- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

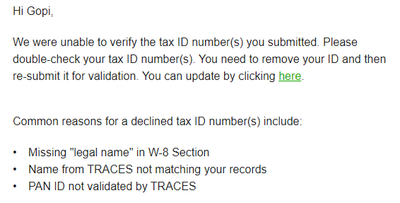

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 7, 2023 10:19:57 AM by Aayush T

They marked them as solved and told me that future earnings' TDS will deduct at 1%. But I updated my PAN no. on 2nd Feb only, according to that earnings after that TDS should deduct at 1% only, but for my earnings on 5th and 6th Feb TDS deduct at 5%. Please credit back 4% into my account as soon as possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 6, 2023 04:58:22 AM by Sanket D

According to what I read on Upwork, if I don't submit and verify my PAN, Upwork will withhold 5% tax. However, I have submitted my PAN and it shows as completed on my profile. Despite this, Upwork still deducts 5% tax from my income on every order. Could someone from Upwork assist me with this issue?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 6, 2023 06:49:51 AM by Nikola S

Hi Sanket,

Thank you for reaching out to us. I checked and it seems that you already created a support ticket regarding your concern. Please allow more time for our team to review your case and respond accordingly to your ticket. You will be notified of their response.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2023 03:00:26 AM by Annie Jane B

Hi Anupam,

Thank you for reaching out to us. I shared your report with our team and one of our agents will reach out to you using a support ticket to assist you further. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 13, 2023 05:48:39 AM by Cheril S

Hello I am from India I got an email saying that my PAN has been verified, but in transaction history I still see 5% tax on my pending payment how to solve this? Ref ID: 563713326

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 13, 2023 06:56:07 AM by Shruti S

I am facing the exact same problem I added the PAN to my profile but it keep on asking for entering the PAN no. again and again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 13, 2023 08:37:07 AM by Nikola S

Hi Cheril,

Thank you for reaching out to us. It looks like you made this withdrawal before your PAN number was approved. I shared your concern with our team and one of our agents already reached out to you directly via a support ticket to assist you further. You can access your ticket on this page.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 21, 2023 02:05:27 AM by Swati C

Hi I have added PAN number few week ago to the upwork profile, but I have noticed that I have been receiving my payment with 5% deduction for 4-5 weeks now.

Help me credit back the rest of the 4% of TDS deduction for all weeks payments.

Look forward to your support.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 21, 2023 11:09:23 AM by Annie Jane B

Hi Swati,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 29, 2023 01:00:25 AM by Debojit S

My concern is, I am from North East india (Assam) and according to the official guidelines we are exempted from linking PAN to Aadhar. As per Notification No. 37/2017 dated 11th May, 2017, PAN Aadhar linkage requirement does not apply to any individual who is:

i. Residing in the States of Assam, Jammu and Kashmir, and Meghalaya;

As i am from the exempted demography, will i get the exemption in upwork too or do we need to link Aadhar with PAN anyways?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 29, 2023 06:48:21 AM by Annie Jane B

Hi Debojit,

Thank you for reaching out to us. I shared your report with our team and one of our agents will reach out to you using a support ticket to assist you further. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 29, 2023 09:31:45 PM Edited Mar 29, 2023 09:35:10 PM by Debojit S

Thank you Annie. The matter is solved at short notice and i got my answer. 😊

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 29, 2023 09:27:05 PM by Kulwinder K

Hi Annie,

I am a freelancer from India, as per Indian rules I have linked my PAN card with Adhaar Card and I've also connected my PAN (also verified) with upwork as well. But still I am getting charged 5% WHT instead of 1% . Can you please help me out?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 30, 2023 07:50:25 AM by Annie Jane B

Hi Kulwinder,

Thank you for reaching out to us. I can see that you opened a support ticket regarding this issue and are now being assisted by one of our agents. Please feel free to update the ticket should you have further questions or concerns.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 1, 2023 06:51:18 PM by Kulwinder K

Hi Annie,

It's been almost 4 days since I generated ticket but still no response from @upwork . That's so disappointing !!

I trust in the platform but my hard earned money is being overly charged for the taxes. Please help !!

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 25, 2023 07:30:50 AM Edited May 25, 2023 07:31:58 AM by Lokesh C

Hi Community,

I have provide my tax information but still I get the error "In compliance with Tax Law in India, Upwork withholds 1% Tax at Deduction Source (TDS) from your payments. The TDS can be as much as 5% if you haven't provided your govt. issued tax id yet. Please click here to add your PAN asap. For more details, read our FAQs." Can anyone help me to resolve this issue.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 25, 2023 08:34:07 AM by Andrea G

Hi Lokesh,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 25, 2023 09:56:26 AM by Lokesh C

Hi Andrea,

Thank you very much for the reply. Also I have one more issue. My legal name is C H Lokesh. I'm trying to change my name in the Contact info from (First name: Lokesh, Last name: Ch) to (First name: C H Lokesh, Last name:C H Lokesh). But my name change request gets denied. Can you please help me with this issue,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 2, 2023 10:54:21 AM by Preeti R

Hi,

I updated my Upwork profile with my PAN number two months ago, yet Upwork is still deducting 5% tax from every payment. I completed my first project in April, 2023 and received my payment with a 5% deduction. I did not get any notification or email regarding the PAN verification. Could you please look into this?

Thank You,

Preeti Rawat

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 2, 2023 11:37:50 AM by Andrea G

Hi Preeti,

We saw your post in the community and converted it into a support ticket to give it the attention it deserves. Rest assured that one of our agents will be reaching out to you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 7, 2023 05:02:29 AM by Sreeshob P

Hi,

Am from india

i entered my PAN card number and my personal details in tax information

it shows completed but upwork is still withholding some as Tax

anyone here to help to fix this

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2023 08:13:01 AM by Manjeet K

Upwork charged me the wrong fee. Today's date is 11/06/2023. Please see date. The date is absolutely wrong. This is totally wrong. I am a new freelancer, but it does not mean that you charge me wrong fees. While I have filled my PAN ID and tax information. A true freelancer earns money by working so hard and you charge him wrong fees in the name of tax and service fee. This is too much. This fee is not 10% and if you deduct it from 10% then it does not become that much. Fix it and give me my refund. If this happens to you too, please support and tell Upwork that this will not work.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2023 09:38:01 AM Edited Jun 11, 2023 09:39:46 AM by Luiggi R

Hi Manjeet,

Thank you for reaching out. If you're referring to the TDS or Withholding Tax, it looks like the name you provided under your Tax Information may not be correct. Please make sure that the legal name you add to your Tax Information (ID) and the Form W-8BEN match the registered name on the PAN ID. If you have a question about paying TDS, we suggest you reach out to a trusted tax expert or advisor to learn more about Indian TDS and your tax obligations since we cannot offer specific tax advice. You may find more information on Indian TDS here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 11, 2023 09:54:48 AM by Manjeet K

Yes you're right. My tax information is wrong. It was my mistake, but It's corrected now. Thanks for helping me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 13, 2023 11:09:40 AM by Annie Jane B

Hi Manjeet,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 12, 2023 11:39:22 PM Edited Jun 13, 2023 09:04:40 AM by Annie Jane B

I already updated my tax information on 11/06/2023. But Upwork is still charging me wrong tax and WHT. Why? Please fix this and refund my earning. This is hurting me a lot. Why are you not understanding?

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 14, 2023 09:07:06 PM by Shubham K

Hi,

I've recently started working on a project. But, Upwork is withholding 5% tax from every payment even though I've filled out the W-8BEN form and provided my PAN details and all these have completed status. I did not get any notification or email regarding the PAN verification. Please help me out in reducing the Withholding tax.

Thank you,

Shubham K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 11, 2023 11:54:00 PM by Krishna K

Hi Upwork Team,

I've provided my PAN card details and it's verified. But still, 5% WHT has been deducted from my recent work instead of 1%.

Can someone help me with this issue, please?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 12, 2023 10:21:25 AM by Annie Jane B

Hi Krishna,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 7, 2023 10:11:49 PM by Dhaval V

The same thing happened to me,

Even though my PAN card is linked to my Adhar card, there was a 5% deduction from my payment,

Please take a look.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 8, 2023 01:52:55 AM by Joanne P

Hi Dhaval,

I've escalated your concern to the team. One of our agents will reach out and assist you directly via a support ticket.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 14, 2023 12:19:47 AM by Pradeep H

Hi Chahat,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here . Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

Thank you,

Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 22, 2023 05:36:31 AM by Divya V

please help me!!!i uploaded all the documents related to my PAN but still upwork charged me 5% tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 22, 2023 09:33:55 AM by Annie Jane B

Hi Divya,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 24, 2023 12:13:49 AM by Sachin S

Hello,

I have added the PAN card to the profile. Will it still take an extra 5% instead of 1%?

How can I get the 5% which was taken in the last transaction?

Regards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 24, 2023 08:27:35 AM by Pradeep H

Hi Sachin,

Thank you for your message. If you have a verified PAN on file and you linked your PAN to your Aadhaar number by the Indian government’s deadline, we are required to withhold 1% of client payments.

I checked your account and noticed that you submitted the PAN details on July 9th while the last earnings were processed on July 7th. We are unable to refund the amount charged with a 5% Withheld Tax as this is already submitted to your government.

Thank you,

Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 24, 2023 11:06:44 AM by Sachin S

Hi,

How do I come to know that my PAN is verified? Will it still deduct 5% from future transactions?

Thanks

| User | Count |

|---|---|

| 493 | |

| 484 | |

| 348 | |

| 331 | |

| 168 |