- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 05:53:17 PM by Gopi P

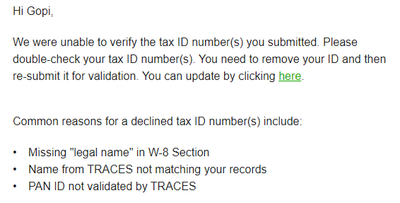

Unable to verify your Tax ID number on Upwork

Please check my Legal Taxpayer Name. Now I verified the legal name and PAN number. Please check and approve.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 1, 2022 10:15:23 PM by Avery O

Hi Abdul,

The TAX ID (PAN) status is under "Pending Verification" until we have a manual verification for PAN. Once you enter a PAN number, you will automatically get a reduced withholding tax of 1% regardless of the PAN "Pending Verification" status. There is no further action needed on your end.

~ Avery

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 20, 2024 11:05:50 PM by Geetha P

Hi Upwork team,

2 Months back, I posted the same question. The solution was to get my PAN card approved. My PAN card is approved now. But, still in the recent transactions, total of 2.8 (GST: 1.8% + Withholding Tax: 1%) is reduced from my payment. Why is it so?

Please let me know.

With Regards

Geetha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 21, 2024 12:59:48 AM by Pradeep H

Hi Geetha,

I understand your concern regarding the tax deductions from your payment. Let's clarify this issue for you. The tax deductions you mentioned consist of both Goods and Services Tax (GST) and Withholding Tax. Since you have updated your PAN number, your Withholding Tax is reduced from 5% to just 1%.

We’re required to comply with the tax laws of the countries where we operate to continue to do business in those countries. In India, it is mandatory for us to collect Goods and Services Tax (GST) on Upwork services and deliver it to the government, unless we have a valid GSTIN (GST identification number) on record for you. In the event that you do not provide a valid GSTIN, we are obligated to charge you GST and remit it to the Indian government. However, if you supply a valid GSTIN, we will be exempted from collecting the tax. To enter your GSTIN, go to your account’s Settings > Tax Information.

To get a clearer understanding of the specific deductions in your case, we recommend reviewing your transaction details or consulting with a tax professional who can provide guidance tailored to your situation. If you have any further questions or need assistance, feel free to reach out to us.

- Pradeep

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 2, 2024 06:42:49 AM by Kamal G

Hello there,

I wanted to clear out a query: I have already submitted my Tax details like PAN number and that PAN is already linked to Aadhar in India. Inspite of the details already there, the recent transaction shows upwork charged 5% WHT, whereas it should be 1%.

Please have look at the screenshot and clarify. Thankyou!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 2, 2024 07:24:25 AM by Luiggi R

Hi Kamal,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 17, 2024 07:26:05 AM by Vipin R

I have already submitted and verified my PAN and the step shows complete. It was done last year and I got verification, but still this notification always shows on top of my profile: "In compliance with Tax Law in India, Upwork withholds 1% Tax at Deduction Source (TDS) from your payments. The TDS can be as much as 5% if you haven't provided your govt. issued tax id yet. Please click here to add your PAN asap. For more details, read our FAQs." I have tried in customer service chat, but couldn't get a resolution. Someone please help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 17, 2024 08:53:28 AM by Luiggi R

Hi Vipin,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 18, 2024 09:31:49 AM by Aakash K

I have my PAN card added to my Upwork account and have completed all of my tax information and tax forms. But instead of a 1% Withholding Tax deduction, a 5% WHT was deducted from my payment.

According to this upwork article https://support.upwork.com/hc/en-us/articles/360044709894-Indian-Tax-Deducted-at-Source-TDS-or-Withh...

I'm new to this website. can someone please help?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 18, 2024 10:26:56 AM by Luiggi R

Hi Aakash,

We’ve escalated your community post to a support ticket. One of our agents will be in touch with you soon to assist.

- « Previous

- Next »

| User | Count |

|---|---|

| 493 | |

| 482 | |

| 354 | |

| 341 | |

| 164 |