- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 16, 2022 11:58:02 AM by Radoslav N

Any plans for "Valid VAT Number" badge for clients in EU

Is it possible to have knowledge if the clients that are located in EU country have valid VAT number, even before considering to apply to a job. This is very important for bidding. If i understand correctly if in the invoice the client addres is in EU i am obliged to add VAT. This is not a problem with clients with valid VAT number of course, but that thing is impossible to know before the first invoice that is generated by Upwork.

Solved! Go to Solution.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 21, 2022 08:35:16 AM by Annie Jane B

Hi Radoslav,

Thank you for following up. Please know that Upwork doesn't currently charge VAT on client payments to freelancers or on payment processing fees. Clients in the EU may enter a VAT number in Settings › My Info so that invoices from the freelancer can be marked "VAT Reverse Charged" when appropriate. This will appear on your invoices if the freelancer or agency is located in a different country. You can find more information in this help article.

Regarding your query about creating an agency. I would like to suggest to you check these articles to help you decide if creating an agency is the right choice for you.

You may check this and this for more information.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 20, 2022 04:00:47 AM by Radoslav N

I have several questions regarding the topic:

- When the client is in EU i am obliged to charge VAT on any service i provide. Except in the cases when the client has valid VAT Number. If he has one, he is responsible to pay the VAT himself and use tax returns if his tax system allows it. The thing is when i am bidding and even until the first invoice i can't see if the client has VAT number at all and if i should account for the 20% diff when making bids. Does Upwork provide any means to check client's VAT information in advance?

- I see in some old threads that freelancers are making custom invoces... which to say the least is yet another thing that makes me skip clients from EU becasue of the hassle (and additional expenses for invoice legalization/translation). Does Upwork provide the service of creating proper invoices between parties within the EU but in different countries?

- I strongly beleive that it's my right to be able to let proffesionals do the financial bookkeeping, but it's never good idea to give 3rd party full access to my Upwork account (this even violates the ToS) Is it possible to give "limited/passive (ReadOnly) access to my profile's invoce data/transactions so my accountant can get it without me being literally copy pasting stuff multiple times each month?

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 20, 2022 07:27:04 AM by Nikola S

Hi Radoslav,

Thank you for reaching out to us. Please know that a freelancer located in the EU who provides services to a client also located in EU should consult their tax advisor to determine if the freelancer must separately send a VAT invoice to that client. Upwork doesn't currently support this capability, nor we're able to display tax information of another user until the contract is formed.

Regarding your last question. You may want to consider creating an agency account on Upwork and adding a team member with financial permissions. You can find more information in this help article.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 21, 2022 02:37:09 AM Edited Jun 21, 2022 02:38:19 AM by Radoslav N

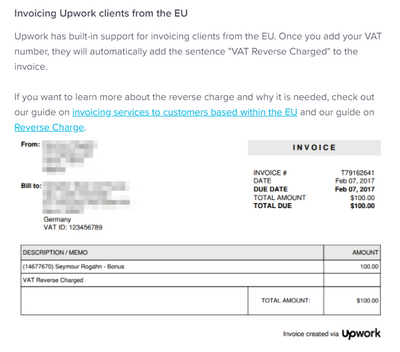

- Is it posible for the client to add his VAT number (if he has any) and show it in the invoices just like its done with the Upwork fees? I found this example but i am not sure if this is up to date information. Can you confirm if i ask my client to add VAT information to his profile the invoice can look like this?

- Please clarify your suggestion: The only way to have financial access for accountant is for me to become something like "single freelancer agency"?... which unfortunately means I will potentially lose half of the jobs on Upwork since majority of clients specifically do not want to work with agencies for some reason...)

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 21, 2022 08:35:16 AM by Annie Jane B

Hi Radoslav,

Thank you for following up. Please know that Upwork doesn't currently charge VAT on client payments to freelancers or on payment processing fees. Clients in the EU may enter a VAT number in Settings › My Info so that invoices from the freelancer can be marked "VAT Reverse Charged" when appropriate. This will appear on your invoices if the freelancer or agency is located in a different country. You can find more information in this help article.

Regarding your query about creating an agency. I would like to suggest to you check these articles to help you decide if creating an agency is the right choice for you.

You may check this and this for more information.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 18, 2023 05:50:01 AM by Tetiana K

It seems like invoice in eu question is still not answered and moderators either understand the question itself or do not have the answer and simply copy paste information we already know .... I am thinking about to stop taking clients from Upwork

because

1. I am paid and charged in USD which makes my bookkeeping in local currency a pain ...

2. Invoices do not include my and client vat number which makes bookkeeping AND taxes messy and hard

If i could still continue using Upwork and pay 20% fee (which i am ok with) but create invoices by myself with all currency conversions and vat mentioned in that invoice i would consider to continue taking clients.

To be honest i think Upwork is great 👍 i worked here for long time before moving to eu, but i feel it is so strange that Upwork can not help us with this business vat invoiceo issue and continue getting nice cut from our freelance jobs, instead we have to leave platform and work with clients outside not because we are greedy for the 20%fee but because it is much more comfortable for accounting and taxes 😔

It is very sad.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 14, 2023 10:27:36 AM by Feras A

This is actually True. All the answers I have seen so far are just copy past and not none of them really address the issue. How the VAT amount could be added the to invoice? How to charge the client these amount? why the invoice doesn't include the VAT number? why not to address this issue automatically with the invoice for EU clients?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 8, 2024 01:57:58 AM by Cem N

I have been going over the forums but it seems to me that moderators beat around the bush instead of giving a clear answer to this question. I need to charge VAT to my customers outside the EU and its been so painful to do it on Upwork.