- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 13, 2021 08:22:20 AM Edited Feb 14, 2022 10:57:33 AM by Valeria K

Ukraine Tax – VAT Collection to Start in January (Update: on February 14): Feedback and Questions

Starting early next year, we will begin collecting Ukraine’s Value Added Tax (VAT) when talent and clients registered in Ukraine purchase Upwork services. Ukraine signed a new law on June 29, 2021 requiring Upwork to collect VAT for certain transactions.

Check out the announcement here and let us know your thoughts about these updates in the comments below.

Cheers,

Mike

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 12:05:27 AM by Yurii B

Valeria K wrote:Hi All,

Apologies for the delay in providing more information about this change. The announcement about it can now be viewed here.

I'd like to note that as this tax is being collected on B2C (business to consumer) transactions, any user that has provided Upwork with a valid VAT ID will not be treated as a “consumer” and therefore will not be subject to tax. You can add your VAT ID in the Tax Information section of Settings. A VAT ID, rather than a 10-digit personal Tax ID, is required in order to be exempted from this tax collection.I have moved this discussion here and have shared yourfeedback about the options available when adding your VAT ID number to your Upwork account with the team. They will be working to address that in product.

If it's not a personal Tax ID number, where do we need to find this 12-digit VAT ID?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 11, 2022 12:54:29 AM by Vasyl S

FOP in Ukrain has not 12 digits VAT ID number. I've added all my company bookkeeping department, I've asked Privatbank assistance - nobody know what is 12 digits VAT ID number in Ukrain. I'm FOP since 2008 and have no 12 digits VAT ID number.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 11, 2022 04:57:04 AM by Viacheslav K

add 00 before a 10 digit VAT number if you have an old variant.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Jan 11, 2022 12:50:57 AM by Vasyl S

Hi Valeria,

Just want to let you know nobody in Ukrain has 12 digits VAT ID numbers. All of us has 10 digits VAT ID number!

Sincerely,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 16, 2021 08:36:02 AM by Vadym B

Hi Mike,

Could you please let us know the amount in percentage that will be deducted off the freelancers' service fees by Upwork?

Thanks,

V.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 16, 2021 11:38:13 PM Edited Dec 17, 2021 09:03:41 AM by Valeria K

I have a 10-digit VAT ID because I was registered as a VAT payer before 09/03/2020.

How can I write 10 digits instead of 12 digits?

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 12:31:40 AM by Yuri Z

Unfortunately there is no way. We all will pay extra 20% from Upwork fees, buying connects etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 16, 2021 11:45:34 PM by Bogdan S

The State Tax Service clarified that the individual tax number for individuals registered as VAT payers until March 9, 2020 will not be changed. For such persons it will be 10-digit until the moment of cancellation of their VAT registration.

That is, the individual tax number in the new 12-digit format will be assigned during VAT registration of natural persons-entrepreneurs starting from March 9, 2020.

The tax authorities explained this by saying that the individual tax number is kept by the VAT payer until the moment of VAT registration cancellation, and laws and other normative legal acts do not have retroactive effect (Article 58 of the Constitution of Ukraine).

It will be recalled that a new algorithm for generating an individual tax number was introduced by the order of the Ministry of Finance of January 29, 2020 № 30, which amended the Regulation on registration of value added taxpayers approved by the order of the Ministry of Finance of November 14, 2014 № 1130. tax number for individuals is a 12-digit numeric number of the following structure:

- 1 - 10th marks - registration number of the taxpayer's account card (or passport number - for natural persons-entrepreneurs who due to their religious beliefs refuse to accept the registration number of the taxpayer's account card and notified the relevant supervisory authority and have a mark in the passport );

- 11th and 12th signs - control digits, the algorithm of formation of which is established by the State Tax Service of Ukraine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 01:12:38 AM Edited Dec 23, 2021 12:54:44 PM by Vadym B

Unfortunately that is not a VAT number.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 09:07:59 AM by Valeria K

Bogdan and Vadym,

A 10-digit personal Tax ID is not a VAT number and does not make you exempt from this tax. A 12-digit VAT ID or 8-digit business registration number is required in order to be exempted from this tax collection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2021 01:59:56 PM by Bogdan S

Valeria,

I have a 10-digit personal Tax ID and a 10-digit VAT ID.

10-digit VAT ID for a VAT payer registered before March 9, 2020.

12-digit VAT ID for a VAT payer registered after March 9, 2020.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 23, 2021 12:18:01 PM by Svetlana L

Valeria, And what?

Why we need to pay VAT if we are free of VAT according to current Ukrainian law?

We pay another taxes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

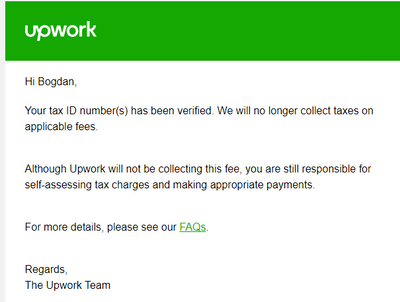

Dec 17, 2021 12:24:23 PM by Bogdan S

Figured it out: 12-digit VAT ID = "00"+"10-digit VAT ID".

Look at the site to check your VAT ID https://cabinet.tax.gov.ua/registers/pdv

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 01:13:38 AM by Vadym B

I agree with Bogdan S and with the info he posted. That's exactly the same thing (same article) I posted here yesterday but moderators removed my message as it was written in Ukrainian.

I hope all of us read this article and now understand that we're not to blame for having been registered before March 9, 2020. Because that's the very reason why we can't have a 12-digit number (even theoretically) but a 10 digit one. So the question remains the same: Can Upwork adjust the field so those who have so to say an 'old school' number would be able to insert it?

Thank you,

V.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 03:10:39 AM by Viacheslav K

Only people paying ПДВ can skip this tax, so it has nothing to do with the timing. Also, they aren't asking your ІПН which everyone in Ukraine has. The tax would be useless then. This isn't even a tax on the people that are working on Upwork and don't pay any legal taxes, but on everyone because of the recent Tax on Google law which required Upwork to pay a 20% tax on all earnings, it gets from Ukraine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 03:44:47 AM by Aleksey K

Dear UpWork, I just recieved this reply from a support agent

We received an update from our internal team and per their advice, the tax is being collected on B2C (business to consumer) transactions, any user that has provided Upwork with a valid VAT ID will not be treated as a “consumer” and therefore will not be subject to tax. You can add your VAT ID in the Tax Information section of Settings. A 12-digit VAT ID or 8-digit business registration number, rather than a 10-digit personal Tax ID, is required in order to be exempted from this tax collection.

Once again, ukranian taxpayers only have 10-digit ID's. There's no such thing as 12-digit VAT ID. We are not consumers, but providers. Please run another internal checkup, what you are requesting cannot be aquired by ukranian taxpayers, because it simply does not exist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 04:01:48 AM by Viacheslav K

There is a 12 VAT id if you pay ПДВ, most freelancers don't. This fee is deducted only from those people making this mandatory for almost everyone.

It's just confusing. They could have left out the deductable because no one is using ПДВ while working on Upwork.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 09:48:27 AM by Sergii V

i think that is reasonable. all services, including AWS, Youtube, etc, while selling their services will need to add extra 20% to their services price. so that is reasonable, and it will add 20% not to your hourly rate, but 20% to Upwork services itself. So like 5% to your rate as example 10$/hour, old price will be 0.5$ will add extra 0.1$ for VAT. So in total 0.6$.

Of course Upwork could do better and make 1% extra discount for us, but i dont think they will do this.

Just, relax, 5% of FOP tax is one of the lowest possible in EU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 17, 2021 11:04:06 AM Edited Dec 17, 2021 11:32:54 AM by Vadym B

Hi Sergii,

it's 4% as far as I understood from the message Upwork support agent sent me yesterday.

'As I have checked, the VAT will be effective on January 1, 2022. The VAT rate of 20% will only be assessed on Upwork fees (Connects purchase, freelancer service fee and membership plan) not on your payments from the clients. For example, let’s say you earn $100 on a project and pay 20% ($20) for freelancer fee. The VAT will be applied to that $20, meaning you’ll pay $4 in VAT.'

Am I right?

In other words now they will deduct 24% instead of 20% as before. When your client pays you $500, Upwork will take $120 instead of $100 as before.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 18, 2021 09:30:42 AM Edited Dec 18, 2021 09:39:50 AM by Vadym B

I'm just trying to figure out things and how they work here to get prepared, especially as this whole situation with new laws and new taxes isn't what I was expecting early next year🤣🤣🤣.

Thanks,

V.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 18, 2021 09:32:15 AM Edited Dec 18, 2021 09:41:40 AM by Vadym B

Hi Mike,

I have to admit I don't have a lot of sufficient knowledge in law and economics but yet I have questions concerning the matter and I hope you'll be able to provide some adequate comments to the list of conclusions listed below:

1. This new tax (VAT) was imposed on Upwork by Ukrainian government, correct?

2. Starting January 2021 Upwork is going to impose the entire amount of the VAT tax on us (freelancers who work in Ukraine) adding the VAT tax to the amount of the service fee we pay to Upwork, correct?

Thanks,

V.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2021 06:43:42 PM by Avery O

Hi Vadym,

We are collecting this tax to comply with local tax laws in Ukraine. A change in the law has required us to collect these taxes unless you provide a Tax ID Number.

Because of this, we are required to assess a 20% tax on the following:

- Freelancer service fees (not your earnings) - For example, you earn $100 on a project and pay 20% ($20) for freelancer fees. The VAT will be applied to the $20. This means you’ll pay $4 in VAT.

- Connects purchase

- Membership fees - This includes our Freelancer Plus plan.

Note that we won’t collect these taxes from you if you provide us with your VAT ID Number. It will be best to check with a tax advisor if you have other questions regarding your concern.

~ Avery

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2021 07:49:50 AM by Vadym B

Hi Avery,

I have another question : Will Upwork impose VAT on a $291 fee that a freelancer need to pay when a dispute is moved to arbitration?

Thanks,

V.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2021 10:08:17 AM by Valeria K

Hi Vadym,

Yes, VAT would be applied to the arbitration fee as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 21, 2021 10:59:14 AM Edited Dec 21, 2021 11:59:25 AM by Valeria K

Hi Valeria,

I've asked this very same question Ruby (Upwork support agent) under the request #33461602. She has written the opposite!

Either You or Ruby is incompetent in this very question.

Please see for yourself the attached screenshot of the message I'm referring to.

Could you plrease reply to me and let me know who's telling misleading conclusions, you or her?

P.S. I'm sending the screenshot of your first reply to her so she can provide a comment as well. It's just lovely, isn't it?

Thanks,

V.

**Edited for Community Guidelines**

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 21, 2021 11:58:48 AM by Valeria K

Hi Vadym,

I’m sorry for the confusion on our end. While we can, by law, collect VAT on arbitration fees, we will not be doing so at this time. This is because we aren’t yet set up to collect VAT on arbitration fees. In the future, we may do so, but we won’t be collecting VAT on arbitration fees for now. Apologies again for providing conflicting information.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 21, 2021 12:28:18 PM by Vadym B

I see. Thanks for a quick reply!

Is there going to be a separate notification when you start collecting it in the future?

Cheers,

V.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2021 01:13:43 AM Edited Dec 19, 2021 01:14:05 AM by Vadym B

Will this VAT affect us in case the dispute with a client goes to arbitration?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2021 02:56:18 PM by Ivan F

hello Upwork!

I have registered business here in Ukraine (FOP) and I'm ALREADY paying all taxes!

My business VAT has 10 digits, so why upwork asking 8 or 12 number??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 19, 2021 04:05:49 PM by Luiggi R

Hi Ivan,

A 10-digit personal Tax ID is not a VAT number and does not make you exempt from this tax. A 12-digit VAT ID or 8-digit business registration number is required in order to be exempted from this tax collection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2021 06:39:16 AM Edited Dec 20, 2021 06:43:45 AM by Vadym B

I've just consulted with a lawyer here in Ukraine and here's the conclusion I can share if you're interested to know.

Our government imposed this tax on Upwork. But there's no legitimate mechanism that can force Upwork to pay this tax out of its own pocket. Hence Upwork is expecting us to pay this tax in a way of adding it to the amount of the Upwork fees. And they have all the rights to do that. Obviously noone can judge them. For example Google did exactly the same thing.

You don't have to be a genious to figure out that our government is the only party who's in a win-win situation. See for yourself, they will get the tax regardless of who will pay it. It's either Upwork (in case you don't provide the VAT ID number) or us (in case you do) who will submit these taxes. Yet the freelancer is the only one who's paying.

Let's hope this is the only unexpected 'surprise' we're getting for Christmas this year😂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 20, 2021 12:51:51 PM by Viacheslav K

When you go to Silpo or every store, you'll see 20% tax that you are paying as the customer. Same as you as a freelancer will have to raise your rate to compensate for this change and your clients will have to pay for it.

I'm just sad that they did this first, instead of taxing the freelancers that don't pay any tax at all, but I guess this way they will get more tax paid in general.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 21, 2021 12:40:22 AM by Vadym B

I'm not sure I quite follow your second thought... Are you suggesting to raise our rates? If so, don't you think that clients would prefer working with the freelancers who charge less and simply wouldn't like to work with us?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 21, 2021 10:38:51 AM by Viacheslav K

Upwork raised their fee rate, why shouldn't you? it's only 2-4%. At least raise your rate for new clients.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Dec 21, 2021 01:09:35 AM by Vadym B

Do I?

Anyway, please let me know the reason why you'd like to know that.