. Simply because there seems to be no way I can compluy with the tax laws that apply here.

Still not sure whether I want to go through the hassle of filing the invoices for the VAT charged on Upwork's commission, as my bookkeeper also doesn't work for free.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 14, 2015 11:47:23 AM by Anonymous-User A

I have to write some invoices for Upwork jobs and found out that now there isn't any document for the freelancer to print that shows what you have earned by a specific job. When I did it the last time (in August) there was at least a kind of receipt that showed the amount of money I have received for the job. This document I could print. When did this disappear? Now I can only see on the screen that I have received money from Upwork.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 14, 2015 03:34:19 PM by Valeria K

Hi Margarete,

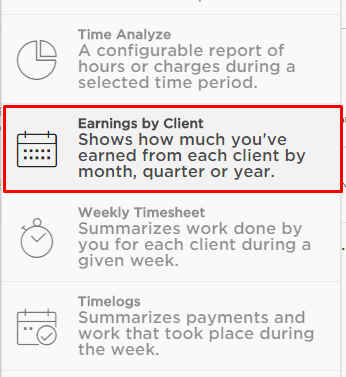

Would "Earnings by Client" report serve that purpose?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 15, 2015 12:22:35 AM by Anonymous-User A

@Valeria K wrote:Hi Margarete,

Would "Earnings by Client" report serve that purpose?

Hi Valeria, definitely no. (I do not want to open the discussion again that the freelancer needs a copy of the invoice sent to the client this time). I have to write an invoice for each fixed price job (applying VAT where necessary) or per week for hourly jobs. I have to prove that I have received the money and I have to add the address of the client as well as description and date of work.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 15, 2015 01:30:27 AM by Joachim M

@Valeria K wrote:Hi Margarete,

Would "Earnings by Client" report serve that purpose?

Valeria,

I'll second Magarate in what she said. Here are the requirements in Europe: http://ec.europa.eu/taxation_customs/taxation/vat/topics/invoicing_en.htm#what_information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 15, 2015 04:28:39 AM by Dave E

Valeria, the legal requirements seem blindingly obvious, as previous posters have provided links to government web sites. Can you explain why it is so difficult for UW to provide compliant documents? And, why this has been an ongoing discussion point for so long with so little action from UW?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 15, 2015 04:42:20 AM by Anonymous-User A

@Dave E wrote:Valeria, the legal requirements seem blindingly obvious, as previous posters have provided links to government web sites. Can you explain why it is so difficult for UW to provide compliant documents? And, why this has been an ongoing discussion point for so long with so little action from UW?

process starting w

At the latest when the MOSS process begins with Upwork's invoices for the service, the European tax authorities will be very interested in the invoices for the work the service refers to. And each freelancer who cannot show a legal invoice for the job will get into serious troubles (for example can be accused for money laundering or fiscal fraud).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 20, 2015 02:40:14 AM by Marek A

Joachim I see that you are very helpful could you explain me how you deal with invoices.

Because now I can put that i give an invoice to Abrakadabra LTD and thats it I dont have more data about client.

And clients telling me thay get invoices from upwork, so they don't need to give their data to me.

How this is working for you?

Best Marek

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 20, 2015 03:38:42 AM by Joachim M

@Marek A wrote:Joachim I see that you are very helpful could you explain me how you deal with invoices.

Because now I can put that i give an invoice to Abrakadabra LTD and thats it I dont have more data about client.

And clients telling me thay get invoices from upwork, so they don't need to give their data to me.

How this is working for you?

Best Marek

Hi Marek,

So far I have had no problems with clients in Europe providing their details. They are interested in receiving legal invoices and my VAT ID too. Some US companies have been difficult though. In these cases I treat Upwork's transaction report for the specific job as a receipt from an unknown entity. Make a screen shot of it and treat it just like I'd treat a receipt from a taxi. The drawback is, that my tax office then views it as revenue generated within Germany and tells me the price includes 19% VAT. That's why I increased my prices by 19% after moving to Upwork from Elance. I'm now lowering them again, as clients not willing to provide the details are so rare.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 20, 2015 08:23:34 AM Edited Nov 20, 2015 08:25:13 AM by Sara P

@Marek A wrote:

And clients telling me thay get invoices from upwork, so they don't need to give their data to me.

_________________________________________________________________________________________Two clients of mine are still considering UpWork as the only contracting party (as the reseller of freelancers' work).

One of them is even deleting freelancers' names from receipts and adding the oDesk EIN manually

I have to say that I'm quite surprised to see so few clients commenting on this thread.

Is UpWork keeping them informed of the latest changes?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 20, 2015 09:28:50 AM by Joachim M

@Sara P wrote:

@Marek A wrote:

And clients telling me thay get invoices from upwork, so they don't need to give their data to me.

_________________________________________________________________________________________Two clients of mine are still considering UpWork as the only contracting party (as the reseller of freelancers' work).

One of them is even deleting freelancers' names from receipts and adding the oDesk EIN manually

I have to say that I'm quite surprised to see so few clients commenting on this thread.

Is UpWork keeping them informed of the latest changes?

Hi Sara,

A continuing problem. We must not forget European clients were receiving useless invoices. Only now is Upwork changing this, if the freelancer confirmed that his address details may be printed on the invoice! And, just like many freelancers assumed that Upwork is their contract partner, so did and do clients.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 20, 2015 09:45:29 AM by Anonymous-User A

@Joachim M wrote:Hi Sara,

A continuing problem. We must not forget European clients were receiving useless invoices. Only now is Upwork changing this, if the freelancer confirmed that his address details may be printed on the invoice! And, just like many freelancers assumed that Upwork is their contract partner, so did and do clients.

____________________

And it could happen that the EU tax authorities will ask Upwork to pay the 19% VAT for the freelancer's work.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 18, 2015 06:10:16 PM by Sara P

He he he... I've just found this among the latest job postings:

We are an Italian company and we use Upwork to hire freelancers . I need a simple ONLY ANSWER to the question: since invoices for download from upwork not go well, because without any reference to the author of the performance ( private / business ) it's Upwork, how do I account for this performance received from freelancers and foreign companies ?

They make me want to hug them... ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 5, 2016 07:12:37 AM by Anonymous-User A

@Sara P wrote:He he he... I've just found this among the latest job postings:

We are an Italian company and we use Upwork to hire freelancers . I need a simple ONLY ANSWER to the question: since invoices for download from upwork not go well, because without any reference to the author of the performance ( private / business ) it's Upwork, how do I account for this performance received from freelancers and foreign companies ?

They make me want to hug them...

Yes, yes, a very old threat, however, nothing changed up to now. The latest invoices to my client in Europe from Upwork only inluded my name, no hint that I am either a private person or a business, no VAT-Id (that I have provided), no country, no address (I could live on the Mars or be an phantom) and no VAT applied or mentioned that is due in my case and has to appear on the invoices because this 19% VAT belong to the German state and not to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 5, 2016 10:38:37 AM by Lena E

Hi Margarete,

By going to your contact info under settings, you will find at the bottom an option to add an address to be displayed on your clients invoices. As for your VAT-ID displaying, let me check on this and I'll let you know.

-Lena

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 5, 2016 11:16:33 AM Edited Jan 5, 2016 11:58:16 AM by Anonymous-User A

@Lena E wrote:Hi Margarete,

By going to your contact info under settings, you will find at the bottom an option to add an address to be displayed on your clients invoices. As for your VAT-ID displaying, let me check on this and I'll let you know.

-Lena

Hi Lena, I have checked this and added this option. This was my mistake. As today I have seen the invoices for the first time (and only because my client provided the copies to me) I was not aware of the problem before. Moreover, I have provided my VAT-Id from the beginning and it has been approved by Upwork. So it should have appeared on the invoice anyway. Anyway, with or without my complete address, with or without my VAT-Id Upwork's "invoice" is not an invoice in Europe. For anybody in Europe who pays his taxes and has a legal business this is just a piece of paper and does not have any value for the tax authorities.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 2, 2016 11:40:01 AM by Guney O

Lena, "display address to client" option solves only the problem on client's side. On freelancer's side, we still need the client's address for very similar legal reasons. Otherwise we have to pay around 18%-19% VAT for payments coming from international client's although we were not supposed to pay. This is just because you don't provide us client's address. It makes profit margins unable to survive here on Upwork.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 2, 2016 12:07:13 PM by Anonymous-User A

@Guney O wrote:Lena, "display address to client" option solves only the problem on client's side. On freelancer's side, we still need the client's address for very similar legal reasons. Otherwise we have to pay around 18%-19% VAT for payments coming from international client's although we were not supposed to pay. This is just because you don't provide us client's address. It makes profit margins unable to survive here on Upwork.

We have explained this a thousand times and it does not interest anybody. However, I think it is only a question of time when the EU-tax authorities and probably from other countries as well will ask Upwork for the invoices they have sent to the clients for the the freelancer's work. They already receive all names of the freelancers with the service fee invoices and the service fee invoices refer to the invoice that have been sent to the client.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 5, 2016 10:57:17 AM by Lena E

HI Margarete,

To clarify the VAT charge that we access is only on the service fee, and you should see that in your service fee invoices which will show your name, address and VAT ID.

What you are inquiring is for your VAT ID and address to be displayed when an invoice is sent to a client, right? I shared in another post that there is an option to add your address to client invoices. I checked with the team on the option to add your VAT ID onto the clients invoice and this is not available.

-Lena

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 5, 2016 11:42:03 AM Edited Jan 5, 2016 02:01:18 PM by Anonymous-User A

@Lena E wrote:HI Margarete,

To clarify the VAT charge that we access is only on the service fee, and you should see that in your service fee invoices which will show your name, address and VAT ID.

What you are inquiring is for your VAT ID and address to be displayed when an invoice is sent to a client, right? I shared in another post that there is an option to add your address to client invoices. I checked with the team on the option to add your VAT ID onto the clients invoice and this is not available.

-Lena

Hi Lena,

Yes, I know this and here Upwork makes a big mistake. If Upwork would provide proper invoices to clients and freelancers as well, in many cases those with a VAT-ID could apply reverse charge instead of detracting 19% VAT from the earnings and handing it over to the tax authorities.

By the way, the problem was discussed here in December:

https://community.upwork.com/t5/Freelancers/VAT-details-missing-on-service-invoice/m-p/144517#M77411

Upwork up to now only provides invoices with VAT added for those without a VAT-ID. Those freelancers with a VAT-ID - who are eligible for reverse charge - just received the same invoices like before. So the reverse charge system has not been applied to their service invoices. Changes have been announced as well as amended invoices for December. Still nothing has happened. It is already too late for 2015, my invoices had to be handed over to my tax consultant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 5, 2016 12:18:35 PM by Lena E

Hi Margarete,

Im sorry but Im not understanding what you mean by this statement:

"So the reverse charge system has not been applied to their service invoices. Changes have been announced as well as amended invoices for December. Still nothing has happened. It is already too late for 2015, my invoices had to be handed over to my tax consultant."

VAT-IDS have been retroactively added to your invoices on service fees. If you got to your reports> transaction history and click on an invoice for a service fee you will see your VAT ID as well as the VAT ID of Upwork.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 5, 2016 01:31:16 PM by Anonymous-User A

@Lena E wrote:Hi Margarete,

Im sorry but Im not understanding what you mean by this statement:

"So the reverse charge system has not been applied to their service invoices. Changes have been announced as well as amended invoices for December. Still nothing has happened. It is already too late for 2015, my invoices had to be handed over to my tax consultant."

VAT-IDS have been retroactively added to your invoices on service fees. If you got to your reports> transaction history and click on an invoice for a service fee you will see your VAT ID as well as the VAT ID of Upwork.

Thank you, Lena. Why did Upwork not announce this the day when it happened that all those invoices have been amended? I was not aware of this because in the middle of December this was not the fact. Some of the invoices without VAT-IDs I have used for my tax reports already. Moreover there is nothing referring to reverse charge on the new invoices. So, we will see if the tax authorities will accept these invoices as reverse charge invoices. They will also be interested in the invoice to the client the service invoice is referring to that cannot be provided by the freelancer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 7, 2016 12:24:03 PM by David G

Hi all,

Lena, or someone from CS:

Do you know if freelancers will be able to get tax/fiscal information such as client address, Tax ID number and full name (private or enterprise)?

We need that sort of information to fill out electronic receipts for our tax system databases (I think it's similar throughout Europe).

But we aren't able emit these receipts without filling out all the information about who is sending us the money (the client) and we can't put Upwork tax information there because Upwork is an intermediary that gets paid by us (freelencers) for a service.

So, by not emiting these receipts we are compelled to evade tax obligations, or imput false information!

Is Upwork planning on providing this information at all? If so, when?

It would be easy to provide a pro-forma invoice with all this client data (but with no legal value) at the same location that we get our invoices for the 10% fees (the transaction history section of the platform).

We could then fill out our receipts and be "legal", even if the client doesn't need/want them.

Thanks,

David

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 7, 2016 01:10:46 PM by Joachim M

David,

I solve this problem by asking my clients for their address and VAT ID and then send them an invoice containing all the necessary information. Clients appreciate this as they are facing the same problems the contractors face.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 7, 2016 01:24:48 PM by David G

@Joachim M wrote:David,

I solve this problem by asking my clients for their address and VAT ID and then send them an invoice containing all the necessary information. Clients appreciate this as they are facing the same problems the contractors face.

Thanks Joachim,

I'll have to do that, but since Upwork already has that information it would be "nice" to have it on the platform (that's what our fees are for, right?).

Anyway, I hope that the invoicing part of the platform improves soon, for the sake of us all, freelancers and clients alike.

Regards,

David

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 7, 2016 01:40:59 PM by Joachim M

David,

I couldn't agree more. It was mentioned that some time early this year we might get access to the invoices Upwork issues on our behalf (like it was on Elance). Then the necessary details would be available, if the client doesn't hide them. On Elance clients could opt for keeping their details secret, btw, same on People per Hour and they are located in Britain, i.e. within the EU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 8, 2016 12:22:41 AM Edited Jan 8, 2016 12:43:03 AM by Anonymous-User A

@Joachim M wrote:David,

I solve this problem by asking my clients for their address and VAT ID and then send them an invoice containing all the necessary information. Clients appreciate this as they are facing the same problems the contractors face.

I do the same. However, not all clients are excited about that. The address is not a big problem, however, sometimes the VAT-Id. One client located in an EU-country provided a copy of the invoices to me a few days ago, there wasn't a VAT-Id on the invoice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 3, 2016 12:52:03 AM Edited Feb 3, 2016 01:38:10 AM by Anonymous-User A

At the moment Upwork still sends invoices to the clients and does not send a copy to the freelancers and I do not see any changes. Moreover, VAT does not appear on the invoices sent to European clients. And it has to be applied when the freelancer is eligable to apply VAT. As this practice is not in accordance with European tax laws, Upwork at least should stop invoicing to the clients and should inform everybody that the freelancers are responsible for applying VAT themselves. Moreover, the VAT-IDs of clients and freelancers have to be provided by Upwork, so that legal invoices can be issued. A lot of freelancers and clients as well in Europe could get in troubles caused by these invoices that are issued by Upwork at the moment, could be accused for tax and especially VAT fraud that is regarded as a crime. Furthermore, Upwork will have to provide answers as well as they issue the invoice (yes, in the freelancer's name) and not the freelancer who has no chance to alter these invoices so that they become legal. I have not authorized anybody to issue invoices in my name that are not according European tax laws.

Finally, as the freelancers have so much additional work issuing legal invoices themselves the 10% service fee should be lowered.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 16, 2016 02:13:51 AM by Peter V

Thank you Margarete and Joachim for all your helpful posts. For your clients outside the EU do you issue the same invoice format? I can't seem to find anything specific on the ec.europa.eu site. Since VAT is not applicable then I'm wondering if that changes the format?

Also, in my field (architecture and interiors) most clients aren't businesses, they are individuals that need house plans or a room in their house designed. So they would most likely have no VAT-ID number which seems like it could be a problem within the EU. I have avoided these types of projects due to this but maybe I am overthinking. Do you see problems with declaring these types of projects?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 16, 2016 11:41:22 AM by Anonymous-User A

@Peter V wrote:Thank you Margarete and Joachim for all your helpful posts. For your clients outside the EU do you issue the same invoice format? I can't seem to find anything specific on the ec.europa.eu site. Since VAT is not applicable then I'm wondering if that changes the format?

Also, in my field (architecture and interiors) most clients aren't businesses, they are individuals that need house plans or a room in their house designed. So they would most likely have no VAT-ID number which seems like it could be a problem within the EU. I have avoided these types of projects due to this but maybe I am overthinking. Do you see problems with declaring these types of projects?

Peter, for clients outside the EU, for example in Switzerland or the United States VAT is not applied. So there should be a hint that the client is responsible for the taxes in his country on the invoice. To prove that you worked for a company and not for a private person, if possible a registration no. of this company should be added on the invoice as well.

If you work for private clients in the EU, you cannot apply reverse charge (provided you are eligible to raise VAT), you have to add the VAT to your invoice. For companies within EU you can apply reverse charge (that means that the company has to pay the VAT in its country). Everything without guarantee, I am not a tax consultant. Therefore I would recommend that you invest some money in a tax consultant to avoid big mistakes from the beginning. VAT and taxes across borders is rather complicated and causes a lot of troubles later if made some mistakes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 15, 2016 06:03:01 AM by Tamás S

Hi,

I read over the complete thread to understand the situation and possible workarounds.

I have a few questions which was already asked by others but wasn't really answered:

Lets assume, I'm from EU and my clients are located in the US. I'm working for them and receiving an amount in hourly rate.

Not sure how is this handled in other EU contries but in Germany, the Tax consultant is always asking from me the following papers after every month:

- Statement of account (Kontoauszug)

- The issued invoice which matches the amount from the invoice and the name from who I received

- A letter from Bank which informs the transaction from foreign country (Ausland zahlung)

Based on the list above, even if I want to do everything legal, I can't because Upwork:

- Sends the money "collected" from all clients/projects

- The name in the transaction says, it was upwork, not the client(s)

- I can't report the 10% fee payed to upwork from my earnings.

Question:

What is the best way handle this problem?

I know it's not 100% legal but still an option to create an invoice based on the received amount for Upwork.

Is there a way to create invoices for every client and report the earnings received from upwork in a single transaction?

For example: Received $100 from client #1, received $220 from client #2;

I'm getting $220 from upwork but I will create 2 invoices with the name of the real clients.

Any help is appreciated.

Tamas

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 15, 2016 08:19:59 AM by Anonymous-User A

@Tamás S wrote:Hi,

I read over the complete thread to understand the situation and possible workarounds.

I have a few questions which was already asked by others but wasn't really answered:

Lets assume, I'm from EU and my clients are located in the US. I'm working for them and receiving an amount in hourly rate.

Not sure how is this handled in other EU contries but in Germany, the Tax consultant is always asking from me the following papers after every month:

- Statement of account (Kontoauszug)

- The issued invoice which matches the amount from the invoice and the name from who I received

- A letter from Bank which informs the transaction from foreign country (Ausland zahlung)

Based on the list above, even if I want to do everything legal, I can't because Upwork:

- Sends the money "collected" from all clients/projects

- The name in the transaction says, it was upwork, not the client(s)

- I can't report the 10% fee payed to upwork from my earnings.

Question:

What is the best way handle this problem?

I know it's not 100% legal but still an option to create an invoice based on the received amount for Upwork.

Is there a way to create invoices for every client and report the earnings received from upwork in a single transaction?

For example: Received $100 from client #1, received $220 from client #2;

I'm getting $220 from upwork but I will create 2 invoices with the name of the real clients.

Any help is appreciated.

Tamas

You asked the same questions in two different threads. Please look here:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 28, 2016 03:21:49 AM by Nicole S

I've read through all postings here and several other threads.

To me it boils down to "upwork is not doing their job", but while we can fix certain parts of that, there is one part which is really bad: double invoices.

I have written up what I think is still not fully legal and valid but maybe at 80%

https://community.upwork.com/t5/Freelancers/Upwork-staff-Details-Invoices-from-freelancers-to-client...

and I would like to invite the members of this thread to comment on there as well.

btw we should not have to fix any of this.

- since the invoice is issued in our name we should be able to add an internal reference number

this would take care of the requirement of sequenced invoice numbers - we should be able to add something to the invoice as "remarks / additions

this would take care of things like special phrases we have to use etc - we should be able to download the full and valid copy for our accounting

- we should be able to export these information as well (csv with all data points) to use it in our accounting and declaration of taxes etc.

And everything else already mentioned.

unrelated question:

how can i find out a link to a specific posting to reference it?

thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 28, 2022 01:49:12 AM by Ivaylo G

It's 2022 and soon 2023 - and we still do not have these features (summarized by Nicole S) that we need since 2015. Obviously it is not a technical reason but something political which nobody dares to say loudly.

It's a shame.

- « Previous

- Next »