- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

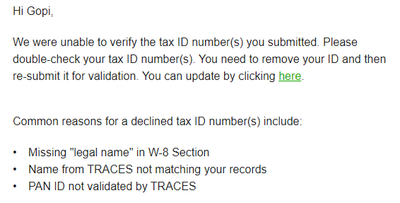

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 24, 2023 03:44:44 AM by Annie Jane B

Hi Sajiya,

I'm sorry to hear about that. It would be best to continue coordinating with our support team as they can advise you best on what steps you need to take next. You can access your support tickets here.

~ AJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Oct 7, 2023 11:03:05 PM by Yash N

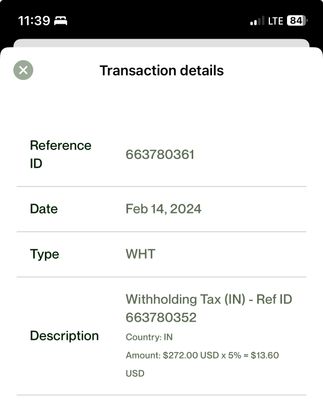

I provided my PAN card information, so why did WHT deducted was 5% of my earnings after I submitted this information?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 24, 2023 01:27:46 AM by Shivam P

After uploading a valid pancard in my tax information upwork india deducting 5% of tds

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Nov 24, 2023 02:43:25 AM by Pradeep H

Hello Shivam,

Thank you for reaching out. I can see that you've already raised a support ticket regarding your concern. You can access your support tickets here. Note that support requests are responded to in the order they are received. Kindly allow 24-48 hours for the team to follow up with you and assist you further.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 1, 2023 07:33:26 AM by Rajwinder K

I linked My AAdhar with PAN in NOvemember. I m still charged 5% TDS . What i can do so that TDS will be 1% .Please suggest if any one knows

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 1, 2023 08:51:31 AM by Rekha S

Did you add your PAN details and address in the tax menu in your profile?

If you did, then the TDS will reduce to 1% from the time the details are saved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 1, 2023 09:00:29 AM by Luiggi R

Hi Rajwinder,

I can see that you're communicating with the support team directly. Please continue to do so and don't hesitate to follow up if you have questions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 30, 2023 09:09:39 PM by Azaj P

Although I have submitted my PAN card detials I still get the suggestion to update my pan card. Moreover, the comission deducted is more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 21, 2024 10:45:06 PM by Neha C

I have added a billing method a week ago but that still not activated, what should I do to check the problem or to get it activated?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 22, 2024 01:51:32 AM by Pradeep H

Hi Neha,

Thank you for your message. If you are referring to the payment method, I see that your payment method is already accepted. Please update the Tax Information page to activate your payment method.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 25, 2024 07:59:52 PM by Abhay B

So i have read details on upwork forum that i will be taxed 1% from April 1, 2021 if i have PAN or an Aadhaar number linked in my profile else 5%. I have currently linked the PAN Number in my tax info but still got charged 5% for my last 2 projects. I am confused what to do. Also i am paying GST Fees for every milestone even though i have mentioned in my profile that i don't have GSTIN. Can anyone please help me with this topic? Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 25, 2024 08:58:28 PM by Pradeep H

Hi Abhay,

As a business operating in India, we have to follow the tax laws of the country. This means we need to collect GST on Upwork services and pay it to the government. However, if you provide us with a valid GSTIN, we can exempt you from this tax.

I will share your report with our team to check your TDS charges and one of our agents will reach out to you using a support ticket to assist you further. You can access your support tickets here.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 5, 2024 09:18:35 PM by Saeed S

Can you plz why i have charge with 5% even after verification of PAN completed

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 6, 2024 12:31:57 AM by Joanne P

Hi Saeed,

We withhold a 5% tax if you have not provided a valid PAN or have not linked it to your Aadhaar number by the Indian government’s deadline. When I checked it looks like you've selected the 'I don't have a GSTIN.' This means that Upwork collects GST on specific transactions. You can check this here. You can check this page for more information.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 6, 2024 10:12:20 AM Edited Feb 6, 2024 10:28:18 AM by Saeed S

Hi Joanne,

you are mixing 2 different things here.

My PAN is verified so my hourly invoice should not be charged with 5%. It should be 1%

and regarding GST which I don't have - GST is already charged with 18% on service fee.

It is some issue with the system instead of 1 % i have been 5%.. plz correct it with payment team

for your reference-

To be compliant, Upwork will begin charging goods and services tax (GST) in India in November 2023. GST applies to many digital service purchases that Upwork supplies, such as the purchase of Connects, service fees, and membership fees. GST does not apply to freelancer or agency services or income earned from completing those services.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 6, 2024 12:49:04 PM by Luiggi R

Hi Saeed,

I see that you've recently raised a support ticket regarding your concern. As soon as the next available agent gets your ticket in their queue, they'll contact you to assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 9, 2024 06:37:54 AM by Sumeet M

Hello I don't have a pan card as I am not yet eligible for that and upwork keeps asking for it to withdraw money how do I solve this problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 9, 2024 07:29:10 AM by Luiggi R

Hi Sumeet,

Having a PAN is an essential requirement for you to be able to withdraw your funds. If you do not have one, please consult a tax advisor or a local tax authority in your country on how you can obtain one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 17, 2024 04:33:22 AM Edited Feb 17, 2024 05:10:04 AM by Luiggi R

Hello,

I have provided tax number (PAN Number). All sections in "Tax Information" is set to "Completed". Please see screen shot below. But, still more than 1% tax is deducted. Please let me know if I am missing something.

**Edited for Community Guidelines**

Thank you,

Geetha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 17, 2024 04:54:35 AM by Johnlery C

It sounds frustrating to still have over 1% tax deducted despite providing your PAN number. Have you reached out to the tax authorities or your employer to clarify the issue? It's important to ensure accurate tax deductions to avoid any financial discrepancies."

"Dealing with tax deductions can be a headache, especially when you've already provided your PAN number. Perhaps there's an error in the system or some additional documentation required. Have you considered consulting with a tax advisor for assistance in resolving this matter?"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 17, 2024 05:09:51 AM by Luiggi R

Hi Geetha,

Thank you for bringing this to our attention. We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 18, 2024 06:22:18 AM by Krishnan K

I am a freelancer from India. I have already uploaded my PAN details but they are being rejected and the chatbot support is really unhelpful. It'd be great if someone can help out with this.

I have already checked everything DOB, Name, Number and re-entered all the details to no avail.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 18, 2024 07:46:56 AM by Luiggi R

Hi Krishnan,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 23, 2024 11:26:28 AM by Devanshi V

Why I am still paying 5% TDS on every payment (in India) when I already submitted all the details asked by Upwork including the Government IDs like Aadhar and PAN card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 23, 2024 12:17:26 PM by Ramesh Kumar K

Are you sure you've linked your PAN with your Aadhar before June 30, 2023, if your PAN was issued before July 1, 2017?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 9, 2024 11:56:28 PM by Jitendra G

HI now i have one question : If i don't add my pan number and you will cut 5% tax from my job, now when i see on my Form 16 OR when i see on my income tax portal is this income shown ? without this pan ?

So i see if my pan is valid and you take 1% and my income is shown on income tax portal , now if i remove that pan number then is it shown in my income tax portal , i mean this earning income ?

I hope you understand my question.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 10, 2024 04:05:35 AM by Joanne P

Hi Jitendra,

Indian tax law requires everyone who had a PAN as of July 2017 to link it to their Aadhaar number by June 30, 2023. If you do not link your PAN and Aadhaar number, your PAN will become invalid and we will withhold 5% for TDS. You will need to add a PAN and link your PAN to your Aadhaar number in order to keep the withholding tax at 1% of your earnings or to claim a credit or refund. To enter your PAN, go here. You can check this page for more information.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2024 03:57:04 AM Edited Mar 11, 2024 04:44:14 AM by Luiggi R

Hi,

I'm Mahendra. I added my PAN card to Upwork two weeks back and it got approved and the Tax Identification Number status shows completed. But as it is showing withholding tax takes 5 percent of my earnings. kindly look into this issue. I checked with Aadhar also it was linked to my PAN card. Kindly resolve this issue and credit back my 4 percent of earnings that have been deducted from my earnings.

Thank you.

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 11, 2024 04:43:53 AM by Luiggi R

Hi Mahendra,

Thanks for bringing this to our attention. We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 15, 2024 06:43:51 AM by Rajeev K

I have seen every information seems correct and updated but still getting mail "e were unable to verify the tax ID number(s) you submitted. "

kindly look after it asap,

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 15, 2024 08:16:44 AM by Luiggi R

Hi Rajeev,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 9, 2024 07:08:28 PM by Surender K

I have already submitted my PAN number. But still 5% WHT tax is being deducted from my earnings instead of 1%. Please help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 9, 2024 11:11:26 PM by Joanne P

Hi Surrender,

I checked your account and saw that you've indicated 'I don't have a GSTIN.' India requires Upwork to collect goods and services tax (GST) and remit it to India’s government unless we have a valid Goods and Services Tax Identification Number (GSTIN) on file for you. GST is a tax on goods or services, including our services to you, and “remit” means to send money for a payment. If you provide a valid GSTIN to Upwork, we will not have to collect this tax from you. You can enter or edit your GSTIN in your account’s Settings > Tax Information. For more information, please check this help article.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 14, 2024 07:07:28 AM by Surender K

I have PAN Tax id which is already verified and linked to my adhaar but still I have been charged 5%WHT Tax instead of 1%, I don't know why?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 14, 2024 07:55:37 AM by Luiggi R

Hi Surender,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 16, 2024 11:41:45 AM by Jishnu N

I'm being Taxed at 5% even after My pan card details are submitted and verified,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 17, 2024 03:30:50 AM by Rahul J

It sounds like you're experiencing an issue with your tax rate in India even after submitting your PAN (Permanent Account Number)

| User | Count |

|---|---|

| 463 | |

| 322 | |

| 301 | |

| 202 | |

| 97 |