- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 24, 2023 01:44:13 PM by Arjay M

Hi Sachin,

Thank you for reaching out to us. Please be reminded that the amount of TDS we are required to withhold depends on whether you have a valid PAN on file with Upwork:

- If you have a verified PAN on file and you linked your PAN to your Aadhaar number by the Indian government’s deadline, we are required to withhold 1% of client payments

- If you do not have a verified PAN on file, we are required to withhold 5.0% of client payments

The team will surely let you know if further verification needs to be performed. Also, the withholding tax is calculated based on the gross amount that you invoice your client, so it is calculated prior to freelancer service fees or any other fees that may reduce the amount credited to your account. You may check this help article for more details.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 1, 2023 02:39:47 AM by Tripti S

I have added the pan details and it is showing completed . I have filled the necessary form for tax identification as well. but when my client release the pay. withholdig tax of 5% is deducted . How can i get it back

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 1, 2023 09:26:14 AM by Annie Jane B

Hi Tripti,

Thank you for reaching out to us. We will only start to withhold a 1% tax on your account after it has been validated. Any payments before it was validated will still be be charged 5% tax.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 1, 2023 04:50:28 AM by Susmita R

I am a non-taxpayer non-US resident. I cannot find the option to put my PAN number in the account. Please help me out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 1, 2023 10:13:35 AM by Annie Jane B

Hi Susmita,

You may enter your PAN in the Tax Info section under Settings. Please also double-check the format you will be using. As defined by the Indian government, the proper format is:

- 10-digit alphanumeric entry, i.e., A A A A A # # # # A

- # = Numeric A = Alphabetic

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 1, 2023 11:50:37 PM Edited Aug 1, 2023 11:50:56 PM by Neetu S

Hello,

I have add agency PAN Card details on agency account. Will upwork still take 5% extra commision?

Thank You!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 2, 2023 07:26:22 AM by Annie Jane B

Hi Neetu,

Thank you for reaching out to us. As long as you fill out your tax information and provide your PAN details, the withholding tax should be reduced to 1% instead of 5%.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 2, 2023 10:17:15 AM by Neetu S

Yes, It should take only 1% after adding. I was reading on internet and some person were saying that , it took extra 5% after adding the details. Could you please confirm that it will not take 5%?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 16, 2023 12:25:56 AM by Kaartik N

Can I request a reimbursement for the 4% withholding tax that was deducted from my Upwork payments prior to my PAN verification, given that they currently deduct only 1% following the verification?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 16, 2023 02:12:32 AM by Annie Jane B

Hi Kaartik,

Thank you for reaching out to us. Any payment before your PAN was approved will have the 5% tax deduction and any payment moving forward will have 1% since the PAN has been approved already.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 19, 2023 11:15:20 AM by Tanay D

I've edited my PAN card details (India) and it's been verified too. Yet, 5% WHT has been deducted from my recent work instead of 1%. Can someone help me with this issue, please?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 19, 2023 12:37:47 PM by Luiggi R

Hi Tanay,

Thanks for bringing this to our attention. I've escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 12, 2023 01:01:33 AM by Claintin R

Hello,

I have filled all my Tax details but still message is displayed to update my TAX info. Past two months i filled several times and all my TAX details shows Completed, but still i am getting message to fill TAX and even upwork charges me 5% tax. Can anyone please help me.

Thank you

S.Claintin Raj

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Aug 19, 2023 11:41:48 PM by Hemil K

I have added my PAN number along with completing all the related tax information.

Even after the status being shown as 'Completed', I am still receiving 5% dedcuted payments.

Please look into it and guide me on how can I start receiving payments with 1% TDS and if I can get back the 4% that was withheld on my previous payments.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 14, 2023 12:27:34 AM by Parth P

Hi

I added my PAN details almost 3 months ago

As per my findings after adding PAN details, the withholding tax deduction will be 0.75%, but Upwork still deducts 5% from my earnings.

Please help, and if I am correct then I want to request a refund for the extra deduction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 14, 2023 03:02:55 AM by Annie Jane B

Hi Parth,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 14, 2023 06:29:36 AM by Yerramalli S

Hi Team,

My Tax information has been verified a while back but i am still getting a 5% WHT on my payments.

Can you please look into this.

Thank you,

Sreekar

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 14, 2023 06:52:24 AM by Annie Jane B

Hi Yerramalli,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 18, 2023 12:18:30 AM Edited Oct 18, 2023 12:19:55 AM by Neetu S

Hello Team,

I added the PAN card of the agency but I can't see the tax submitted on behalf of the agency PAN card. Upwork cuts 1% if a PAN card is added. I have already added agency PAN card and upwork started to cut 1% also but I can't see the submitted tax at our indian government tax portal. Does Upwork submit the tax per quarter or per week ( when the transaction happens) ?

Thank You!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 18, 2023 01:37:17 AM by Annie Jane B

Hi Neetu,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 18, 2023 05:41:21 AM by Anmol V

Hi Neetu,

I understand you query.

You can check 1% deductions on your agency Pan Login Account.

When you login from your Agency pan on ITR Login portal then you can see the deductions.

Regards,

Anmol Verma

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 18, 2023 02:03:33 AM Edited Oct 18, 2023 03:21:38 AM by Annie Jane B

Hi,

I am going to add my Local Bank transfer details for My Agency on upwork.

I have opened current account on the behalf of my Agency Name.

The issue is which Name and PAN should be enter in the fields for agency account Get paid option. See screenshot attached.

I don't know what should be enter in the "First Name" "Last Name" and "Name On Account" and "Pan Number" fields.

Is my personal name should enter their or my agency name?

and Which Pan number should be enter their my or agency PAN?

I want all the PAN transactions only should come on agency PAN.

Please let me know.

Thanks Everyone!

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 18, 2023 03:31:51 AM Edited Oct 18, 2023 03:32:18 AM by Annie Jane B

Hi Anmol,

Thank you for reaching out. Since you already have PAN details for your agency, please use them for your agency tax information. Once your PAN has been verified by our Tax Team, succeeding payments that you'll have will then be subjected to just 1% instead of 5% withholding tax.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 18, 2023 05:38:44 AM by Anmol V

Hi Annie,

And what about the names in the form fields? I have also asked that naming query as well.

Can you please check and revert the same?

Have you checked screenshot?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 19, 2023 04:44:01 AM by Rahul S

Hi Avery,

I am facing the same problem I have updated my PAN way back and finished 2 contracts and third is in progress, but still upwork withholds 5% for every transaction, I tried raising an isssue but that page dose not even work, and I dont know where to complain how to reach out, can you please help

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 19, 2023 07:28:02 AM by Annie Jane B

Hi Rahul,

Thank you for reaching out to us. I checked your account and it looks like the PAN details you submitted last September were rejected due to formatting error. You resubmitted your PAN details last 17th of October and this time, it was accepted.

Please keep in mind that the withholding tax of 1% will only apply to your earnings after your PAN has been verified hence your previous earnings were still subjected to 5% tax.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 20, 2023 05:50:53 AM by Rahul S

Hi Annie,

Thanks for the update, now since my PAN details are accepted, can I expact any payment received after 17 Oct to have only 1% withholding, also previously deducted 5% will be reflected in my Income tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 20, 2023 06:04:17 AM by Annie Jane B

Hi Rahul,

Yes, that should be the case in your future earnings.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

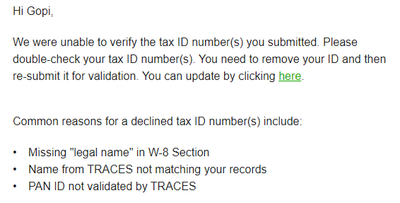

Oct 19, 2023 08:33:00 AM Edited Oct 19, 2023 08:36:46 AM by Shanti D

Hello Upwork team,

Greetings.

I already added my PAN card but I am still receiving this message. Is there an issue with my PAN card or other? Can you please check and help me with this?

Thanks & Regards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 19, 2023 11:36:34 AM by Arjay M

Hi Shanti,

I took a closer look at your account and can also confirm that your Tax Information has been completed. Nothing to worry about; as long as a new W-8BEN/W-8BEN-E form is filled out completely and validly, we are not required to withhold U.S. income tax.

Please try clearing your cache and cookies or use a different browser. Then log back into your account and see if the prompt still appears. Let us know if you need further assistance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 9, 2023 07:47:36 AM by Sajiya S

Hello,

I am trying to verify my tax information from last 15 days but its still not verified. The red line saying 5% tds will be cutted if you dont verify your pan card still appears. What should I do? how can I know if its verified or not. Please help me. I have opened this ticket before and there were reply which I followed but still its not verified.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 9, 2023 08:19:07 AM by Nikola S

Hi Sajiya,

Thank you for following up. I checked and it looks like one of our agents already reached out to you directly via a support ticket to assist you further. You can access your ticket on this page. Please consider following up on the ticket so that our team can assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 11, 2023 05:55:29 AM by Sajiya S

I know he replied that why I mentioned that I followed the helpdesk guide but still its not verified. My works are pending I am not applying just because of this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 11, 2023 07:03:58 AM by Nikola S

Hi Sajiya,

If you need further assistance it is best to respond to your ticket directly so that our team can assist you accordingly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 12, 2023 06:36:53 PM by Sajiya S

the helpdesk they replied and I have fixed the issues. But still its not

verifying. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 12, 2023 09:01:49 PM by Pradeep H

Hi Sajiya,

I checked your account and noticed that we are unable to verify your PAN due to a name mismatch. As mentioned by the support agent, we verify your PAN against government records to make sure it is accurate and valid. Make sure that the name on your PAN matches the name on your Upwork account. That said, please update your name on the Upwork account to match the details on the PAN.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 24, 2023 02:47:22 AM by Sajiya S

When the helpdesk first notify me to correct my name. I corrected at that time without wasting any time. Still its same. I am getting new contracts and in this phase if I got tds for 5%. It would be bad for me.

| User | Count |

|---|---|

| 463 | |

| 322 | |

| 301 | |

| 202 | |

| 97 |