- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 13, 2021 08:22:20 AM Edited Feb 14, 2022 10:57:33 AM by Valeria K

Ukraine Tax – VAT Collection to Start in January (Update: on February 14): Feedback and Questions

Starting early next year, we will begin collecting Ukraine’s Value Added Tax (VAT) when talent and clients registered in Ukraine purchase Upwork services. Ukraine signed a new law on June 29, 2021 requiring Upwork to collect VAT for certain transactions.

Check out the announcement here and let us know your thoughts about these updates in the comments below.

Cheers,

Mike

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 21, 2021 10:40:25 AM Edited Dec 21, 2021 11:59:52 AM by Valeria K

Can we get a withdraw to a local bank in UAH option, please? Preferably, Privatbank. This way we could lower my tax group and be able to pay a fixed tax instead of %.

@Valeria K, you can contact them here **Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 21, 2021 11:58:16 AM by Valeria K

Thanks for your suggestion, Viacheslav. We do offer Direct to Local Bank services in many currencies and our payment team is continuously working on ways to expand this option to more currencies. Unfortunately, it's not yet available in Ukraine. However, if it becomes available in the future, we'll definitely notify the Community about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 22, 2021 12:10:08 AM by Svetlana L

Hi!

I am also waiting for solving of this issue. I can't add my 10 digits code.

According to current tax law of Ukraine I am not a VAT payer, I have another tax group and I pay taxes according to it. So, I have not VAT code, I have only 10 digits identification number that I use in tax documents.

And I have no possibility to enter it in Upwork.

So... waiting for resolving this issue.

Thank you in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 22, 2021 07:51:21 AM by Valeria K

Hi Svetlana,

I'd like to clarify that a 10-digit personal Tax ID is not a VAT number and does not make you exempt from this tax. A 12-digit VAT ID or 8-digit business registration number is required in order to be exempted from this tax collection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Apr 25, 2023 05:43:02 AM by Pavlo O

Hi Valeria.

Can you please clarify whether I need A 12-digit VAT ID or 8-digit business registration number in order to work on the platform ? Because it is not crystlal clear.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 23, 2021 03:36:05 AM by Olena P

Hello,

Could you please explain a bit more about the new indirect taxes for Ukraine and the changes that should be done in the client account? I've read your article https://support.upwork.com/hc/en-us/articles/4410783603219, but it doesn't include anything regarding the billing methods. Should we change the billing method as well? Or the VAT number and address are the only things that must be entered? And how long does the VAT verification take?

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 23, 2021 09:45:47 AM by Valeria K

Hi Olena,

You don't have to update your billing method unless you'd like to do that. We're providing clients and talent in Ukraine with an option to add their VAT ID in the Tax Information section of Settings. I'd also like to add that in order to avoid any possible issues, the client may first visit the Ukraine tax registry to validate that the information they will provide on their Upwork profile is accurate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 28, 2021 03:30:30 AM by Olena P

Hi Valeria,

I still have issues while entering the VAT ID. I've tried to enter both the business ID number and VAT ID, but none passed your verification. Both are correct, and I have additionally checked using the link you provided above that I should use our LLC business ID number.

But I've received the email from you about a country, name and VAT ID number mismatch. How could I reach anybody directly to check what should be entered?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 23, 2021 08:16:36 AM by Denys T

Hi! I'm having such a problem. I need to enter my VAT ID on Upwork, but the thing is that the system asks for a 12-digit number. This is a mistake, there are no 12-digit individual VAT ID in Ukraine, it have 10 digits. What should I do with this? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 23, 2021 09:28:03 AM by Andrea G

Hi Denys,

A 10-digit personal Tax ID is not a VAT number and does not make you exempt from this tax. A 12-digit VAT ID or 8-digit business registration number is required in order to be exempted from this tax collection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 3, 2022 06:25:32 AM by Bohdan K

Hello,

Please contact me via ticket to speed up the verification process.

I have provided a valid business tax ID, but colleaque has notified me that you also need the business registration documents. Or how can I contact your support team directly?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 3, 2022 09:01:07 AM by Andrea G

Hi Bohdan,

Someone from our team will reach out to you via support ticket in order to assist you further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 24, 2022 02:36:49 AM by Royal V

Hi ,

The Ukraine Tax ID is 10 digits and Upwork is requesting for 12 digits. What do I do?

I am unable to process my payment details on upwork because of this issue.

Kindly advise

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 24, 2022 05:21:57 AM by Andrea G

Hi Royal,

A 10-digit personal Tax ID is not a VAT number and does not make you exempt from this tax. A 12-digit VAT ID or 8-digit business registration number is required in order to be exempted from this tax collection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 26, 2022 02:05:25 AM by Serhii H

Hey! I work with the site and I received a notification that I need to provide a VAT ID to confirm that I pay taxes. In our country, there is such a type of activity as FOP(in Ukrainian) - Individual entrepreneur and it has three groups (I have 3rd). And the tax number of this person is an individual tax number (it has 10 digits). And according to our legislation, I pay a quarterly tax for it and + income tax. In your system, you cannot specify the IPN number (which is an indicator of my activity). What should be indicated in this case?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 26, 2022 02:10:55 AM by Goran V

Hi Serhii,

A 10-digit personal Tax ID is not a VAT number and does not make you exempt from this tax. A 12-digit VAT ID or 8-digit business registration number is required in order to be exempted from this tax collection. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

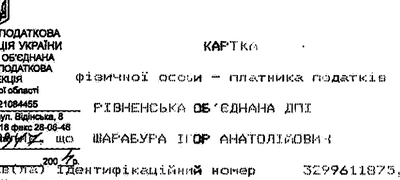

Jan 27, 2022 12:35:43 AM Edited Feb 1, 2022 07:29:01 AM by Andrea G

Greetings! You probably misunderstood me. I pay taxes as a private entrepreneur under the "FOP 3 group" taxation system. And my VAT number is Tax ID. And I pay quarterly 4000 UAH + 5% of income. Link to law - https://diia.gov.ua/tax-systems/3-grupa

I also attach a file with information that I am a tax payer!

"The number of the bribe on the appearance of the payer of taxes 265221203584" maybe I need to specify this number?

Let's figure it out, otherwise it turns out that I pay taxes, and they assure me of the opposite.

Perhaps you need some more documents about these moments? Tell me and I will gladly provide!

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 1, 2022 06:19:33 AM by Serhii H

Hi Goran V,

can you answer a question or comment on my post Jan 27, 2022 12:35:43 AM January?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 3, 2022 03:43:27 AM by Vitaly M

Hello Mike.

There's a mistake in the Tax VAT number. Here in Ukraine, we have 10 digits number for Individual entrepreneurs. But the platform requires me to enter 8 or 12 digits instead.

Actually, in Ukraine the short form of 'Individual entrepreneurs' is FOP.

12 digits are correct for the legal entity, not Individuals.

Could you check this issue, please? Also, you can verify my words in public sources.

https://en.wikipedia.org/wiki/VAT_identification_number#cite_note-23

This article is correct but mentioned Legal entities only.

This article point to the official government website.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 3, 2022 10:49:27 AM by Viacheslav K

You need a ПДВ number. You need to register it separately. It's not ІПН.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 7, 2022 10:36:17 PM by John F

Hi,

Why I've been asked to start paying Ukraine’s Value Added Tax (VAT) if we are US-based company who hiring freelancers?

I've reviewed my profile, and there is no any mentions about the Ukraine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 10, 2022 11:52:09 AM by Dmytro N

Due upwork notification asfor ADDITIONAL VAT fees% payment for Ukrainian residents(freelancers).

This law 1525 regulates the procedure for paying tax for non-residents! of Ukraine, so it does not concern freelancers ( Ukrainian citizens) - but upwork platform as that non resident side. ThUS, charging additional fees 20% from freelancers - residents of Ukraine is illegal (not related to this law). Upwork shifts its tax obligations to Ukrainian tax department onto the shoulders of a freelancer, this is illegal. You might resolve the issue between yourself - Upwork and the possible client (customer) , without burdening the freelancer with a second tax - which you want to oblige him to pay instead of you, from your profits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Feb 10, 2022 12:37:58 PM by Dmytro N

take attention from this law requirements once more= This law 1525 regulates the procedure for paying tax for non-residents! of Ukraine, so it does not concern freelancers ( Ukrainian citizens) - but upwork platform as that non resident side. ThUS, charging additional fees 20% from freelancers - residents of Ukraine is illegal (not related to this law).freelancer paid 20/10% to upwork. and this shoul be the end of the story... taxes might be paid by upwork.. fron upwork profits.. not from freelancers wallets. Upwork shifts its tax obligations to Ukrainian tax department onto the shoulders of a freelancer, this is illegal. You might resolve the issue between yourself - Upwork and the possible client (customer) , without burdening the freelancer with a second tax - which you want to oblige him to pay instead of you, from your profits... freelancer does pay 20-10% to upwork.. and nothing more.. all other ( taxes) due the law 1525 might be paid by upwork.... as non resident due th Law.. and freelancer not might pay your upwork tax to Ukrainian tax department from own wallet but upwork might.from own1. instead of that you share requirement to pay upwork additional fee (called it as a tax) ! do not manipulate please with the need.. cause you try to get illegal additional payment from freelancer to cover own obligations. zakon.rada.gov.ua/laws/show/1525-20#Text

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 3, 2023 09:21:15 AM Edited Jan 3, 2023 09:25:42 AM by Viacheslav K

True. Google, Steam don't take they 20% from customers, but pay it themselves. They didn't even raise their prices.

the US adds tax after the purchase, while in EU and Ukraine the tax is included. The correct thing would be for Upwork just pay % out of their profit, because they use ukraine's resources but don't pay anything for that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 15, 2022 03:51:06 AM by Andrew S

Because of the war, the Ukrainian government initiated tax reform, essentially canceling VAT. What's Upwork's position on account of these changes?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Mar 15, 2022 12:27:29 PM by Michael J

Hi Andrew,

Thank you for your question. We're looking into this and will follow up when we have more information.

Cheers,

Mike

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

May 27, 2022 07:56:00 AM by Vladyslav K

Hello, I live in Ukraine. And our taxpayer number consists of 10 digits. Please tell me how to fill in correctly and what documents so that it is considered. Because the tax is very high, I now pay in the country as a private entrepreneur - 5%

And this would change a large commission very significantly. It is important. Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 10, 2022 07:41:33 AM Edited Jun 10, 2022 07:42:41 AM by Igor S

In Ukraine we have 10 digits

How long time need to change 12/8 to 10 digits in Upwork form VAT?) 2-3 years?) one year has passed 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jun 16, 2022 07:58:38 AM by Valeria K

Hi Igor,

A 10-digit personal Tax ID is not a VAT number and does not make you exempt from this tax. A 12-digit VAT ID or 8-digit business registration number is required in order to be exempted from this tax collection.

I hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 6, 2023 11:18:45 AM Edited Jul 6, 2023 11:28:57 AM by Dmytro N

By and large, we are generally the buyer of goods from upwork - goods in the form of part-time work for a third party (customer), for which we pay upwork 10% of such goods... and based on the fact that upwork is a non-resident of Ukraine and receives income from Ukraine, it is upwork that should pay VAT... and it is on the 10% of interest that it takes from us from each contract... that is, it is upwork that should pay this 2% (20% of the 10% commission), and not demand an additional 2% from us.За великим рахунком ви взагалі є покупцем товару в апворку - товару у вигляді підробітку для третьої сторони (замовника), за що сплачуєм апворку 10% такого товару..і виходячи саме з того, що апворк є нерезинентом України та отримує дохід з України - то платити НДС має саме апворк.. і саме з тих 10% відсотків, які він у нас забирає з кожного контракту.. тобто ці 2% ( 20% від 10% комісії) має платити саме upwork, а н е вимагати з нас додатково 2%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 6, 2023 10:48:29 AM Edited Jul 6, 2023 10:54:04 AM by Dmytro N

IF ukrainian freelancer is not registered in Ukraine as VAT payer => upwork has no basis to ask ukrainian freelancer for sharing VAT number - cause the person does not provide any activity related to pay VAT taxes.. and that s why does not have TAX registry in Ukraine. In this situation upwork might avoid such freelancers from sharing VAT IDs and not extort 20% from him under any pretext*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jul 6, 2023 11:19:39 AM Edited Jul 6, 2023 11:21:55 AM by Dmytro N

By and large, we are generally the buyer of goods from upwork - goods in the form of part-time work for a third party (customer), for which we pay upwork 10% of such goods... and based on the fact that upwork is a non-resident of Ukraine and receives income from Ukraine, it is on upwork"s side to pay VAT from OWN INCOMES... . that is, it is upwork that should pay this 2% (20% of the 10% commission), and not demand an additional 2% from us.

- « Previous

- Next »