- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

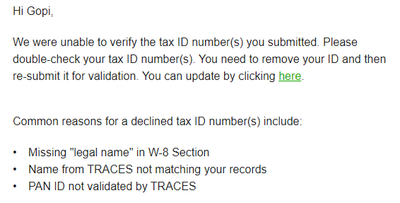

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

Community Manager

Community Manager

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 2, 2024 06:42:49 AM by Kamal G

Hello there,

I wanted to clear out a query: I have already submitted my Tax details like PAN number and that PAN is already linked to Aadhar in India. Inspite of the details already there, the recent transaction shows upwork charged 5% WHT, whereas it should be 1%.

Please have look at the screenshot and clarify. Thankyou!

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 2, 2024 07:24:25 AM by Luiggi R

Hi Kamal,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 17, 2024 07:26:05 AM by Vipin R

I have already submitted and verified my PAN and the step shows complete. It was done last year and I got verification, but still this notification always shows on top of my profile: "In compliance with Tax Law in India, Upwork withholds 1% Tax at Deduction Source (TDS) from your payments. The TDS can be as much as 5% if you haven't provided your govt. issued tax id yet. Please click here to add your PAN asap. For more details, read our FAQs." I have tried in customer service chat, but couldn't get a resolution. Someone please help.

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 17, 2024 08:53:28 AM by Luiggi R

Hi Vipin,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 18, 2024 09:31:49 AM by Aakash K

I have my PAN card added to my Upwork account and have completed all of my tax information and tax forms. But instead of a 1% Withholding Tax deduction, a 5% WHT was deducted from my payment.

According to this upwork article https://support.upwork.com/hc/en-us/articles/360044709894-Indian-Tax-Deducted-at-Source-TDS-or-Withh...

I'm new to this website. can someone please help?

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 18, 2024 10:26:56 AM by Luiggi R

Hi Aakash,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 28, 2024 11:18:25 PM by Titiksha S

I have provided govt. issued tax id and PAN, but the upwork site it still tells "In compliance with Tax Law in India, Upwork withholds 1% Tax at Deduction Source (TDS) from your payments. The TDS can be as much as 5% if you haven't provided your govt. issued tax id yet. Please click here to add your PAN asap. For more details, read our FAQs."

I have made sure all details are correct, it also tells the process it completed.

It has been week I am facing this.

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 29, 2024 01:22:35 AM by Pradeep H

Hi Titiksha,

Thank you for your message. I checked and can confirm that you have already added your PAN number under the tax identification number section, but you have not added a signature and clicked the check box under the Signature section. You will need to add enter your full name as your Signature and click the check box below that as seen here. Also, enter your signature under 'Affidavit of unchanged status' section.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 8, 2024 02:05:02 PM Edited Jun 8, 2024 10:00:47 PM by Pradeep H

It's been 8months on upwork and with my pancard verified since day one but still I get charged 5% WHT on every earning.

Please shine light on this, Thank you.

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 8, 2024 07:18:48 PM by Pema L

we all pay too, idk about other nations but they charge Indian for 5% WHT

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2024 06:38:40 AM by Anish G

Hello Upwork Staff,

This is the same situation with my account as well, Even I am charged with 5% WHT.

Could you please reolve the issue as early as possible.

Thanks and Regards,

Anish Gunda.

Retiring Moderator

Retiring Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 9, 2024 08:27:58 AM by Luiggi R

Hi Anish,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 30, 2024 11:55:27 PM by Rizwaan S

Hey Pradeep,

I'm also facing the same issue. I have already submitted my tax information and everything seems to be successfully validated. But I'm still being charged 5% WHT instead of 1%. Hope for a it to be fixed soon

Thanks,

Rizwaan

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 20, 2024 05:50:41 AM Edited Jun 20, 2024 06:58:16 AM by Luiggi R

Hi Team,

I hope you are all doing well.

I updated my PAN card on May 25, 2023, and all the details have been updated accordingly. However, I noticed that my tax is being deducted at 5% instead of the correct rate of 1%.

Can someone please explain what might be causing this issue?

Please see the attached snapshot for reference.

Thank you for your assistance.

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 20, 2024 06:19:27 AM by Ashraf K

Make sure your PAN is linked to AADHAR, if it is not linked PAN becomes inactive, and Upwork will withhold 5%, faced a similar problem and after linking I had to raise a ticket to get it back to 1%...

If you have already linked PAN to AADHAR raise a ticket, if not get it linked first!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 2, 2024 01:58:31 AM by Anmol V

Hi,

I have a doubt. I am running an agency on Upwork and my freelancer account as well.

So on both accounts withdrawal method is different one is for agency bank details to withdraw and second is to withdraw into my own personal account.

My question is: Can I change/use my agency BANK account details and PAN details to my freelance account to withdraw amount at same place?

Thanks!

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 2, 2024 04:19:42 AM by Pradeep H

Hi Anmol,

You can add your agency bank details to your freelancer account only if you are the owner or one of the partners for your agency. You will also need to add the agency PAN to your freelancer account to ensure you adhere to your country's tax law.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Retired Team Member

Retired Team Member

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 9, 2024 05:01:53 AM by Pradeep H

Hi Aishwarya,

I checked and it appears that your name on the PAN card does not match the registered name on Upwork. You will need to ensure your Upwork account name matches your PAN card to resolve this issue.

- Pradeep